Author:Wall Street CN

The story of AI is evolving from "software devouring the world" to "hardware being stuck by the world".

In the deeply divided American political landscape, there are virtually no issues that could bring far-left Senator Bernie Sanders and far-right Governor Ron DeSantis to the same side—except for “curbing data centers.”

This is not only a political spectacle in Washington, but also a cold-blooded "physical correction" facing Wall Street. As Silicon Valley giants wave checkbooks more expensive than the Apollo moon landing program in an attempt to prolong the AI boom by piling up computing power, they have run into a wall built by both politics and the limits of the physical power grid.

New York State legislators have also introduced a bill to suspend the issuance of permits for the construction and operation of new data centers for at least three years. New York would be at least the sixth state to consider suspending the construction of new data centers.

In short, from community protests in Florida to the abrupt halt to regulatory oversight of the Texas power grid, a risk that has been overlooked by the market is rapidly escalating:If the physical power grid cannot be connected and the political environment does not permit it, then the hundreds of billions of dollars in capital expenditures that were originally included in the valuation model may simply "not be spent".

When Sanders and DeSantis "colluded"

Sanders and DeSantis are bitter enemies on most issues, but on the issue of the proliferation of data centers, they have reached a rare consensus: the brakes must be applied.

This bipartisan "united" hostility stems from the acute pain felt by the American public regarding the "side effects" of AI. Across the United States, the 24/7 low-frequency noise from data centers is unbearable for neighboring communities, the enormous cooling demands are causing local water shortages, electricity bills for residents and small and medium-sized enterprises are soaring, and public protests are growing louder.

Florida Governor DeSantis's abrupt shift in attitude is the most striking manifestation of this political trend. Just last June (2025), he signed a major tax relief bill extending the tax credit period for data centers from 2027 to 2037. However, faced with escalating public protests, DeSantis quickly reversed course.

“We don’t want to subsidize technologies that will replace the human experience,” DeSantis said at a recent roundtable. He called for an “AI rights bill” and supported legislation requiring data centers to pay their full utility costs. He stressed that local communities should not foot the bill for the expansion of these “richest companies in human history,” adding, “You shouldn’t have to pay a single extra penny for this.”

This argument echoes that of Sanders, who previously released a report warning that technology will fail to improve workers' lives if decisions are made solely by billionaires concerned only with short-term profits on boards. He explicitly called on Congress to pass a bill to halt the construction of new data centers: "I think this process must be slowed down."

Politically astute lawmakers are following suit. States such as Arizona, Georgia, and Virginia are pushing for legislation to eliminate tax breaks or prohibit the signing of non-disclosure agreements (NDAs) that conceal details from the public; while in Georgia, Oklahoma, and Vermont, lawmakers are even proposing, as Sanders suggested, to directly halt the construction of new projects (Moratoriums).

For tech giants, the era of attracting investment through "red carpet" campaigns is over.

Can such massive capital expenditures be spent?

If political resistance is a "soft constraint," then the bottleneck of the physical power grid is a more fatal "hard wall." Wall Street currently faces a perplexing logical paradox:Does the market really believe that the approximately $600 billion in capital expenditures projected for 2026 will materialize?

