Author:Wall Street CN

Key points

1. Promoting stable economic growth and a reasonable recovery in prices should be an important consideration in monetary policy.

At the international level, the report analyzes and discusses the increasing trade barriers, expectations of a global growth slowdown, the risk of volatility in high AI valuations, and geopolitical conflicts in parallel. Domestically, the policy focus has shifted more clearly to "continuously expanding domestic demand and promoting a reasonable recovery in prices," and by listing the marginal improvements in CPI, core CPI, and PPI, it emphasizes that the synergistic effect of macroeconomic policies is taking shape, and that price recovery has a policy-supported foundation. Overall, pushing up nominal growth is the primary challenge at present.

2. In terms of policy approach, the report continues the tone of "moderately loose", but the structure of tools has been significantly deepened.

On the one hand, aggregate tools have stabilized liquidity, with open market operations and a year-end excess reserve ratio of 1.5% indicating overall stable funding conditions. More noteworthy is the resumption of open market treasury bond trading in October, with the explicit statement of "promoting the yield curve to operate within a reasonable range," signifying that "stabilizing the yield curve" has moved from policy rhetoric to an operational phase. On the other hand, the interest rate framework emphasizes the closed-loop transmission of "policy rate—market rate—liability cost." Combined with the slight reduction in policy rates in 2025 and cost-reduction arrangements using structural tools, this suggests a more likely "small steps + strong transmission" approach in 2026.

3. Structural tools are the core highlight of this report.

To expand domestic demand, the report constructs an executable chain of fiscal and financial coordination through "relending + fiscal subsidies + risk-sharing tools": re-lending for equipment upgrades is expanded and reduced to 1.25%; the amount of re-lending for agriculture, small businesses, and private enterprises is increased; re-lending for service consumption and elderly care is implemented in conjunction with fiscal subsidies; and risk-sharing tools for technological innovation and private enterprise bonds are established. The column also systematically explains how policies can improve financing availability and the credit environment through structural optimization, from the perspectives of unified green finance standards, the merger of asset management and deposits, and one-off credit repair policies. Overall, expanding domestic demand is promoted more through structural tools and risk-sharing mechanisms than by relying on large-scale aggregate stimulus.

4. Regarding policy projections for 2026, the report provides the following tools and objectives:

Under the baseline scenario, policy interest rates will remain stable, structural tools will continue to be expanded and costs reduced, and liquidity and yield curve shape will be managed through open market operations and treasury bond trading. If the recovery in prices or domestic demand weakens again, a slight interest rate cut cannot be ruled out.

Regarding the RMB exchange rate, the report emphasizes "enhancing flexibility and maintaining basic stability," tolerating two-way fluctuations and leveraging the automatic stabilizer function, with the exchange rate not being the primary constraint on current monetary policy.

