Author:On chain believers

July 21st, 2025 – UAE, Abu Dhabi

LayerBTC has announced the launch of its LBTC token presale, introducing a new project focused on integrating with Bitcoin’s decentralized finance (DeFi) and infrastructure ecosystem.

LayerBTC is a Bitcoin Layer 2 network built for scalable applications, digital assets, and decentralized finance. LayerBTC provides developers, businesses, and communities with the tools they need to build on top of Bitcoin—without compromising on speed, flexibility, or sustainability

The LBTC token serves as a utility asset within the LayerBTC ecosystem, facilitating access to certain platform services, enabling fee reductions, and contributing to the platform’s operational framework.

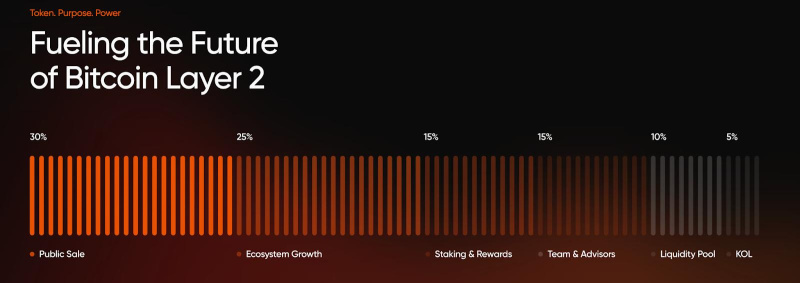

The total supply of LBTC is fixed at 12 billion tokens. Of this, 30% is allocated to the public sale, 25% to ecosystem growth, and the remaining tokens are designated for staking rewards, liquidity, team members, advisors, and strategic contributors.

This distribution model is structured to support long-term development and maintain alignment between the project’s users, builders, and investors.

Round 1 of the public sale is nearing completion, with over $340,000 already raised. The current price of LBTC is $0.00088, while the listing price has been confirmed at $0.06.

Investors can participate using a wide range of assets—including USDT, USDC, Bitcoin, Ethereum, XRP, Solana, and others—via both crypto wallets and bank card options.

ICO details: https://layerbtc.ai/Aww8PQoA

Utility, Roadmap, and the Role of LBTC

While LBTC is not required to utilize LayerBTC’s core infrastructure, it provides optional benefits for users who engage with additional features of the platform. These include access to advanced functionalities, reduced service fees, and the ability to license certain development tools.

Additionally, LBTC supports the protocol’s sustainability through optional usage-based fees and community funding mechanisms such as grants and rewards.

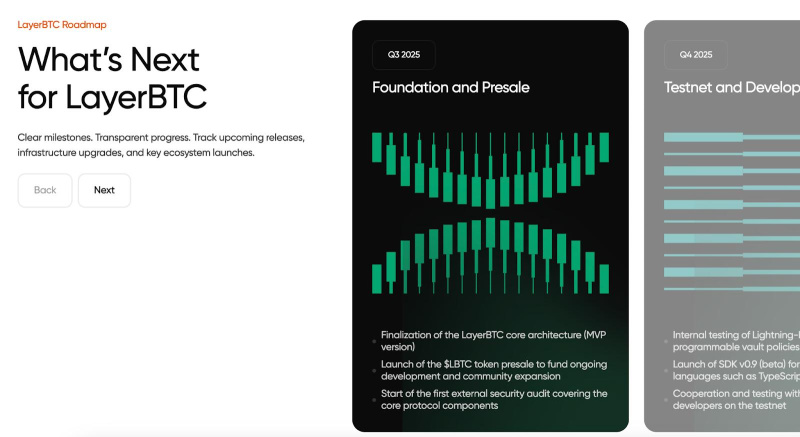

Looking ahead, LayerBTC has outlined a development roadmap that begins with the current presale and MVP architecture finalization in Q3 2025.

The following quarter will see the launch of a developer testnet and SDKs in multiple programming languages, enabling integration with wallets and apps. By Q1 2026, LayerBTC plans to activate mainnet smart vaults, open its developer grant program, and release SDK v1.0 for production-ready applications.

Building Infrastructure for a New Era of Bitcoin

As Bitcoin enters a new phase of global relevance, LayerBTC provides the infrastructure needed to expand its utility beyond store-of-value. By combining Bitcoin’s security with a flexible economic model and developer-friendly tools, LayerBTC aims to lower barriers to innovation and open new pathways for value creation on the Bitcoin network.

In a market increasingly focused on real-world utility, LayerBTC offers a structured, long-term approach to scaling Bitcoin’s capabilities.

With the LBTC presale currently in progress and a publicly available roadmap outlined, the project aims to establish an infrastructure layer designed to support the development of Bitcoin-native applications.

About LayerBTC

LayerBTC is a modular Layer-2 toolkit with a combination of unified proven Bitcoin extensions that combines a first-class user experience and a Bitcoin security model.

LayerBTC provides a set of tools designed for developers, advanced users, and institutional participants seeking to build or interact with applications while maintaining compatibility with the Bitcoin network.

Official links to get all the latest updates.:

Website: https://layerbtc.ai/Aww8PQoA

Twitter: https://x.com/layeronbtc

Telegram Community: https://t.me/layeronbtc

Contact