Author:Sky Walker

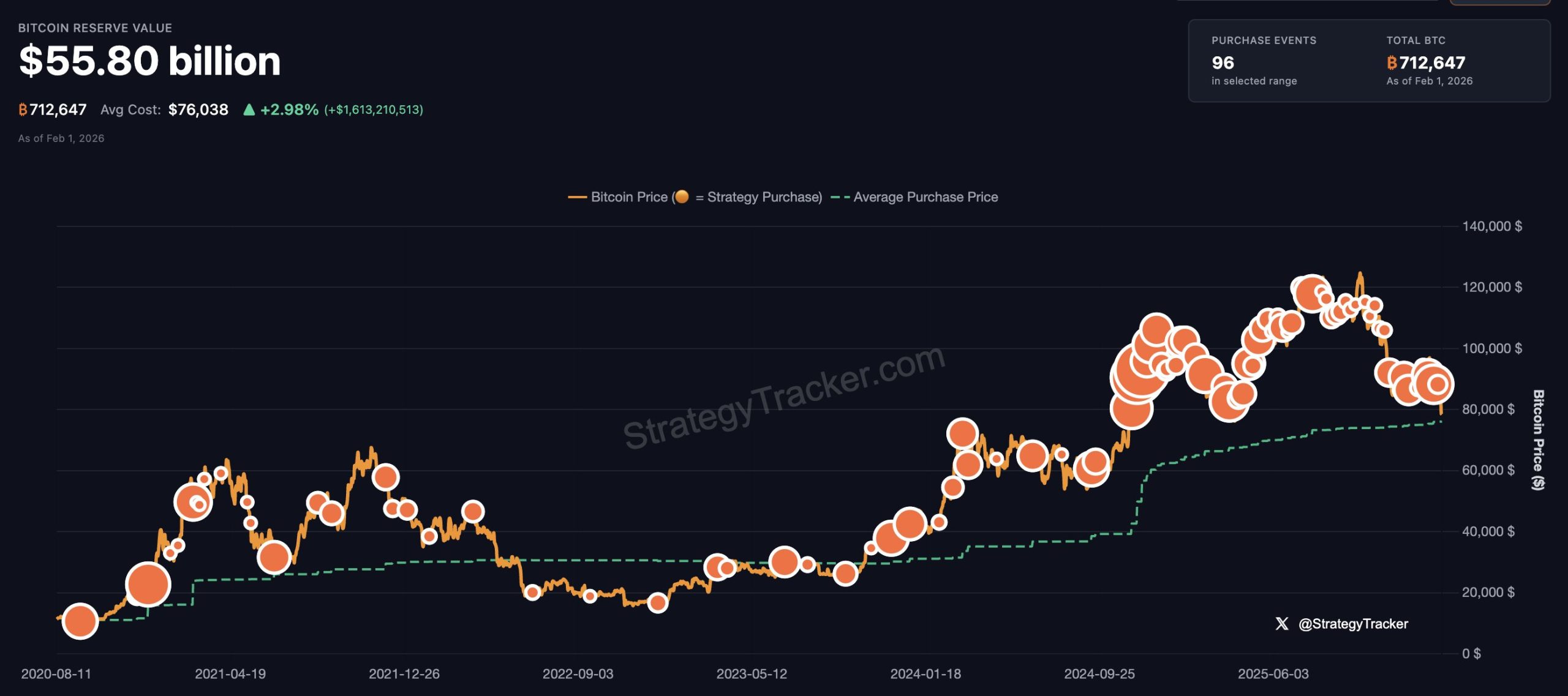

Bitcoin treasury company Strategy acquired an additional 855 BTC for approximately $75.3 million at an average price of $87,974 per bitcoin between Jan. 26 and Feb. 1, according to an 8-K filing with the Securities and Exchange Commission on Monday.

Strategy now holds a total of 713,502 BTC — worth around $56 billion — bought at an average price of $76,052 per bitcoin for a total cost of around $54.3 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor.

To put that in perspective, the haul represents more than 3.4% of Bitcoin's total 21 million supply, but with the continued negative price action, that now implies just $1.2 billion of paper gains at current prices. With bitcoin dropping below $76,000 at one point on Monday, Strategy's average cost briefly showed an unrealized loss for the first time since October 2023.

The latest acquisitions were made using proceeds from at-the-market sales of its Class A common stock, MSTR. Last week, Strategy sold 673,527 MSTR shares for approximately $106.1 million. As of Feb. 1, $8.06 billion worth of MSTR shares remain available for issuance and sale under that program, the firm said. No shares of Strategy's various perpetual preferred stocks were sold last week.

'More Orange'

Saylor gave his usual hint at the firm's latest set of acquisitions ahead of time, sharing an update on Strategy's bitcoin acquisition tracker on Sunday, stating, "More Orange."

Last Monday, Strategy announced it had purchased an additional 2,932 BTC for approximately $264 million, at an average price of $90,061 per bitcoin, bringing its total holdings to 712,647 BTC.

Meanwhile, Strategy's shares are increasingly the preferred indirect bitcoin-exposure vehicle for Norway's sovereign wealth fund. Some 81% of NBIM's indirect BTC exposure originates from the company's shares, valued at 7,801 BTC, according to K33. That represents around 1.16% in ownership of Strategy.

According to Bitcoin Treasuries data, 194 public companies have adopted some form of bitcoin acquisition model. MARA, Tether-backed Twenty One, Metaplanet, Adam Back, and Cantor Fitzgerald-backed Bitcoin Standard Treasury Company, Bullish, Riot Platforms, Coinbase, Hut 8, and Vivek Ramaswamy's Strive make up the remainder of the top 10, with 53,250 BTC, 43,514 BTC, 35,102 BTC, 30,021 BTC, 24,300 BTC, 18,005 BTC, 14,548 BTC, 13,696 BTC, and 13,132 BTC, respectively.

However, the value of many of the cohort's shares is down significantly from their summer 2025 peaks, as their market cap-to-net asset value ratios have sharply contracted; Strategy is down 67%, for example. Strategy's mNAV currently stands at around 0.81, meaning the company is worth less than the value of the bitcoin it holds.

Last year, Saylor said Strategy's capital structure is designed to withstand a 90% drop in bitcoin that persists for four to five years, thanks to its mix of equity, convertible debt, and preferred instruments — though he has acknowledged that shareholders would still "suffer" in such a scenario.

Strategy's stock fell 7% last week to close Friday at $149.71, according to The Block's Strategy price page, while bitcoin also declined 7% over the same period. MSTR is currently down 8% in pre-market trading on Monday.