Author:Encryption Jianghu

Ripple [XRP] shorts are facing mounting pressure as the token stabilizes around $1.95 and begins pushing higher.

Short positions have built up as funding rates stay negative. As a result, the recent bounce is forcing cover and fueling near-term upside momentum.

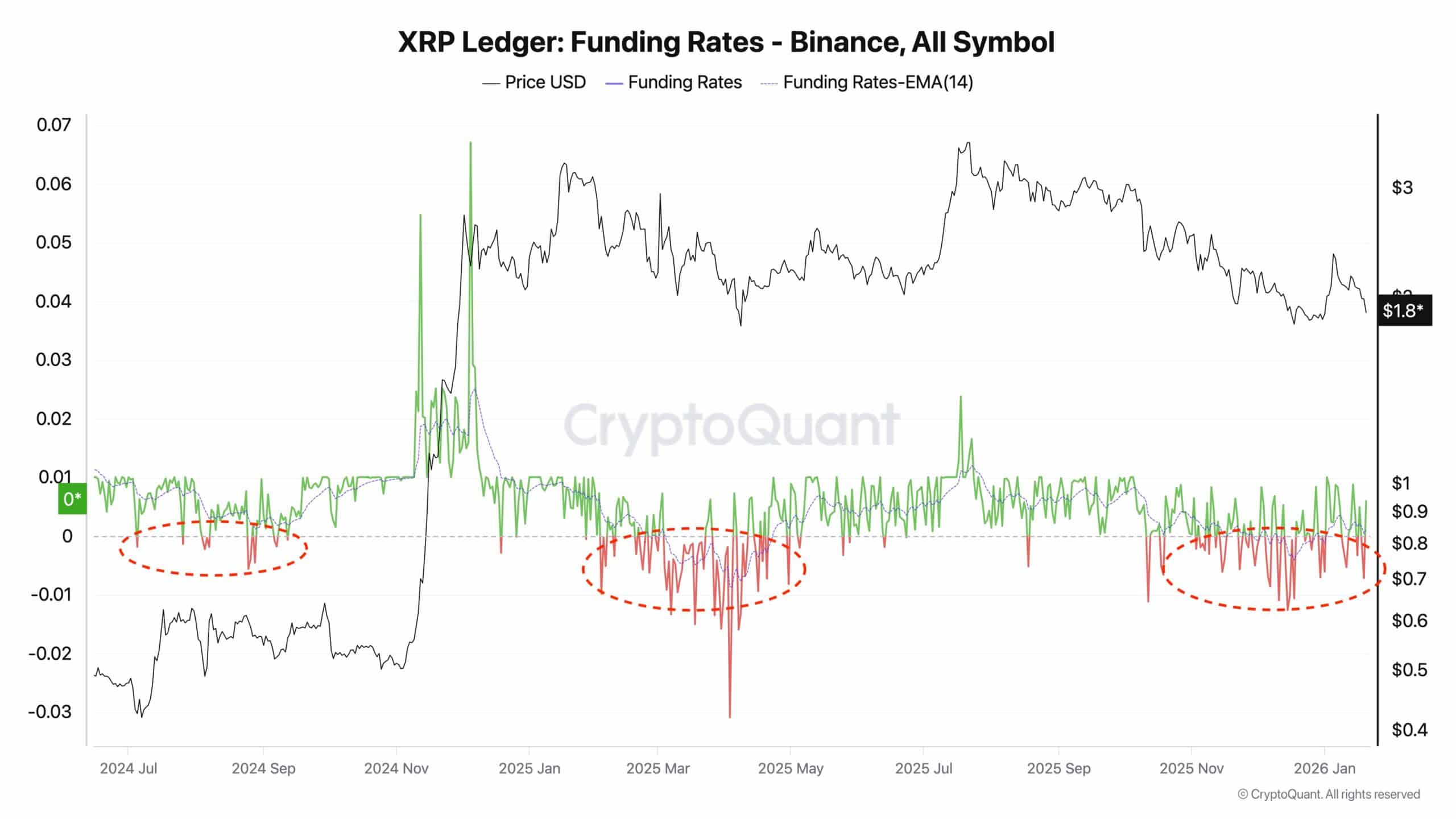

XRP Funding Rates turned negative as sellers crowded derivatives markets during price consolidation.

First, between August and September 2024, declining Spot momentum pushed perpetual funding below zero, signaling bearish positioning.

Then, a similar pattern reappeared during the April 2025 correction, as uncertainty and profit-taking intensified downside hedging.

Consequently, sentiment skewed defensive, while long holders stepped aside and volatility compressed. However, history shows this negativity often exhausts sellers.

As funding normalized, the price rebounded sharply, reflecting risk appetite. If negative funding persists, investors should watch for drawdowns and rising open interest.

Conversely, a flip back to positive rates warrants strategic reaccumulation.

XRP derivatives signal risk-off sentiment

According to CoinGlass data, XRP Funding Rates and price have exhibited closely correlated movement across market cycles.

From 2021 to mid-2023, XRP traded near $0.40-$0.60 while funding stayed flat to mildly negative, reflecting low conviction.

Then, in late 2024, the price surged above $3.00 as funding spiked toward +0.10%, signaling aggressive long positioning.

However, that imbalance preceded sharp pullbacks. During 2025, XRP corrected toward the $2.00-$2.50 range while funding slipped back below zero.

As a result, traders reduced leverage and shifted defensively. Mildly negative funding suggests cautious sentiment, historically associated with base building and potential trend resets.

What’s different this time?

Unlike past XRP cycles shaped by hype or regulatory drag, 2026 reflects a structurally stronger setup.

The regulatory overhang disappeared after the SEC case against Ripple closed in 2025, restoring the U.S. institutional access.

Spot XRP ETFs launched soon after and absorbed $1.3–1.4 billion in steady inflows, effectively tightening the liquid supply.

Meanwhile, Ripple’s acquisitions, RLUSD stablecoin expansion, and new licenses reinforced real-world settlement use.

Together, these shifts validate a higher price regime, as demand is now anchored in infrastructure, liquidity, and institutional adoption rather than speculative excess.

Liquidation clusters signal rising short squeeze risk

The Heatmap showed both clumps of liquidation that are concentrated around the range between $1.98 and $2.05, with the most populous at slightly above $2.00.

These levels were similar to the previous XRP structures in periods of extreme negative funding. The price was trading around $1.95 at press time, but downside liquidation pockets were not very strong, as they were below $1.90.

This imbalance matters. Short exposure at a price is accumulating overhead because the price is greater than $1.93-1.94. Every step of consolidation puts a strain on the market.

In the past, when XRP was under heavy accumulations such as this, even small spot bids would cause cascading short liquidations. Consequently, the $2.00 to $2.05 zone is gradually becoming a squeeze trigger instead of resistance.

To sum up, timing currently dominates, as squeeze risk and seller exhaustion outweigh pure directional conviction.

As a result, near-term upside momentum remains the highest-probability outcome despite ongoing consolidation.

Investors should watch out for the funding flip to positive as confirmation of sustained trend strength.

Final Thoughts

- Negative funding and concentrated liquidation clusters above $2.00 signal rising short squeeze risk as XRP holds near $1.95 with limited downside liquidity.

- At the same time, regulatory clarity, ETF inflows, and Ripple’s ecosystem expansion tighten supply, reinforcing upside resilience and favoring continuation over breakdown.