Author:Coin Gabbar

HYPE Price Prediction After Hyperliquid Surpasses Coinbase in Volume

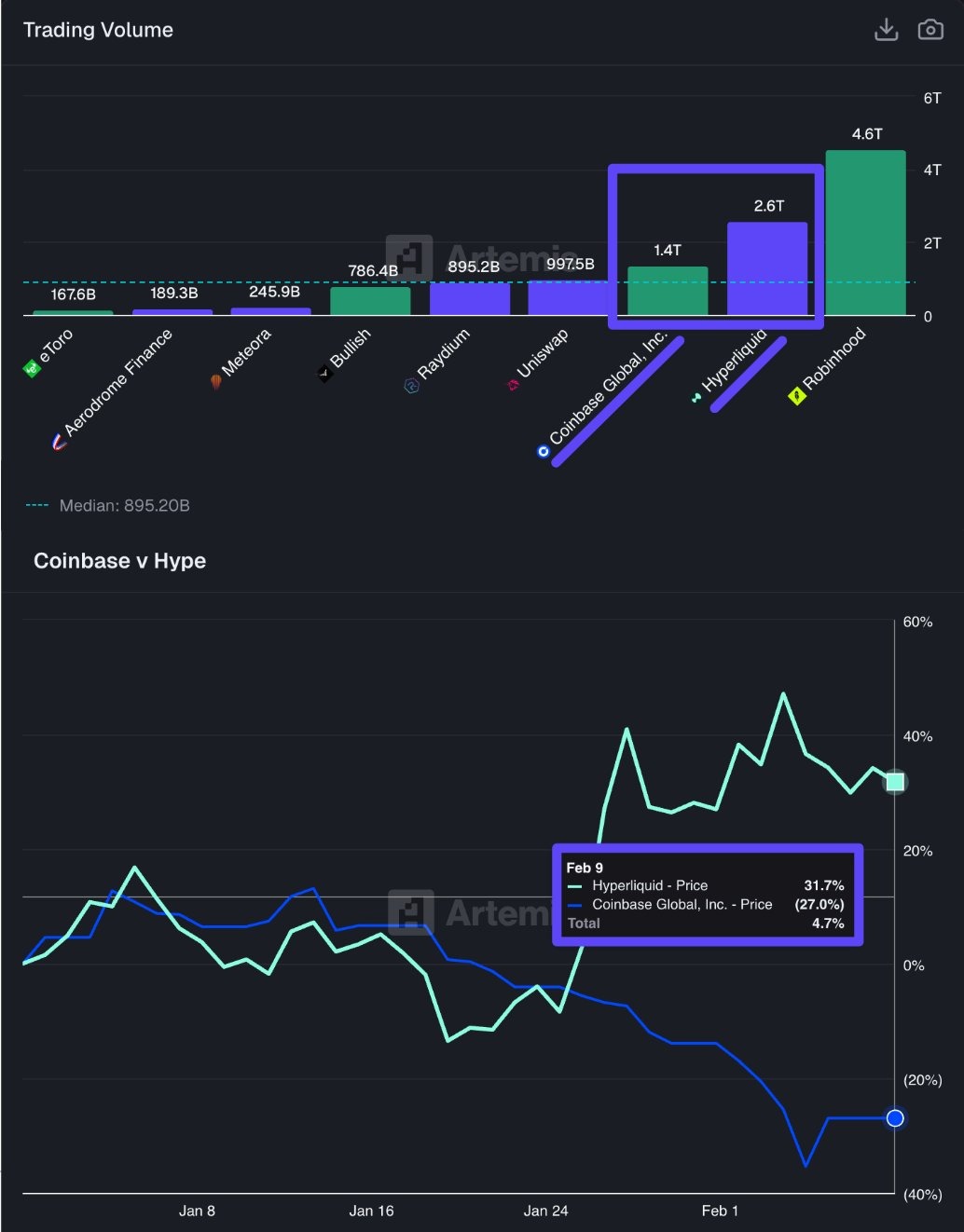

A major shift is taking place in the crypto market as Hyperliquid Surpasses Coinbase in total trading volume. Artemis data shows the onchain trading platform has processed nearly $2.6 trillion in notional trades, while Coinbase handled about $1.4 trillion as per Artemis Data. That is almost double the volume and a clear sign that trader behavior may be evolving.

