Author:BlockBeats

Original title: LayerZero gathers Wall Street's old money in one day, as the cross-chain leader begins to tell the story of the "Wall Street public chain".

Original source: Deep Tide TechFlow

On February 10, LayerZero launched Zero in New York.

This is a self-developed Layer 1 public chain, with the goal of supporting institutional-grade financial market transactions and clearing.

LayerZero calls itself a "decentralized multi-core world computer." Let me translate it for you: a blockchain specifically designed for Wall Street.

Meanwhile, Wall Street institutions began openly endorsing the move, with some responding by directly providing financial support.

Citadel Securities has made a strategic investment in the ZRO token.

This company handles about one-third of retail stock orders in the United States. In its report on this matter, CoinDesk specifically pointed out that directly purchasing crypto tokens is not routine for traditional Wall Street financial institutions like Citadel.

ARK Invest also acquired shares and tokens in LayerZero, and Cathie Wood joined the project's advisory board. Tether announced a strategic investment in LayerZero Labs on the same day, but the amount was not disclosed.

Beyond buying cryptocurrencies and investing in equity, there's an even quieter signal.

DTCC (the central clearing house for US stock trading), ICE (the parent company of the NYSE), and Google Cloud have also signed a joint exploration agreement with Layerzero.

So,For a project that builds cross-chain bridges to transform, it can simultaneously obtain collective endorsement from the entire industry chain, including clearing, trading platforms, market makers, asset management, stablecoins, and cloud computing.

Traditional institutions have once again taken steps to establish on-chain financial channels.

Following the announcement, ZRO's price surged by over 20% at one point that day, and is currently trading around $2.30.

Instead of building a bridge, are we going to build a pipeline?

LayerZero's actions over the past three years have been straightforward:

It allows tokens to be moved from one chain to another. Its cross-chain protocol currently connects more than 165 blockchains, and USDt0 (the cross-chain version of Tether's stablecoin) has handled more than $70 billion in cross-chain transfers in less than a year since its launch.

This is a mature business, but the ceiling is clearly visible.

Cross-chain bridges are essentially tools; users will use whichever is cheapest and fastest. However, with the shrinking crypto market and declining transaction volume, cross-chain technology has become a pseudo-demand, so LayerZero's decision to switch tracks is understandable.

Moreover, it has the capital to invest. A16z and Sequoia Capital have led the investment in the project, raising a total of over $300 million, and its valuation was once $3 billion.

The portfolio companies of these two firms are essentially Wall Street's address book. The fact that Citadel and DTCC are now willing to sit down and endorse LayerZero may have a lot to do with who is backing them.

Returning to LayerZero's new L1, Zero, it doesn't seem to be designed for DeFi players or meme traders.