text

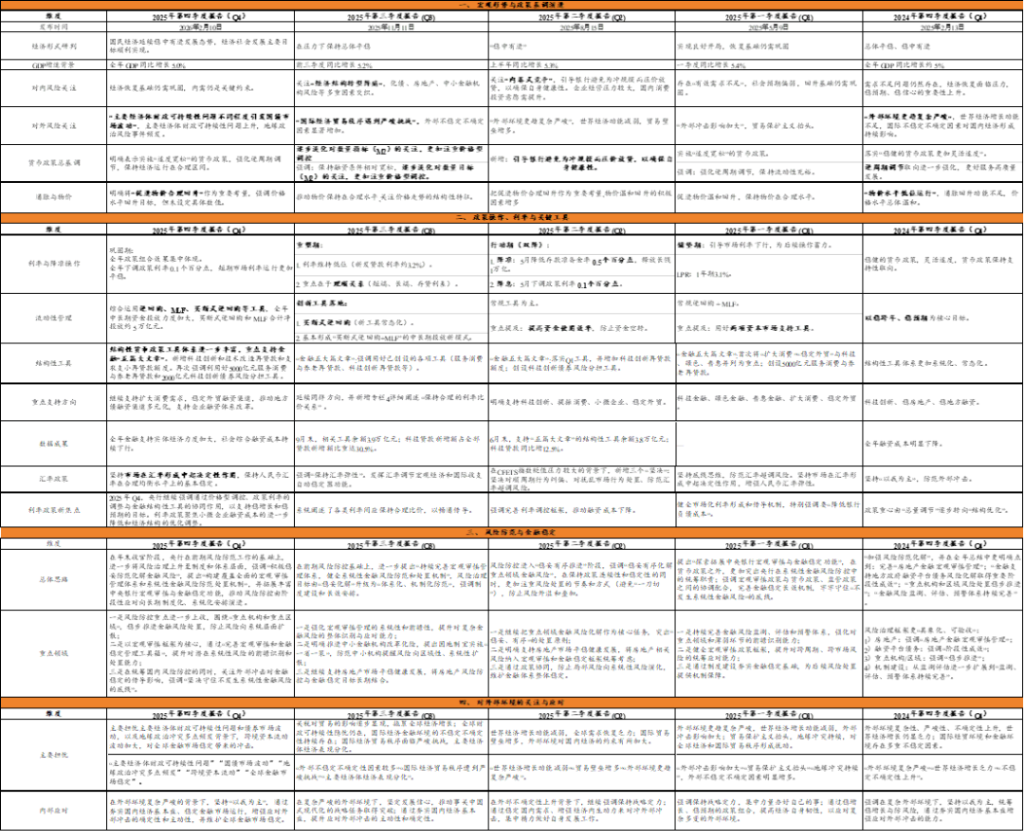

I. Macroeconomic Situation Analysis

1) International Situation: Trade uncertainty, AI valuation, and geopolitical risks point to a potential increase in tail risks of financial volatility. Compared to many years' Q4 reports, which focus more on "uneven recovery/sticky inflation/market volatility," the 2025 Q4 report's description of external risks is more like a "risk list," and it places trade barriers, geopolitics, and AI valuation within the same logical framework.

First, trade uncertainty is rising, putting pressure on global growth. The report states bluntly that "trade barriers are increasing," and cites WTO forecasts that global merchandise trade growth will decline sharply from 2.4% in 2025 to 0.5% in 2026.

Second, the stock market rally driven by AI sentiment is at a high level, and the risk of a pullback is linked to geopolitical/policy shifts. The report points out that the main driver of the stock market rally in major economies is "optimism about artificial intelligence and related industrial chains," and explicitly warns that if AI development falls short of expectations, geopolitical tensions escalate, or policy adjustments lead to a shift in risk appetite, "it could increase the pressure for a market correction."

2) Domestic Situation: The policy focus has shifted to "expanding domestic demand + promoting a reasonable recovery in prices," and the term "synergistic effect" is used to emphasize the combined effect of policies. The Q4 report's description of the domestic situation in the "Trend Outlook" section significantly reinforces two sets of key terms: First, the direction of macroeconomic policies, explicitly proposing "continuously expanding domestic demand" and "developing new quality productivity," and listing "counter-cyclical + cross-cyclical" measures side-by-side, emphasizing the improvement of macroeconomic governance effectiveness. Second, the synergy between prices and policies, specifying that the December CPI was 0.8% year-on-year, core CPI was 1.2% year-on-year (above 1% for four consecutive months), PPI was -1.9% year-on-year (narrowing from the year's low), and rose for three consecutive months month-on-month, emphasizing that "the synergistic effect of macroeconomic policies is constantly strengthening...which will further...support a reasonable recovery in prices."

II. Policy Approach

1) Aggregate Tools: Maintaining stable liquidity remains the foundation, but the addition of "government bond trading" makes "stabilizing the yield curve" more than just a statement; it's an actionable step. The report's description of the overall liquidity foundation for the year is results-oriented, specifically stating: a 0.5 percentage point reduction in the reserve requirement ratio, providing approximately 1 trillion yuan in long-term liquidity; open market operations to "smooth out short-term fluctuations in fiscal revenue and government bond issuance"; and a year-end excess reserve ratio of 1.5%. More importantly, the resumption of open market government bond trading in October, with the stated purpose of "promoting the operation of the government bond yield curve within a reasonable range," provides a more readily available tool for the bond market. The implications for bond trading may be: the downward trend in interest rates may continue, but the slope and speed are more constrained; if the decline is too rapid or steep, policymakers may be more inclined to correct it through "tools" rather than "words."

