Author:AInvest

In 2025,

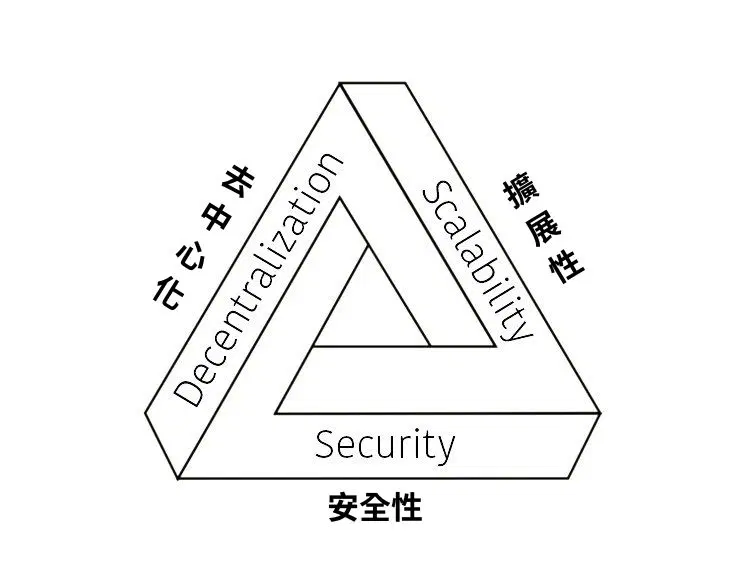

(BCH) has emerged as a standout performer among Layer 1 blockchains, driven by groundbreaking technical upgrades, expanding merchant adoption, and surging institutional investment. As the crypto market matures, BCH's unique value proposition-combining scalability, usability, and real-world utility-positions it as a compelling long-term investment. This analysis breaks down the three pillars of BCH's success and why it warrants a strategic allocation in 2026.1. Technical Upgrades: A Quantum Leap in Scalability and Smart Contract Capabilities

BCH's May 2025 protocol upgrade, known as the Velma hard fork, marks a paradigm shift in its technical architecture. The introduction of Targeted Virtual Machine Limits (CHIP) and BigInt CHIP has unlocked unprecedented scalability and computational efficiency. These upgrades

than before while reducing node compute utilization by 40%.The BigInt CHIP, in particular, has revolutionized smart contract development by enabling high-precision arithmetic and complex financial logic. This has allowed decentralized finance (DeFi) tools like automated market makers (AMMs) and stablecoin protocols to thrive on the

network. For instance, the reduced contract lengths facilitated by BigInt CHIP have , making BCH a cost-effective alternative to for developers.Moreover, the upgrade's support for post-quantum cryptography and zero-knowledge proofs future-proofs BCH against emerging threats, ensuring its relevance in a rapidly evolving tech landscape. These advancements have not only enhanced BCH's throughput but also attracted enterprise-grade use cases, from supply chain management to cross-border payments.

2. Merchant Adoption: A Practical Payment Network for the Digital Age

BCH's core thesis as a peer-to-peer electronic cash system has gained traction in 2025, with

to $50 billion. This growth is driven by its $0.01 average transaction fee and sub-second confirmation times, making it ideal for everyday commerce.Real-world adoption is accelerating in regions with high inflation and underdeveloped banking infrastructure. For example, Paytaca, a BCH-focused platform in the Philippines, has

to accept BCH payments via POS systems and mobile wallets. Similarly, the BTCPrague 2025 initiative demonstrated BCH's viability as a mainstream payment method, with 25 local merchants processing 7,079 transactions totaling 0.5885 BTC during a single event.While

in 2025, BCH's niche as a low-cost, high-speed alternative is carving out a unique market. Platforms like Cashonize and Selene Wallet are further simplifying onboarding for merchants, ensuring BCH remains competitive against stablecoins like .3. Institutional Inflows: A Legitimacy Boost from Wall Street

Institutional adoption has been the most transformative force for BCH in 2025. While direct figures for BCH are sparse, the broader institutional crypto landscape tells a clear story: digital assets are now a core asset class.

The approval of spot Bitcoin ETFs in early 2024 and the subsequent

have normalized crypto allocations for pension funds, sovereign wealth funds, and hedge funds. BlackRock's IBIT ETF, with $50 billion in AUM, has become a benchmark for institutional confidence. This trend has spilled over into altcoins like BCH, with mF International .Regulatory clarity has further accelerated adoption. The U.S. GENIUS Act and EU MiCA framework have

, reducing compliance risks. As a result, 86% of institutional investors now have exposure to digital assets, with many treating BCH as a diversified satellite holding alongside and Ethereum.Looking ahead,

by 2030, driven by tokenized treasuries and real-world asset (RWA) integrations.Conclusion: A Strong Buy for 2026

Bitcoin Cash's 2025 performance is a testament to its ability to evolve while staying true to its original vision of electronic cash. The Velma upgrade has transformed it into a scalable, enterprise-ready blockchain, while its merchant adoption and institutional backing have solidified its legitimacy.

For investors, BCH offers a unique combination of technical innovation, real-world utility, and institutional momentum. With a price target of $3,000 by 2030

, BCH is not just a "buy" for 2026-it's a foundational holding for the next decade of blockchain innovation.