Author:Blockchain expert

With the Supreme Court set to rule on Trump’s tariffs, mid-January brings tension to the markets. Traders are watching trade policy, executive authority, and fiscal implications closely.

Table of Contents

- Mid-January markets are tense ahead of the Supreme Court ruling on Trump’s tariffs, with traders monitoring trade policy, executive authority, and fiscal risks.

- Crypto markets are showing modest gains: Bitcoin price +1.5%, Ethereum price +0.5%, and XRP price +0.7%, as traders remain cautious.

- Lower courts rejected the government’s IEEPA-based tariffs; if upheld, the U.S. could owe over $130 billion, creating fiscal strain and executive power debates.

- BTC maintains a bullish outlook near $92,070, while ETH and XRP may see short-term volatility but long-term opportunities remain strong.

- The Supreme Court decision could drive more capital into crypto as investors seek alternatives, supporting Bitcoin, Ethereum, and XRP for the long term.

According to the latest crypto market forecast, some turbulence and mixed gains are likely.

Market context: Calm before the decision

Modest gains are showing in crypto today: Bitcoin price +1.5%, Ethereum price +0.5%, and XRP price +0.7%. Most traders are cautious, keeping a close watch on the Supreme Court decision.

Lower courts previously rejected the government’s IEEPA-based tariffs. If the Supreme Court concurs, the U.S. may have to return upwards of $130 billion — a serious fiscal strain and an executive power debate. Traders are clearly playing it safe.

Why the ruling matters for crypto

The Supreme Court ruling is a stress test for the economy. Crypto tends to shine when policy’s wobbly, since investors are hunting for alternatives outside the usual systems. If the ruling shakes trade or fiscal confidence, we could see more cash flowing into crypto. Even if tariffs stick, inflation and trade worries keep the long-term story looking bright.

Bitcoin outlook: Volatility with a bullish bias

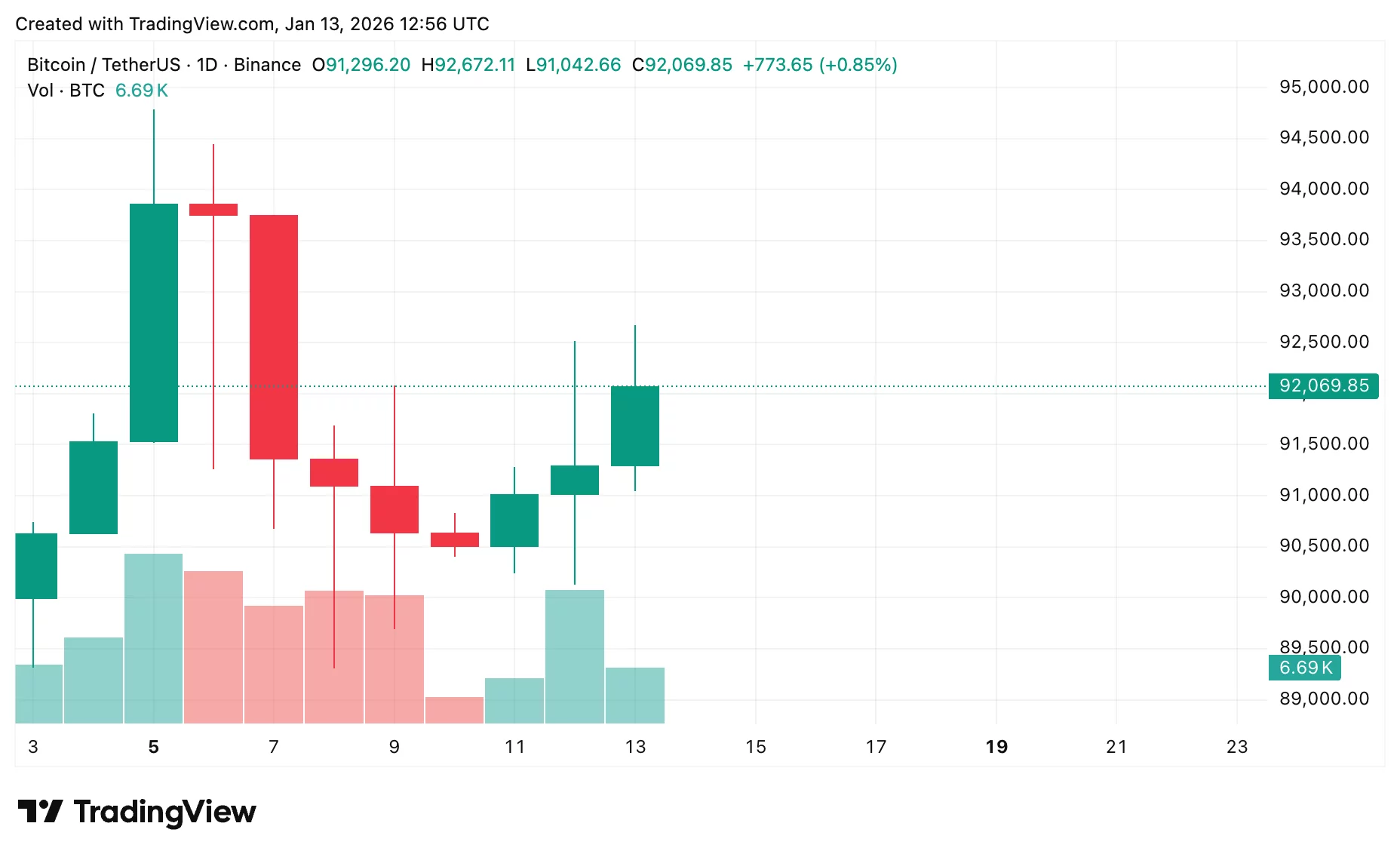

Bitcoin (BTC) is trading near $92,070, defending $90,000 but capped by EMA resistance. A drop could target $86,000, though bigger losses seem unlikely without broader market stress.

The Bitcoin price prediction stays bullish. Tariff reversals could boost its hedge appeal, and inflation plus geopolitical risks support the long-term case.

Ethereum outlook: Sensitive to risk sentiment

Ethereum (ETH) is hanging around $3,133 and might wobble a bit if the Supreme Court ruling makes traders nervous.

The Ethereum price prediction expects some near-term turbulence, but things should look bright in the long run once institutional flows and infrastructure momentum kick back in.

XRP outlook: Opportunities amid uncertainty

Currently around $2.06, Ripple (XRP) tends to see big moves when markets are unsettled. Traders may first retreat to safer assets, but a rebound in sentiment could push XRP higher as money returns to altcoins.

According to the XRP price prediction, near-term caution might flip into strong upside once the broader market shows signs of improvement.

Final thoughts

The Supreme Court ruling arrives January 14, and traders are on high . Bitcoin stays a steady choice, while Ethereum and XRP could see gains afterward. Fiscal and trade pressures continue to make crypto appealing for the long term.