Author:Bloomberg

Europe needs a digital euro to guarantee its autonomy from payment providers outside the region, European Central Bank Executive Board member Piero Cipollone said.

“Today, Europe is significantly reliant on non-European payment systems and if we don’t do anything this reliance will increase,” Cipollone said Thursday in Rome. “It’s critical infrastructure for the functioning of the economy and putting it off would mean accepting a structural vulnerability.”

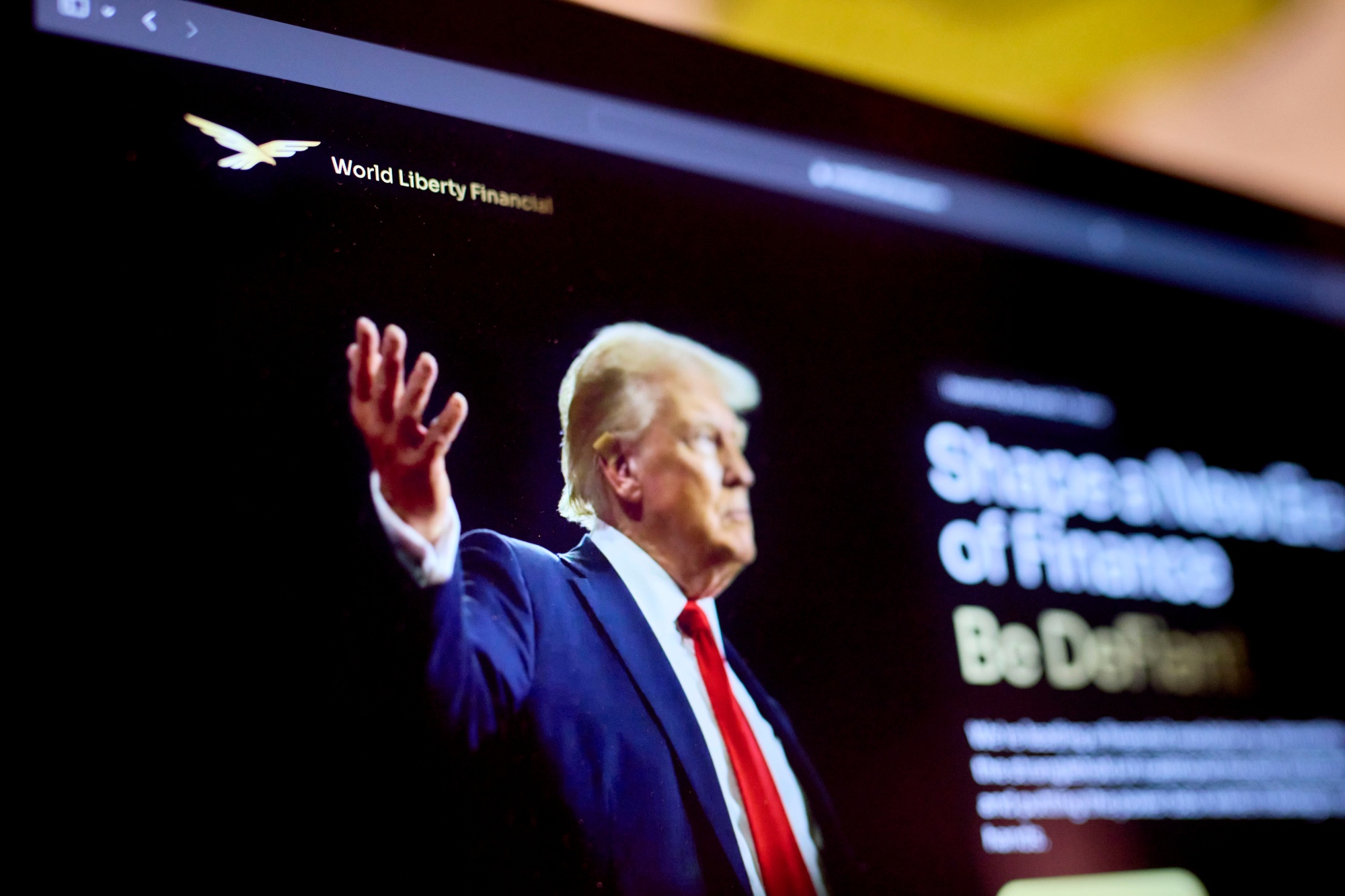

The ECB has been pushing for a digital counterpart to banknotes and coins for years to reduce the continent’s reliance on firms like Visa, Mastercard and PayPal for retail payments. Fears about excessive financial dependency on the US have been heightened by Donald Trump’s latest trade threats.

In a joint interview with La Stampa, Cipollone reiterated to Bloomberg that the digital euro could start its pilot phase in 2027 and begin issuance in 2029.

“It’s not, however, about reacting to someone, but about acting on our mandate,” he said. “The ECB must guarantee the proper functioning of payment systems and such a marked dependency on extra-European systems in such a crucial sector represents a systemic risk.”

While the main goal is domestic, the infrastructure — once in place — could be expanded to allow use by countries outside the euro area, he said.

The ECB launched its digital-euro push in 2021, but is still awaiting a legal framework. More than two years after the European Commission issued its proposal in 2023, member states in December agreed on a common position. The biggest roadblock is the European Parliament, which must still finalize its stance, with some lawmakers preferring a private-sector solution.

Separately, Cipollone discussed stablecoins, which are championed by Trump but — according to the IMF — could threaten traditional lending, undermine monetary policy and spark a run on some of the world’s safest assets.

Cipollone said the instruments could “threaten financial stability” in Europe, suggesting citizens should instead be offered simple and reliable alternatives.

“The response is to guarantee an efficient combination of public and private money in euros,” Cipollone said.