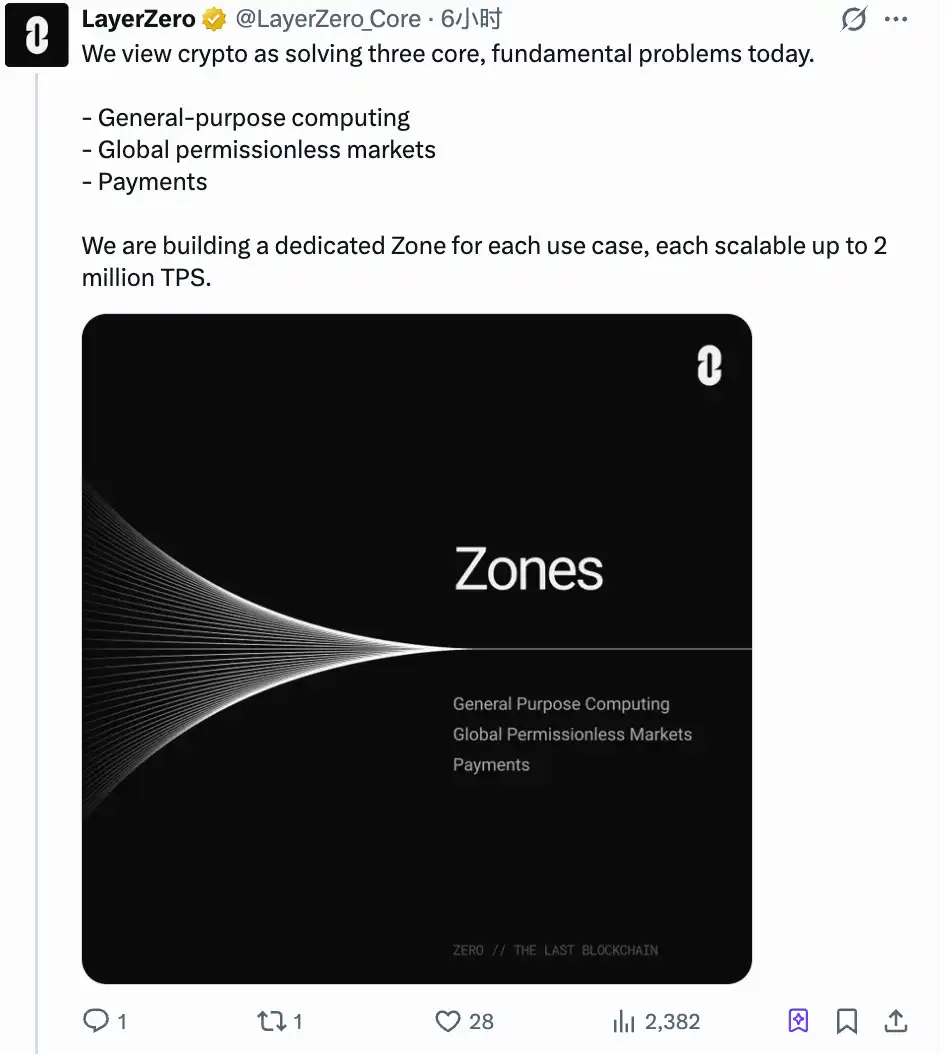

Zero's architecture differs from existing public blockchains. Most blockchains operate on a single, uninterrupted path.Zero breaks the chain down into multiple independently operating partitions.LayerZero calls themZone.

Each zone can be optimized independently for different scenarios without interfering with each other.

At launch, three zones were created: a general environment compatible with Ethereum smart contracts, a privacy payment system, and a dedicated transaction matching environment.

These three zones are designed for three different types of customers.

A general-purpose EVM environment retains existing crypto developers with low migration costs. Privacy payments address a long-standing problem for institutions: when trading on Ethereum, counterparties can see your positions and strategies, and large funds are unwilling to be exposed.

The dedicated trading zone targets a more direct approach, responsible for matching and settlement after the tokenization of securities.

Looking back at the attendance list makes it clear. DTCC clears trillions of dollars in securities transactions annually, and it wanted to know if clearing could be faster. ICE, which operates the NYSE, whose stock market is only open on weekdays, wanted to try 24/7 trading. Citadel handles massive order flows, and every step faster in the post-trade process costs money.

So when you look at them together, these aren't the needs of the crypto industry, but rather Wall Street's own pain points.

LayerZero CEO Bryan Pellegrino was quite blunt in a public interview:

"It's not that what we have now isn't good enough; it's that we really need scenarios with 2 million transactions per second, which belong to the future of the global economy."

Incidentally, Zero, this new chain, claims to achieve 2 million transactions per second (TPS) in its test environment, which can indeed meet the needs of traditional financial production. However, the performance narrative of public chains has already been thoroughly explored, and no matter how high the performance is, I don't think it's surprising.

The story may remain the same, but the audience can change; this time, it's the turn of the old money.

Wall Street wants to move transactions on-chain, but Ethereum can't handle it.

The reason why institutions are flocking to LayerZero is not because of the crypto bull market, but because Wall Street itself is pushing for tokenization.

BlackRock's BUIDL fund, launched on Ethereum last year, raised over $500 million. JPMorgan Chase's Onyx platform, running Ethereum technology, has already processed trillions of dollars worth of buyback transactions.

