Author:The storm in the wallet

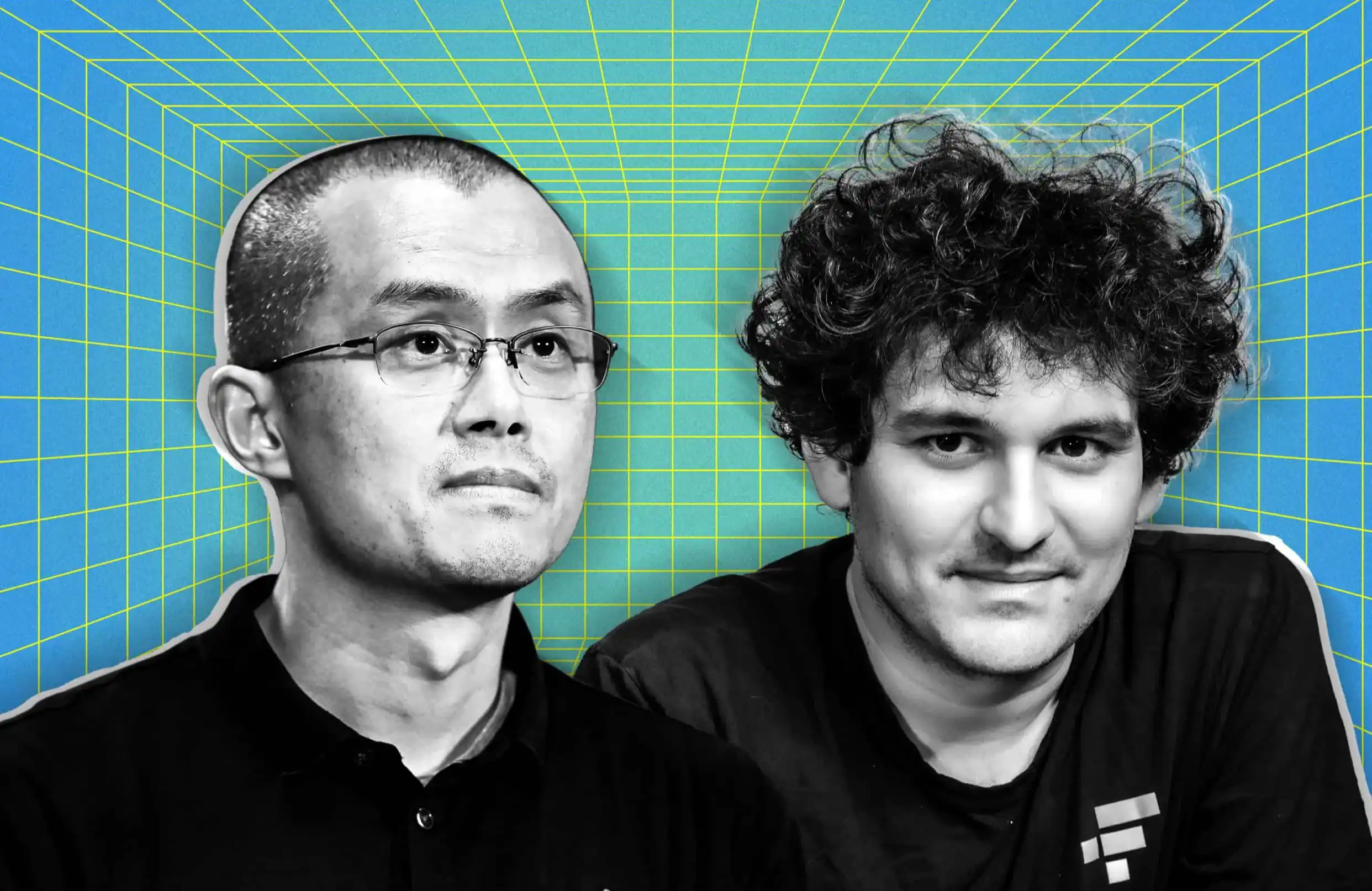

Changpeng Zhao (CZ), the former CEO of Binance, has debunked viral claims that BlackRock, the world’s largest asset manager, filed for a staked Aster (ASTER) exchange-traded fund (ETF).

The link between Aster and CZ stems from CZ’s significant personal investment and public endorsement of the decentralized derivatives exchange, which has sparked massive price rallies and speculation in the past.

Did BlackRock File For An Aster ETF?

A social media post alleging BlackRock had filed for a staked ASTER ETF with the Securities and Exchange Commission went viral on X (formerly Twitter) today. The post included what appeared to be an official S-1 registration document dated December 5, 2024, citing an “iShares Staked Aster Trust ETF” and listing BlackRock’s contact information.

The image spread quickly, leading to speculation about institutional moves regarding ASTER. However, it’s important to note that there is no evidence of such a registration in official SEC filings. The fabricated document closely imitated real SEC filings, making the forgery difficult to detect at first glance.

Still, a closer look at the image reveals it is photoshopped. The description in the document actually refers to the iShares Staked Ethereum Trust ETF, a real filing BlackRock submitted on December 5. Furthermore, the asset manager has made it clear in the past that its current focus on crypto ETFs is limited to Bitcoin and Ethereum.

CZ also responded promptly to debunk the misinformation. He cautioned his followers that even established crypto opinion leaders can be deceived.

“Fake. Even big KOLs gets fooled once in a while. Aster doesn’t need these fake photoshopped pics to grow,” he wrote.

Notably, the connection between CZ and Aster dates back a long way. In September, the executive voiced his support for the platform. Furthermore, YZi Labs (formerly Binance Labs) holds a minority stake in the DEX.

In November, CZ revealed that he had personally purchased about $2 million worth of Aster tokens as a long-term investment. This triggered a 30% surge in ASTER token’s price.

ASTER Price Slips Despite Buyback Program

Meanwhile, the ASTER token is facing market headwinds despite the project’s latest buyback effort. On December 8, the team announced that it would initiate an accelerated Stage 4 buyback program, increasing its daily purchases to approximately $4 million worth of tokens, up from the previous pace of around $3 million.

“This acceleration allows us to bring the accumulated Stage 4 fees since Nov 10 on-chain more quickly, providing more support during volatile conditions. Based on current fee levels, we estimate reaching steady-state execution in 8–10 days, after which daily Stage 4 buybacks will continue at 60–90% of the previous day’s revenue till the end of Stage 4,” Aster posted.

So far, the move has not translated into upward price momentum. ASTER fell nearly 4% over the past 24 hours, extending recent losses.

At the time of writing, the altcoin was changing hands at $0.93. Trading activity also weakened, with daily volume dropping by 41.80%.