Author:Chain Road Prophet

The cryptocurrency market experienced a brutal flash crash in the early hours of Nov. 21, driving bitcoin from above $85,000 to a low of $82,032 in minutes. The sell-off caused the total crypto market capitalization to drop below $3 trillion.

Altcoins Decimated

In a brutal flash crash during the early hours of Nov. 21, bitcoin ( BTC) tumbled from just above $85,000 to a low of $82,032 in a matter of minutes, bringing the cryptocurrency within range of pessimistic predictions made by figures like BitMEX founder Arthur Hayes and veteran trader Peter Brandt. Although BTC made an almost immediate recovery, rallying back to $84,000, it remained down nearly 14% over seven days and more than 22% over the last 30 days.

With bearish sentiment seemingly growing, many analysts and bettors on prediction markets are increasingly wagering on the sell-off continuing, with BTC potentially ending the year trading under $80,000.

The flash crash decimated the altcoin market. Ethereum ( ETH) plunged to just above $2,700, marking its lowest point in four months. XRP last traded near $1.80 in the days following U.S. President Donald Trump’s “Liberation Day” tariff announcement, which roiled global markets and drove BTC down to $76,000.

Read more: Trump’s Tariffs Target Global ‘Cheating’ as BTC Dips and Stocks Slide After Hours

BNB, which had recently trended against the market, tumbled to $828 before recovering to trade around $834. The story was similar for many high-cap altcoins, which saw double-digit or near double-digit losses in 24 hours. Overall, the sell-off drove the crypto economy’s total market capitalization below $3 trillion, bringing the cumulative market losses since the start of the week to more than $300 billion.

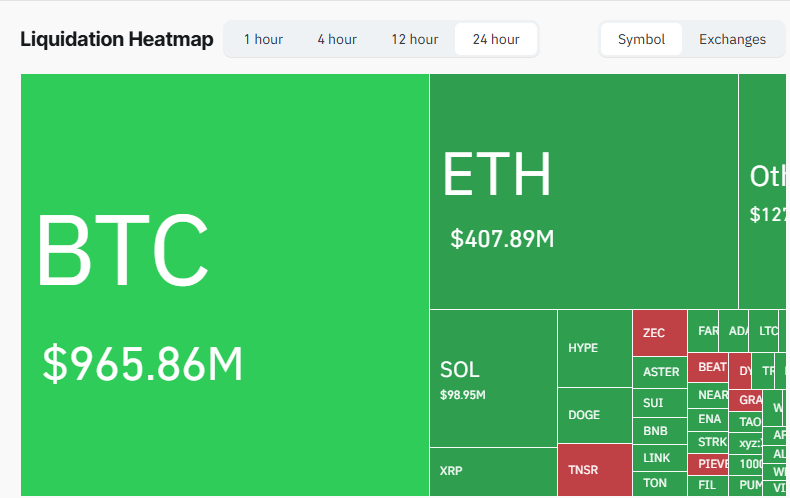

As expected, the sharp price movement triggered a massive liquidation event, wiping out $1.93 billion in leveraged positions and affecting nearly 400,000 traders. Coinglass data (3:40 a.m. EST) showed BTC accounted for $965 million of the liquidations, with liquidated long positions constituting more than 90% of those losses.

While liquidated longs dominated across most assets, the reverse was true for Zcash (ZEC), where $7.54 million in short positions were liquidated versus $6.96 million in wiped-out longs.

FAQ 💡

- What happened to bitcoin on Nov. 21? BTC plunged to $82,032 before rebounding to $84,000.

- How did altcoins react worldwide? ETH fell below $2,700, XRP hit $1.84, and BNB dropped to $828.

- What was the overall impact? Crypto market cap sank below $3 trillion, losing over $300 billion in a week.

- How many traders were affected? Nearly 400,000 traders were liquidated, with $1.93 billion wiped out in positions.