Author:Whistleblower in the cryptocurrency industry

Bitcoin is increasingly behaving like a speculative risk asset rather than digital gold, according to a new study by Grayscale analysts. This challenges the long-standing narrative of the leading cryptocurrency as a safe haven, at least in the short term.

Report author Zach Pandl noted on February 10 that while Grayscale still considers Bitcoin a long-term store of value due to its fixed supply and independence from central banks, recent market behavior contradicts that assumption.

Bitcoin Tracks Tech Stocks More Closely

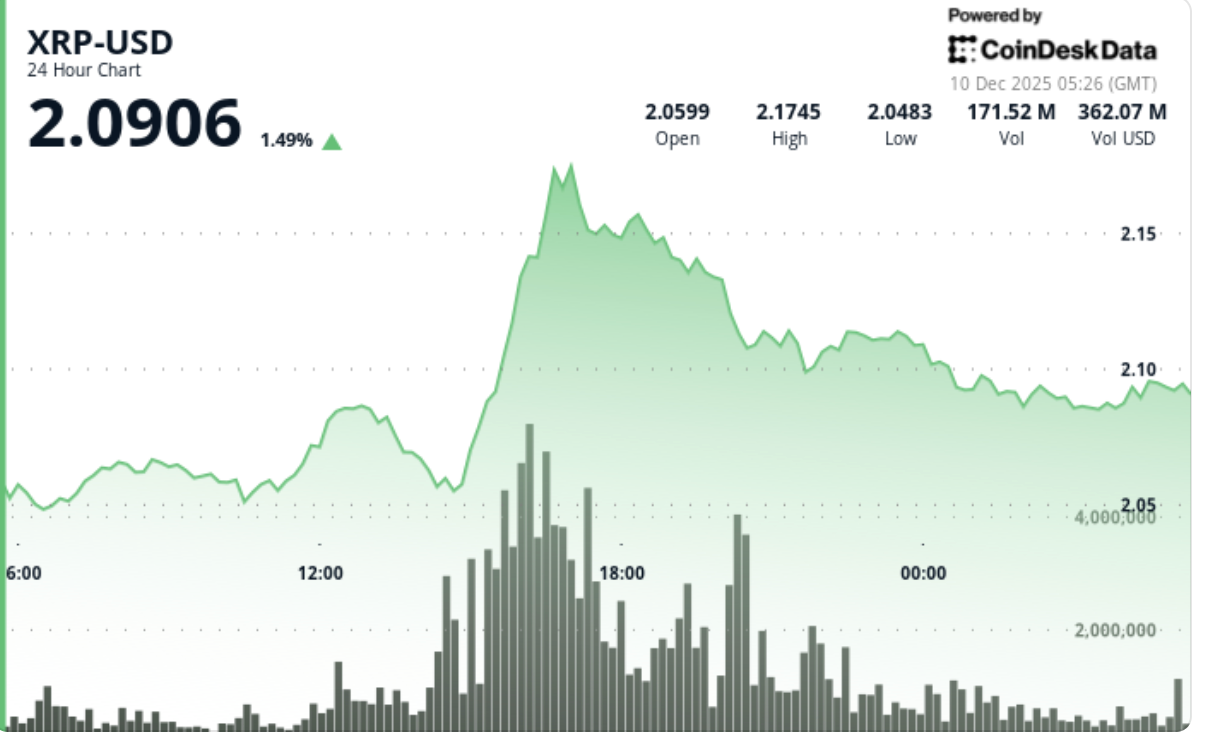

The study found that Bitcoin has developed a strong correlation with software stocks, particularly since early 2024. The sector has recently faced intense selling pressure amid concerns that artificial intelligence could disrupt parts of the software industry.

Bitcoin's recent declines mirror the collapse of tech stocks since early 2026. Grayscale notes that Bitcoin's growing sensitivity to stocks and growth assets reflects its deeper integration into traditional financial markets. This trend is driven in part by institutional investor participation, exchange-traded fund activity, and changing macroeconomic risk sentiment.

These changes have contributed to Bitcoin losing about 50% from its October 2025 peak above $126,000. The decline occurred in waves, beginning with a historic liquidation in October 2025, followed by further sell-offs in late November and January 2026. Grayscale also cited motivated U.S. sellers, noting persistent price discounts on Coinbase.

Part of Bitcoin’s Ongoing Evolution

Grayscale emphasizes that Bitcoin's inability to act as a short-term safe haven should not be viewed as a failure, but as part of the asset’s ongoing evolution.

Pandl pointed out that expecting Bitcoin to replace gold as a safe-haven asset in such a short period would be unrealistic. "Gold has been used as a medium of exchange for thousands of years and served as the foundation of the international monetary system until the early 1970s," he said.

While Bitcoin has not yet achieved a similar universal store-of-value status, Pandl explained that this limitation supports his long-term investment thesis. He suggested that Bitcoin could evolve in this direction as the global economy becomes increasingly digital through artificial intelligence, autonomous agents, and tokenized financial markets.

Insights

Historical data shows a similar pattern with Amazon shares, which were highly correlated with the tech sector in 2000–2002 before charting their own path. Institutional adoption of Bitcoin via ETFs has had a similar effect, making the asset inherit both capital and the behavioral patterns of traditional investors.

Meanwhile, retail investors increasingly view Bitcoin through the lens of technology trends rather than monetary theory. Social media discussions often link Bitcoin with AI and startups rather than inflation or geopolitics. This evolving public narrative could become more influential than Bitcoin's fundamental properties.