2) Interest Rate Framework: The "policy rate—market rate—liability cost" form a closed loop, suggesting a more likely "small-step approach + emphasis on transmission" in 2026. The report explicitly states that the 7-day reverse repo rate will be lowered from 1.5% to 1.4% in May 2025, and points out that "the policy rate will be lowered by 0.1 percentage points throughout the year." Meanwhile, the report describes the next stage of tasks in subsequent chapters as "deepening interest rate liberalization, improving the transmission mechanism, and reducing overall financing costs." This may mean that while there is still room for policy rates to adjust in 2026, it is more likely to be implemented in smaller steps, with a greater emphasis on supporting measures (liability cost/self-regulatory mechanisms/structural tools).

3) Structural Tools: The scope has expanded from "science and technology innovation" to "consumption and elderly care," with fiscal subsidies embedded, indicating that "expanding domestic demand" has entered an executable toolchain. First, there's the service consumption and elderly care relending program. The report states the need to "leverage the incentive and guiding role of relending" and "cooperate in implementing fiscal subsidy policies for consumer loans." It also provides figures such as a loan balance of 2.8 trillion yuan in key service consumption areas and a household consumption loan balance (excluding mortgages) of 21.2 trillion yuan. Second, there are "five major initiatives." At the end of 2025, the loan balance reached 108.8 trillion yuan, a year-on-year increase of 12.9%; the weighted average interest rate for new loans issued in December 2025 was 3.35%, a year-on-year decrease of 0.41 percentage points; and services were provided to 82.18 million enterprises and individuals. The main policy signal conveyed by these data is that expanding domestic demand no longer relies solely on "aggregate easing driving credit expansion," but rather on a combination of "structural relending + fiscal subsidies" to bind the price of funds to their allocation.

4) Policy Path: Structural Priority, Supported by Fiscal Coordination. The report explicitly outlines the central bank's policies for January 2026: First, expanding the scope of support for service consumption and pension relending, and "lowering the relending rate to 1.25%"; simultaneously, the Ministry of Finance optimizes interest subsidy policies, including digital, green, and retail consumption sectors. Second, merging and establishing a risk-sharing tool for science and technology innovation and private enterprise bonds, providing a total relending quota of 200 billion yuan, and clarifying that "the central government will arrange risk-sharing funds...in coordination with central bank tools." This indicates that the start of 2026 did not begin with a "major policy interest rate move," but rather directly focused on "expanding domestic demand/promoting consumption/stabilizing private enterprise financing" through structural tools and fiscal coordination. This is entirely consistent with the Q4 report's narrative of "continuously expanding domestic demand and supporting a reasonable recovery in prices."

III. Overview of Key Points of the Column

The column in Q4 of 2025 focused on topics such as fiscal and financial coordination, green finance, total liquidity, and one-off credit repair.

Column 1: Fiscal and Financial Coordination to Support Domestic Demand Expansion – The Policy Implications of “Upgraded Toolbox” are Stronger

The column provides verifiable details of a package of measures to "coordinate efforts to expand domestic demand" in January 2026:

First, there's equipment upgrades. The relending program for technological innovation and technological upgrading started in April 2024 (with a quota of 500 billion yuan and an interest rate of 1.75%), and was subsequently increased multiple times. By January 2026, the relending program had increased by another 400 billion yuan, bringing the total quota to 1.2 trillion yuan, and the relending interest rate was lowered to 1.25%. Simultaneously, the fiscal authorities optimized the scope of interest subsidies, including fixed asset loans related to equipment upgrades and technological innovation loans within the subsidy scope.

Second, support for agriculture and small businesses/private enterprises. In January 2026, the quota for relending to support agriculture and small businesses will be increased by 500 billion yuan, and it will be integrated with rediscounting and the interest rate will be reduced by 0.25 percentage points; a separate 1 trillion yuan relending program for private enterprises will be set up under the relending program for supporting agriculture and small businesses; and the fiscal authorities will introduce interest subsidies for loans to small and micro enterprises.

