Author:AInvest

The 2025 crypto market crash exposed the fragility of traditional speculative strategies,

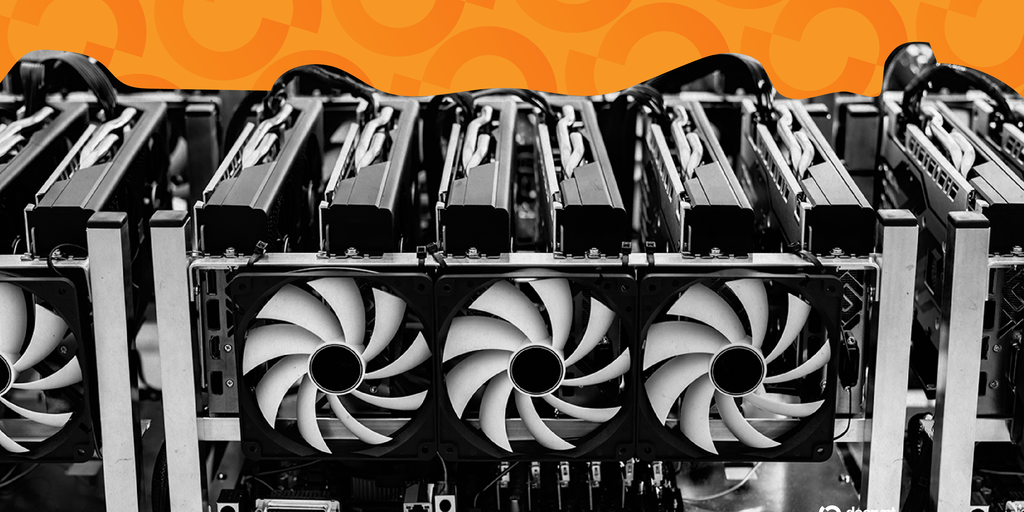

(BTC) and (ETH) plummeted amid macroeconomic turbulence. For holders of , , and , the volatility underscored the need for alternative income streams that mitigate downside risk. Enter cloud mining platforms like IO DeFi and ETC Mining, which have emerged as strategic tools for generating stable, passive income during periods of instability. By leveraging renewable energy, enterprise-grade security, and transparent yield contracts, these platforms offer a compelling counterbalance to the inherent volatility of direct crypto exposure.IO DeFi: A Renewable-Powered DeFi Fortress

IO DeFi has positioned itself as a rare beacon of stability in the 2025 crypto landscape. The platform's infrastructure is powered entirely by renewable energy,

but also insulates it from energy price fluctuations that plague traditional mining operations. Its security architecture, , and DOSS Multi-Layer Defense Framework, has been lauded for withstanding the liquidity crunches and cyber threats that intensified during the crash.Data from November 2025 reveals that

DeFi to users even as BTC dominance surged and altcoins like ETH and XRP faced sharp corrections. With over 3 million global users and operations in 180 countries, the platform's yield contracts-offering fixed-term, transparent returns-have become a refuge for investors seeking predictability. User testimonials highlight the platform's "hedged approach" and "renewable-energy-powered operations" as key factors in maintaining confidence during the downturn. , IO DeFi's structured model provides a way to lock in consistent income without exposing assets to the extreme price swings of spot markets.ETC Mining: Balancing Accessibility and Resilience

ETC Mining, while less centralized than IO DeFi, has carved out a niche by emphasizing accessibility and sustainability. The platform's recent mobile app launch

in real time, with SSL encryption and distributed server redundancy safeguarding data. Its reliance on solar and wind energy mirrors IO DeFi's green ethos, though Mining's focus on GPU-based (ETC) mining introduces unique dynamics.Profitability for ETC miners in 2025 remained relatively stable compared to BTC and ETH, despite the broader market crash.

, for instance, could still yield approximately $85 monthly at $0.10/kWh electricity costs. However, -marked by an 8.4% drop in November 2025-highlights the risks of relying on a smaller altcoin. , however, mitigate some of these risks by providing predictable earnings streams. For XRP holders, the platform's multi-currency support offers a way to diversify exposure while leveraging cloud mining's operational efficiency.Strategic Advantages in a Volatile Market

Both platforms thrive on principles that counteract crypto's inherent instability:

1. Security and Transparency: , coupled with real-time on-chain data recording, ensures asset protection. ETC Mining's SSL encryption and encrypted cloud storage further bolster trust. 2. Operational Resilience: Renewable energy infrastructure reduces exposure to energy cost spikes, in 2025. 3. Predictable Returns: Fixed-term yield contracts and daily settlements provide income stability, that exacerbated the 2025 crash.Challenges and Considerations

While IO DeFi and ETC Mining offer compelling risk mitigation, they are not without caveats.

means its profitability remains tied to broader market sentiment. Additionally, in 2025 has increased slippage for miners converting earnings into fiat, eroding 2-5% of profit margins during volatility spikes. IO DeFi, though more insulated, , which some critics argue contradicts DeFi's decentralized ideals.Conclusion: A Strategic Hedging Tool

For BTC, ETH, and XRP holders navigating 2025's volatility, cloud mining platforms like IO DeFi and ETC Mining represent a strategic shift toward stability. By prioritizing security, sustainability, and transparency, these platforms enable investors to hedge against downside risk while generating passive income. As the crypto market continues to mature, the integration of cloud mining into diversified portfolios may prove essential for weathering future downturns.