Author:BitPush

Author: Wenser, Odaily Planet Daily

Original title: ai.com's debut a disaster! Crypto.com spends a whopping 70 million to acquire the most expensive domain name, but crashes after launch.

Last weekend, besides the Bithumb airdrop of 620,000 BTC blunder, another breaking news story sparked heated discussion: the mysterious buyer behind the top-level domain ai.com has finally surfaced. Contrary to many people's expectations, the buyer is not from an AI giant, but rather Kris Marszalek, co-founder and CEO of the cryptocurrency exchange Crypto.com.

This deal, reached in April 2025, was worth a staggering $70 million, giving the outside world a direct glimpse into the astonishing financial power of a cryptocurrency tycoon. This transaction not only ended the ownership dispute surrounding the domain name but also brought to a close the "top-level domain pointing battle" that had previously raged between giants like OpenAI and xAI.

The ai.com domain name battle: a three-year-long, high-stakes war.

In November 2022, after ChatGPT (GPT 3.5) emerged, AI suddenly became a hot topic, and the price of related domain names naturally soared.

In February 2023, rumors circulated that OpenAI, the parent company behind ChatGPT, had acquired ai.com. This news was later confirmed to be fake news, but the $11 million listing price for the domain in 2021 was still astonishing.

In August 2023, the domain name ai.com was changed to point to xAI, an AI company owned by Elon Musk, which once again attracted a lot of attention.

Since then, more information about the top-level domain has been unearthed: the domain was first registered in May 1993, more than 30 years ago, making it a long-established domain. However, Musk remained unmoved by this, once again making it clear to the market that changing the domain's pointing address was merely a marketing tactic by the ai.com domain holder to "hold out for a higher price."

When it reappeared in the public eye, it was recently revealed that it was priced at a staggering $70 million.

Public information shows that Kris Marszalek, co-founder and CEO of Crypto.com, successfully acquired the top-level domain name, setting one of the highest publicly disclosed domain name transactions to date. The transaction was facilitated by domain broker Larry Fischer, and payment was made in cryptocurrency. For reference, this record-breaking price is double the previous sale price of the voice.com top-level domain.

As a long-established cryptocurrency trading platform founded in 2016, Crypto.com has always been known in the industry for its "huge marketing spending." Previously, it had promoted itself through sports sponsorships and celebrity endorsements. In 2021, it even spent a whopping $700 million to win the naming rights to a stadium in Los Angeles.

In a media interview, Kris Marszalek revealed that he had received even more outrageous resale offers, but chose to retain the domain name because he believes it will be crucial for the trust and recognition of his future business. Furthermore, he boldly declared, "We broke through thousands of crypto trading platforms back then, and this time we will make ai.com successful again."

Thus, the years-long battle over the top-level domain ai.com came to an end; and just as the market was anticipating and speculating about how Kris Marszalek would use this domain, he unexpectedly made a huge mistake.