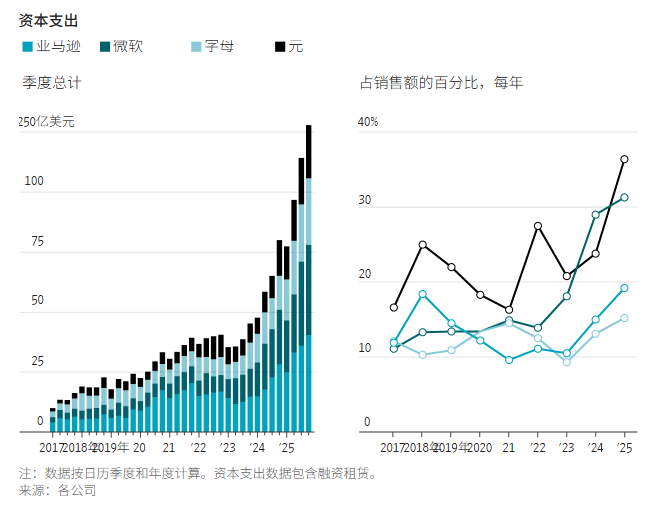

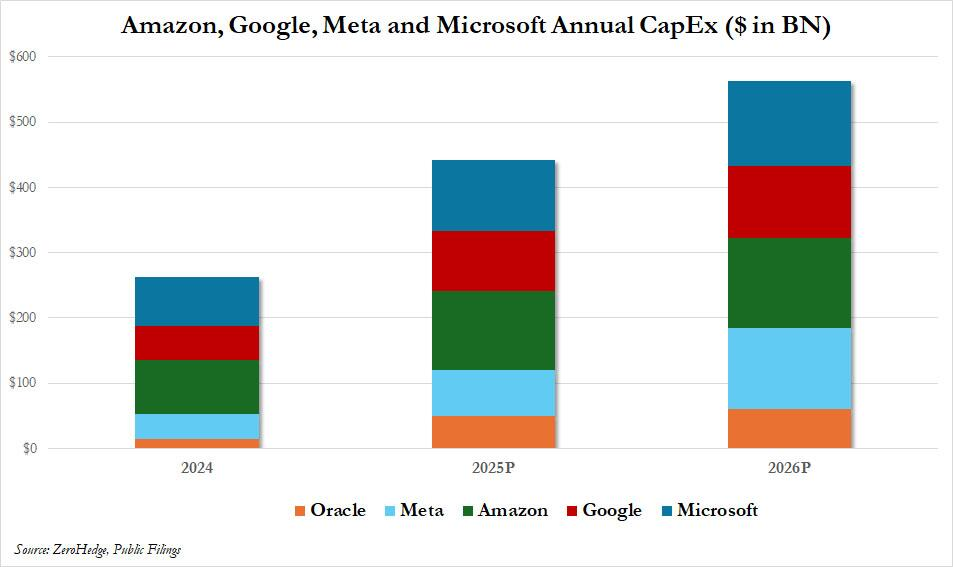

According to the latest data, the four major tech giants alone—Microsoft, Meta, Amazon, and Google—have planned to spend a staggering [amount missing] on AI infrastructure this year.$670 billion.

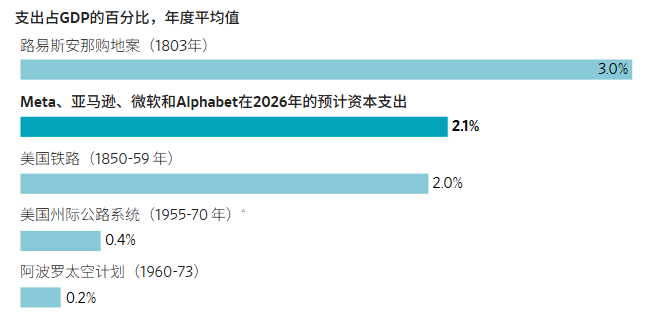

In terms of its proportion of US GDP, this figure has surpassed the Apollo moon landing program of the 1960s and the Interstate Highway System of the 1970s, second only to the Louisiana Purchase of 1803. Amazon alone plans to increase its capital expenditures by nearly 60% to $200 billion this year.

Most of this massive amount of funding will be used to build data centers, which require enormous amounts of energy. According to BloombergNEF's forecast, by 2035, the energy demand for data centers will triple, surging from 34.7 gigawatts (GW) in 2024 to 106 GW, equivalent to the electricity consumption of 80 million households.

The problem is that the current U.S. power grid is simply unable to meet this demand.

This physical constraint has evolved into a regulatory crisis in Texas. As the state's second-largest data center cluster after Virginia, Texas's power grid operator, ERCOT (Texas Electric Reliability Commission), is applying an unprecedented "sudden stop" to the project.

