Author:Chain Road Prophet

Bitcoin prices lost another key level, moving under $84K as Japan approved a stimulus package that aims to put nearly $273 billion behind its worsening economy. Analysts assess that the uncertainty caused by this development might creep into stock markets and affect bitcoin, which is correlated with risk assets.

Bitcoin Loses $85K, Liquidations Hit Over $1.93 Billion

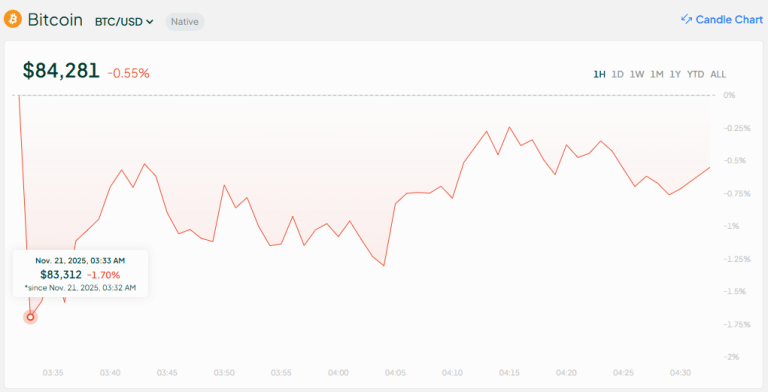

Bitcoin has yet again reached a new low, dropping below the key $85K level and reaching as low as $83,312 on Bitstamp during the early Friday morning hours. The drop swept the cryptocurrency market, generating over $1.93 billion in liquidations in the last 24 hours.

But unlike the days before, analysts attribute this new drop to a clear development: the announcement of a massive stimulus package in Japan, destined to aid Japanese citizens in coping with increasing inflation. The move would be financed with tax revenue and by issuing more debt, increasing the already worrying figures of Japanese debt.

The market reacted cowering in fear, as investors sought to shelter from risk assets, a behavior that had been predicted by analysts before, as the move sent what was once a predictable economy into new territory.

Read more: Bitcoin’s Brutal Flush Sets the Stage for a Violent Upside Rebound

The whole effect of the package, including private funds that will get a boost from the spending, will reach $273 billion.

Kohei Okazaki, chief market economist at Nomura Securities, told Bloomberg that this number might not be final, as Prime Minister Sanae Takaichi has a broader plan in sight.

He stated:

The current economic package is merely an early rollout of key measures. The broader growth strategy covering 17 targeted sectors is still set to come, so this may not be the end of her spending spree.

This, combined with the uncertainty regarding the Federal Reserve’s upcoming moves, a brutal bearish sentiment, and thin liquidity, might take BTC even lower, dragging the whole cryptocurrency market with it.

FAQ

-

What recent low did bitcoin reach?

Bitcoin dropped below the key $85K level, hitting a low of $83,312 on Bitstamp early on Friday morning. -

What triggered this latest drop in bitcoin’s price?

The decline was primarily attributed to Japan’s announcement of a $273 billion stimulus package aimed at combating rising inflation. -

How did the market respond to the stimulus announcement?

Investors reacted with fear, leading to over $1.93 billion in liquidations across the cryptocurrency market within 24 hours. -

What other factors could affect bitcoin’s price going forward?

Uncertainty regarding the Federal Reserve’s decisions, along with bearish sentiment and thin liquidity, may further drag Bitcoin and the overall cryptocurrency market down.