Coinbase has long been considered a trusted gateway for crypto investors. But now through the results, analysts believe decentralized platforms are gaining real momentum. The hyperliquid blockchain is attracting traders with fast execution, strong liquidity, and advanced derivatives tools that allow users to trade directly onchain.

Source: X (formerly Twitter)

This milestone suggests the market is slowly opening up to alternatives beyond traditional centralized exchanges.

Breaking Down the Numbers

When Hyperliquid Surpasses Coinbase at this scale, it signals more than short-term excitement. It shows that both professional and retail traders are increasingly comfortable using this network.

Trading Volume (Notional):

• Coinbase: $1.4 trillion

• Hyperliquid: $2.6 trillion

The gap is significant. Many market watchers say traders value the transparency and control that decentralized platforms provide while still offering deep liquidity.

Performance data adds another interesting angle. Year-to-date returns show Hyperliquid up 31.7%, while Coinbase is down 27.0%. This creates a sharp 58.7% divergence in a short time. It may point toward a longer-term shift in how crypto trading is done.

Hyperliquid Price Today: Why the Token Is Under Pressure

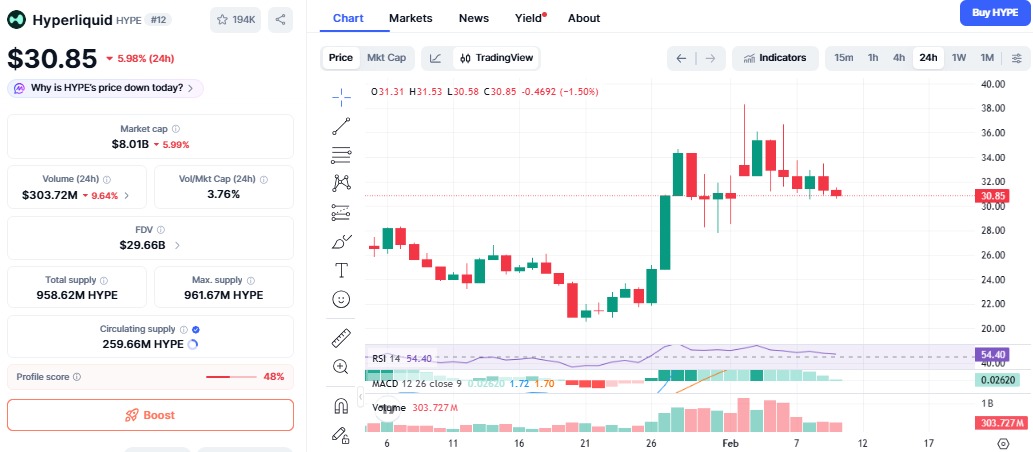

The HYPE token is down 5.91% in the past 24 hours and is trading near $30.85, falling more than Bitcoin’s 2.29% drop.

Source: CoinMarketCap Chart

The main reason behind the price crash appears to be forced liquidations. Roughly $122.96 million worth of leveraged positions were closed during volatile trading. When leveraged trades unwind quickly, automatic selling increases and pushes prices lower.

This means the HYPE token price down move was driven largely by trading mechanics rather than weak fundamentals. Platforms that support high leverage often experience sharper price swings during uncertain conditions.

Market Sentiment Is Adding to the Decline

The broader crypto market is also facing pressure. Total market capitalization has slipped about 2%, and the Fear & Greed Index remains in the “Extreme Fear” zone.

During cautious periods, investors usually reduce risk exposure. High-growth tokens tend to drop faster as traders rotate funds into safer assets such as Bitcoin.

This indicates the decline is not happening because Hyperliquid Surpasses Coinbase temporarily. Instead, the token is reacting to wider market sentiment affecting digital assets overall.

What’s Next for the Price?

Key Support Levels and HYPE Price Prediction

Traders are closely watching the $28–$30 support zone.

• If the price holds above this range, the token could stabilize before attempting a rebound.

• If it breaks below $28, analysts see the next support near $26.

There is one potential catalyst: Arthur Hayes’ public wager that the hype token might perform better than major altcoins in the coming months: such high-profile interest could result in fresh interest among traders.

Conclusion

This underscored the speed with which decentralized systems are developing. Onchain trades are no longer niche. They’re gaining ground as a notable competitor to traditional exchanges.

One thing is certain in the world where Hyperliquid Surpasses Coinbase, and that is the stage that the war between decentralized and centralized exchanges is in.

YMYL Disclaimer: This content is for informational purposes only and not financial advice. Crypto investments carry risk. Always do your own research before investing.