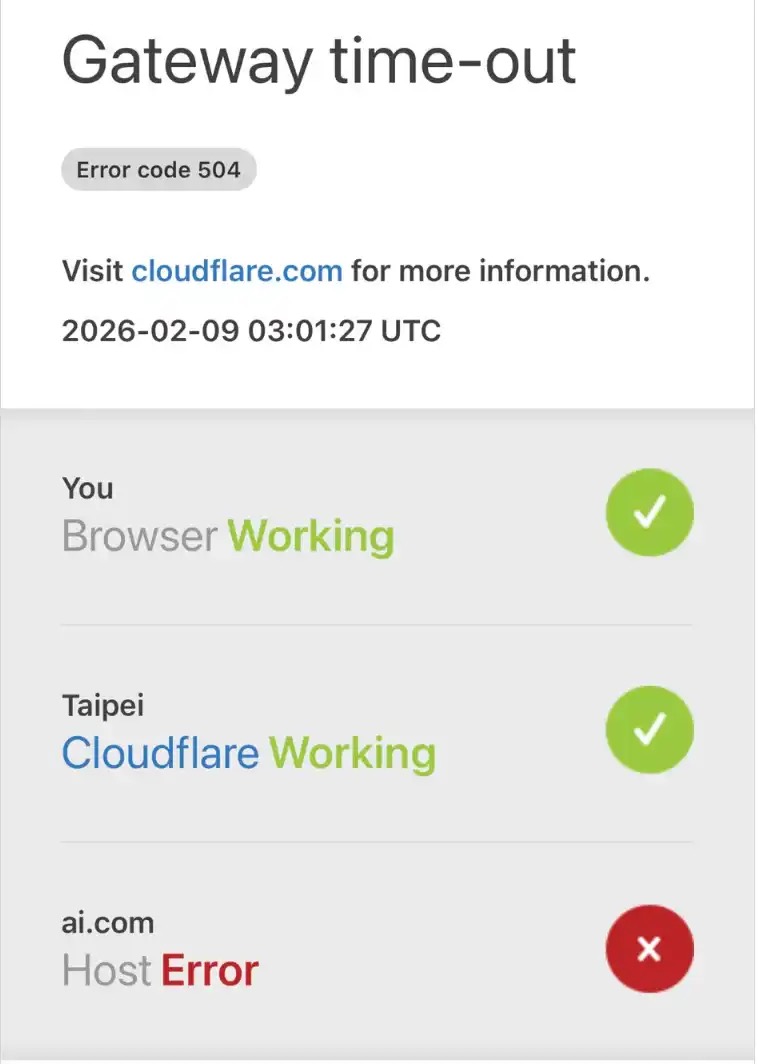

A disastrous product launch: ai.com experienced a temporary outage less than 48 hours after its launch.

Crypto.com co-founder and CEO Kris Marszalek announced that after purchasing the domain, they have been quietly building the platform and will launch the product during the Super Bowl on Sunday, February 8th. He further stated that, leveraging the AI Agent on the ai.com platform, users will soon be able to deploy their own agents to perform a range of actions on their behalf, such as stock trading, automating workflows, scheduling daily tasks using a calendar, and all other operations, all while remaining private, based on user permissions, and entirely under user control.

However, amidst much anticipation, ai.com experienced a "downtime drama" less than 48 hours after its launch.

This morning, NVIDIA engineer yuhang posted that "this $70 million domain name became a 504 error after running an $8 million ad (note: the typical price for a Super Bowl ad)".

It has to be said that this incident once again proves the saying – "The whole world is just a big makeshift operation."

As of the time of writing, the ai.com website has returned to normal, and users can pre-register personal subdomains and AI Agent subdomains to facilitate subsequent experience of the platform's corresponding functions; as for whether it can realize the "autonomous AI Agent" mentioned in Kris Marszalek's vision, I will reserve my opinion for now.

The "Mainstream Path" of Crypto Moguls: Some Buy Houses, Others Buy Power Plants

Another hot topic that has emerged from the news that Crypto.com's co-founder and CEO spent $70 million to buy a top-level domain is the various mainstreaming paths chosen by cryptocurrency moguls.

Following Justin Sun's million-dollar bid for a lunch with Warren Buffett, the recent moves by cryptocurrency tycoons have become even more diverse:

Aave founder Stani Kulechov purchased a £22 million (approximately $30 million) mansion in London's Notting Hill area last November.

Tether CEO Paolo is focusing on "dividing the eggs in different baskets." Reliable sources say that Tether has invested its stablecoin profits in 140 deals covering sectors from agriculture to sports, and plans to expand its workforce to 450 people. In addition, Tether's gold reserves have exceeded $23 billion.

Last November, Justin Sun, through his family office SunFund Energy, acquired two small hydroelectric power plants in Norway in one go, with a total installed capacity of 86 MW and an annual power generation of approximately 350 GWh, equivalent to the annual electricity consumption of 40,000 European households. In the era of AI's great voyage, Justin Sun, who has always been bold and decisive, chose to hold the "electricity ticket" to board this train of the times.

Regardless of the investment outcome, cryptocurrencies have become more widely known through various news reports as payment currencies, symbolic figures, and asset classes. Perhaps this is an indispensable part of the mainstreaming process of cryptocurrencies.