Author:Wall Street CN

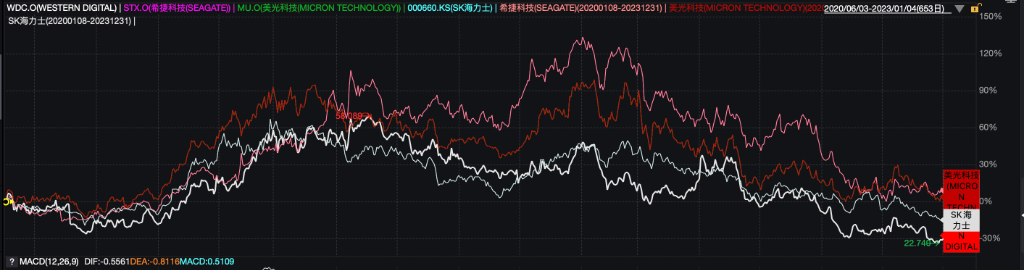

According to an analysis by the Financial Times of the UK,Despite the unprecedented surge in the memory chip sector driven by demand from artificial intelligence, the industry's strong cyclical nature has not disappeared.Over the past six months, SanDisk's stock price has surged 1,200%, while Western Digital, Seagate, Micron, and SK Hynix have also seen gains of 180% to 280%, making them the best-performing stocks in the S&P 500.This rally has raised concerns in the market that investors may be repeating the mistakes of the 2022 cycle reversal.

The report believesThe storage demand driven by AI applications is the core driver of this market trend.With memory prices continuing to rise, SanDisk has shifted from a cash-burning state in 2024 to generating nearly $1 billion in free cash flow last quarter. However,The storage industry is highly cyclical, with rapid fluctuations in demand and lagging capacity adjustments, often leading to dramatic price swings.

The article cited industry insiders warning that"Investors have very short memories."Historical data shows that from mid-2020 to early 2022,Western Digital, Seagate, Micron, and SK Hynix all saw their stock prices rise by more than 100% at one point.,It subsequently gave back all its gains within nine months.Similar dramatic fluctuations occurred in 2014 and 2018.The current market optimism is causing people to overlook the lessons learned from the cyclical nature of industries.

Large-scale procurement and capacity expansion may give rise to a new round of overcapacity.

Industry analysts point out that the current memory market is exhibiting structural risks similar to those of the 2022 cycle.To secure partnerships with cloud computing hyperscale vendors, suppliers often procure storage devices before receiving confirmed orders to demonstrate their supply capabilities. However, not all suppliers ultimately secure contracts, resulting in total orders far exceeding actual demand.

at the same time,Hyperscale manufacturers themselves often overestimate future demand.Once the company adjusts its order size, the existing excess supply will quickly transform into a severe market oversupply. The report, citing industry sources, stated that...Order volumes have already doubled or even tripled, and production capacity is expanding in tandem.Samsung's recent announcement of plans to significantly increase DRAM production capacity has further exacerbated potential pressure on the supply side.

Is this cycle different?

Despite the inherent cyclical risks in the storage industry, market analysts believe...This round of expansion driven by artificial intelligence may last longer than in the past.Jonathan Goldberg, an analyst at Digits to Dollars Advisory, stated:

“Looking back at history, the market eventually corrects over the past five years. This cycle has a larger amplitude, so prices may continue to rise. Many semiconductor investors who weren’t in the industry five years ago would say that this time is different. But the fact is, the cycle hasn’t changed.”

on the other hand,Technological advancements in high-bandwidth memory (HBM) are seen as a key variable that could reshape the industry landscape.This dedicated high-performance DRAM is currently dominated by Samsung, SK Hynix, and Micron. Creative Strategies analyst Ben Bajarin points out:

"This cycle is largely driven by HBM, which is more differentiated and will not become a homogenized product in the short term... I believe that memory revenue has bottomed out and rebounded."

The market is currently at a juncture where technological iteration and cyclical patterns intertwine, and the supply and demand dynamics of HBM will become one of the core factors influencing the length and form of this cycle.