ERCOT has proposed a review of power consumption projects totaling approximately 8.2 gigawatts—equivalent to the power generation of eight conventional nuclear reactors. It is worth noting that this includes many…Previously approvedThe project.

Currently, ERCOT has launched a review mechanism called "Batch Zero," which plans to review projects in batches to assess their overall impact on the power grid. Katie Bell, an energy project manager at Meta, admitted that some projects submitted 18 months ago still do not meet the "Batch Zero" criteria.

This uncertainty is shattering the expansion plans of tech giants: if the power grid can't be connected, data centers can't be built; if data centers can't be built, the $670 billion budget can't be spent; if the money can't be spent, the expected growth in AI computing power and commercialization will become a pipe dream.

The "physical correction" of Wall Street's most crowded trades

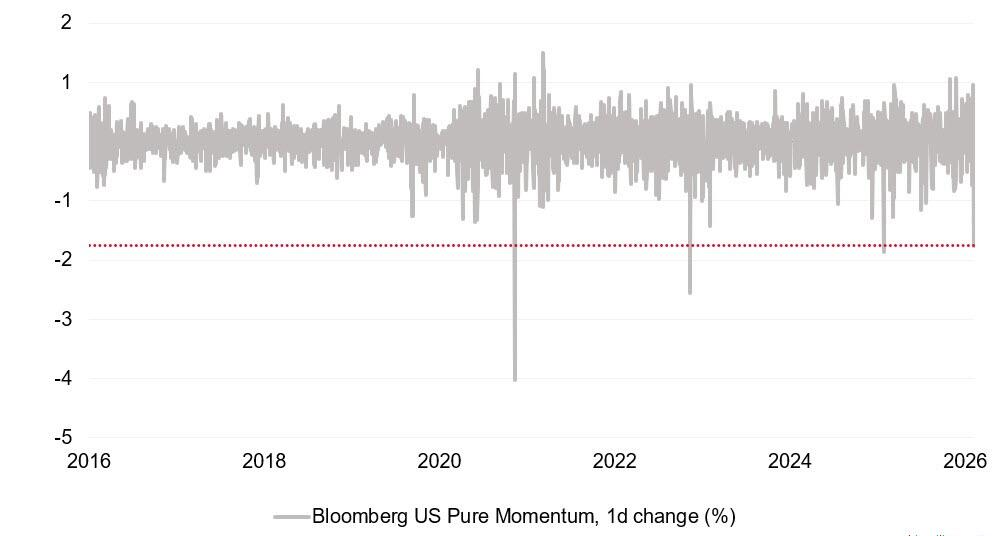

When the risk of "having money but not being able to spend it" begins to be priced in, the financial markets react dramatically. Recently, US stocks experienced the fourth largest single-day sell-off of "momentum stocks" in the past decade.

It's worth noting that even independent power producers (IPPs) and nuclear power stocks, originally seen as the "shovel sellers" of the AI boom, haven't been spared. Previously, the market logic was that "AI-driven power shortages are good for power stocks," but now the logic has evolved to:If grid connections are disrupted, new electricity demand cannot be realized.

UBS analysts say that shares of IPP giants like Constellation Energy have fallen sharply due to concerns that new loads may not be able to contract with existing generating capacity.Year-to-date (YTD) decline has reached 27%.The market has realized that without the physical expansion of the power grid, mere power generation capacity is meaningless.

This panic has led to the rise of "anti-AI trading." Funds are flowing out of high-beta tech stocks and into defensive sectors such as chemicals and regional banks. This is a typical "deleveraging" sell-off, driven by both quantitative funds and actively managed funds.

Currently, the market must resolve this vexing paradox: either believe that the power grid can miraculously expand to accommodate the $600 billion in Capex, or acknowledge that we have reached a physical bottleneck. If it's the latter, it means no power grid construction, no capital expenditure, and no demand for chips—ultimately, the valuation bubble of the AI supercycle will burst.

Currently, with Sanders and DeSantis forming a political encirclement and ERCOT closing its doors physically, Wall Street seems to be forced to accept the second possibility.