Author:99Bitcoins

Fifteen consecutive days of positive inflows on Wall Street have brought a total of 897 million dollars into crypto ETFs, led by Canary, Grayscale, and Bitwise. Meanwhile, 21Shares is preparing to launch its XRP ETF, TOXR, which will bring even more institutional access to XRP.

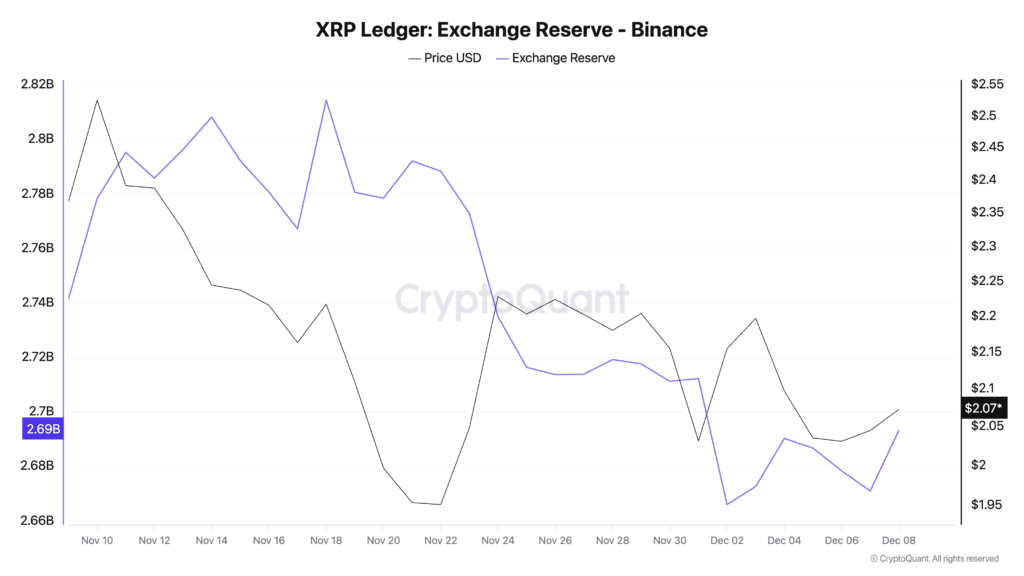

Many analysts expect XRP to rally soon as institutions continue draining the supply. XRP reserves on exchanges have been declining over the past thirty days despite a weak market, with ETF buyers steadily stepping in. It has now recorded fifteen straight days of positive inflows.

Ripple CEO Brad Garlinghouse also highlighted a major milestone, noting that the XRP ETF became the fastest to reach one billion dollars in assets under management in the United States since the ETH ETFs.

XRP Price Prediction: A Rebound To $2.50 Before New Year

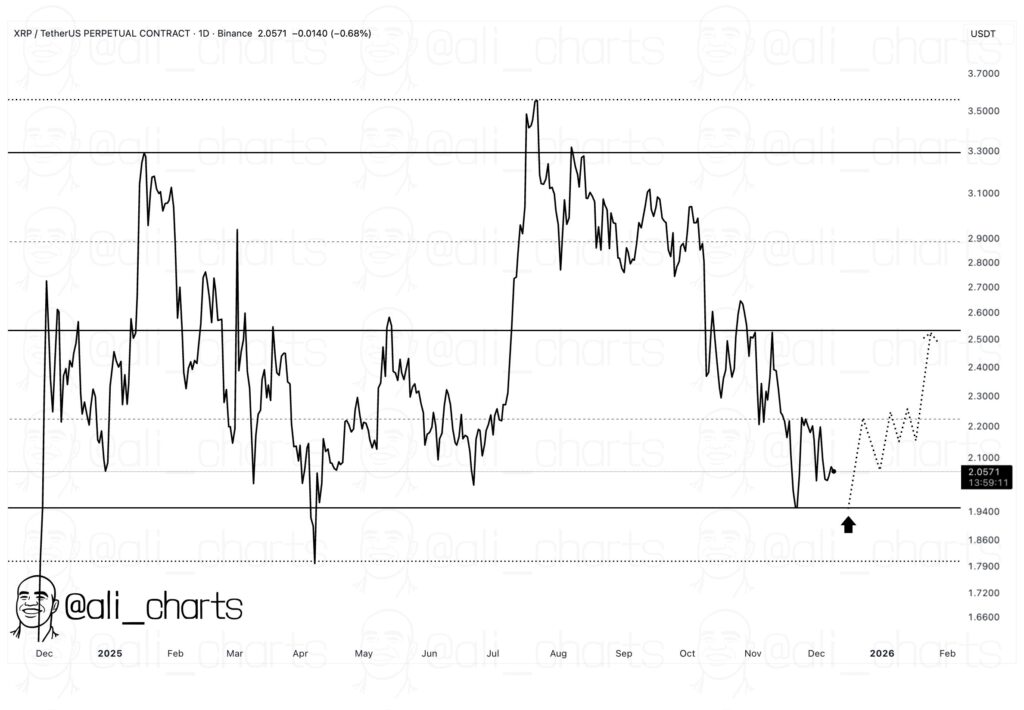

This XRP chart by experts basically maps out a classic reclaim attempt after a heavy multi-month downtrend. Price recently tagged the one-dollar ninety zone, which has acted as a major historical floor, and the sharp bounce from that level lines up with the black arrow shown on the chart.

From there, the structure begins to tighten, showing a series of slightly higher lows that suggest accumulation around the two-dollar area. The dotted projection illustrates what a gradual recovery path could look like if buyers continue defending this base: first a slow grind back toward two point thirty, then a challenge of the key two point fifty resistance that previously marked the breakdown point.

If XRP can flip that into support, the chart leaves room for a run toward the three-point thirty band, which has rejected multiple rallies in the past. For now, the whole setup hinges on holding above the one-dollar ninety floor, because losing that would shift the entire outlook back into a deeper correction.

Bitcoin Hyper: The Layer 2 Project Stealing Attention as Institutions Load Up on Crypto

While institutional money continues to pour into ETFs and capital shifts back into high conviction assets like XRP, one early-stage project is capturing outsized attention from retail and analysts alike. Bitcoin Hyper is emerging as one of the strongest narratives heading into 2026, blending a meme-powered identity with real Bitcoin layer 2 infrastructure that solves major scalability limitations.

Bitcoin Hyper is built on the Solana Virtual Machine, enabling high-speed execution, ultra-low fees, and full smart contract support on top of Bitcoin’s security layer. The project also introduces decentralized governance and a Canonical Bridge designed to move BTC smoothly across chains without the friction that has held back existing solutions.

Its presale has already surpassed 29 million dollars, showing strong appetite from early adopters. Analysts such as Borch Crypto are calling for a potential one-hundred-times rally once HYPER lists on major exchanges, and a fresh Coinsult audit reported zero contract vulnerabilities, increasing the project’s credibility even further.

HYPER tokens power staking, governance, and gas fees within the ecosystem, and presale buyers can earn up to forty percent APY. With the full platform launch set for 2026, Bitcoin Hyper positions itself as an early access opportunity for investors seeking exposure to the next major upgrade in Bitcoin utility.