Wall Street used Ethereum as a proof of concept, demonstrating the feasibility of tokenization. The next step is to find a place to run production workloads.

Zero's three zones are designed to address this gap. EVM compatibility means that assets and contracts on Ethereum can be migrated over.

This may be the real dividing line between LayerZero and Ethereum.

Ethereum is currently using standards like ERC-8004 to gain the right to define definitions, giving AI agents on-chain identification and setting rules for the future on-chain economy...

LayerZero's current approach is to disregard definitions, directly build pipelines, and tell institutions that their transactions can run through them.

One is writing a rulebook, the other is laying water pipes. They're betting on different things.

Ethereum is betting on its irreplaceable role as the trust layer, backed by its TVL scale, security audit ecosystem, and institutional recognition. LayerZero is betting on the demand for alternatives at the execution layer: Wall Street needs speed, privacy, and throughput; whoever provides these first will be used.

Whether the two paths will eventually intersect is unclear. But the flow of capital has already given a directional signal.

What does $ZRO mean?

ZRO's initial positioning was simple: the governance token of the LayerZero cross-chain protocol. The total supply was 1 billion tokens, used for voting and staking, nothing more.

After Zero was released, the story of this token changed.

ZRO is the native token of the Zero blockchain, pegged to network governance and security. If Zero truly becomes institutional-grade financial infrastructure, the valuation logic for ZRO will no longer be "how many transactions are conducted on the cross-chain bridge," but rather "how many assets are running on this chain."

The two valuation anchors, as you all know, have ceilings that differ by several orders of magnitude. But narratives aside, several hard variables will determine ZRO's future trajectory.

Supply side: 80% of the tokens have not yet been unlocked.

ZRO currently has a circulating supply of approximately 200 million, representing just over 20% of the total supply. According to CoinGecko data, about 25.71 million ZRO, worth approximately $50 million, representing 2.6% of the total supply, will be unlocked on February 20th and distributed to core contributors and strategic partners. The entire unlocking cycle extends to 2027.

The release of these shares on February 20th was the first supply shock since the press conference. Whether the market can absorb it will be a litmus test for short-term sentiment.

On the demand side: The cost switch has not yet been turned on.

Currently, ZRO lacks a direct value capture mechanism. A governance vote was held last December proposing to charge for each cross-chain message, with the revenue used to buy back and burn ZRO, but it failed due to insufficient voter turnout. The next vote is scheduled for June of this year.

If approved,ZRO has a burning mechanism similar to ETH, where each transaction reduces the circulating supply.If the project fails again, the token's "governance rights" will only consist of voting rights, without any cash flow support.

Therefore, in summary, players interested in ZRO can keep an eye on three key time points:

In June, a second vote was held on the fee switch. Whether it passes or not directly determines whether ZRO has an inherent demand.

2. The Zero mainnet will launch this fall.

3. ZRO tokens will not be fully unlocked until 2027. Before then, each unlocking round will be a source of pressure, and coupled with the current bear market in the crypto market, positive news may not necessarily boost the price of ZRO.

Finally, LayerZero calls Zero a "decentralized multi-core world computer," which is clearly a direct challenge to Ethereum's concept of a world computer. It is attempting to play a more important role in the settlement layer, especially in the financial settlement layer, while simultaneously transitioning from and separating itself from the thin narrative of cross-chain bridges.

However, the official statements from several partners are worth noting.

Citadel describes its participation as "evaluating how the architecture supports high-throughput workflows"; DTCC says it's "exploring scalability in terms of tokenization and collateral."

In other words, we think this might be useful, but we haven't made a decision yet.

Wall Street money is smart; smart enough to place many small bets simultaneously, seeing which one will emerge first. Therefore, when a project attracts a group of star institutions, it doesn't necessarily mean a strong, unbreakable bond, but rather acts as a catalyst for short-term gains.

What LayerZero received might be an admission ticket, or it might just be an interview opportunity.