Third, promote consumption. This includes relending for service consumption and elderly care (established in May 2025, with a quota of 500 billion yuan and an interest rate of 1.5%), and fiscal subsidies for loans to service industry operators (covering 8 categories of consumption, with a subsidy of 1 percentage point). In January 2026, the central bank expanded the scope of support and lowered the relending rate to 1.25%, while the fiscal side included digital/green/retail consumption areas in the scope of interest subsidy support.

This combination of "re-lending + interest subsidies/credit enhancement" essentially transforms expanding domestic demand from a slogan into a "practical credit supply mechanism," and clarifies the risk-cost sharing between the fiscal and central banks. For interest rates, this coordination is more like "reducing tail credit/demand risk" than directly raising the growth center: it is more likely to create an environment with looser financing conditions and limited room for interest rate increases. The report also clearly states in its overall policy orientation that it will "continue to implement moderately loose monetary policy" and "flexibly utilize reserve requirement ratio and interest rate cuts to maintain ample liquidity and relatively loose social financing conditions."

Column 2: The Quality and Efficiency of Green Finance – Shifting from “Scale Expansion” to Hard Constraints of “Standards/Incentives/Transparency”

The column emphasizes three main themes:

1) Unified standards and expanded scope: The 2025 "Green Finance Supported Project Catalog" will unify the standards for green loans, green bonds, and green insurance, and expand the scope of green finance support to green trade and green consumption; at the same time, it will promote transformation finance and promote the implementation of transformation finance standards in industries such as steel, coal power, building materials, and agriculture.

2) Incentive mechanism: The carbon emission reduction support tool has a quota of 800 billion yuan, and its effectiveness will be enhanced by expanding the scope of support, increasing the number of qualified institutions, and reducing the interest rate of relending; green loans/green bonds, mechanism building, product innovation, carbon accounting and information disclosure will be included in the evaluation indicators, and the application of evaluation results will be strengthened.

3) Transparency and Collaboration: Align with international standards and domestic sustainable information disclosure requirements to enhance the transparency of the green finance market; and emphasize collaboration with industry departments such as the Ministry of Ecology and Environment and the Ministry of Industry and Information Technology to facilitate the transmission of industrial policies to the financial system.

This time, green finance is not just about "continued support," but about clarifying the unified standards, information disclosure, and assessment constraints. This will change the structural differentiation of credit spreads: within the same industry, "disclosure quality/clarity of transformation path" will increasingly become a quasi-financial indicator in pricing. The combination of "catalog + transformation finance standards" means that the future expansion of green/transformation bond supply will not be a disorderly expansion, but more likely a structural expansion after the compliance threshold is raised.

Column 3: A Combined Perspective on Total Liquidity – Explaining Deposit "Moving" Using "Deposits + Asset Management" to Reduce Misinterpretations

The report directly addresses the discussion of "deposit outflows," proposing to use a combination of asset management products and bank deposits to observe the liquidity of the financial system.

Since the second quarter of 2025, the asset management scale has accelerated its growth, and the growth rate reached the highest level since the new asset management regulations were introduced at the end of October; the total asset management balance at the end of the year was RMB 120 trillion, up 13.1% year-on-year, with an increase of RMB 13.8 trillion for the whole year (RMB 2.2 trillion more than the same period last year).

Structurally, bank wealth management products and public funds accounted for a large share and grew rapidly, with year-end growth rates of 10.6% and 14.3%, respectively.

The growth in asset management is explained as a trade-off between returns and risks by residents and enterprises under interest rate liberalization. Since 2024, deposit interest rates have declined, while the overall yield of cash management products has remained higher than that of deposits, and other asset management products offer even higher yields. As a result, funds have shifted from deposits to wealth management products/funds, and it is noted that newly added asset management assets are mainly invested in interbank deposits and certificates of deposit.

The central bank's "communication objective" here is clear: to pull the market away from the misconception that "deposit outflows equal tighter liquidity," and to emphasize that this is an asset reallocation within the same financial system. This type of narrative typically points to the fact that fluctuations in liquidity stem more from structural and maturity mismatches than from a general depletion of liquidity.

Column 4: One-off Credit Repair – A Typical Example of Financial Infrastructure Transformation for “Inclusive Finance and Domestic Demand Expansion”

The report primarily emphasizes the background and specific procedures for one-time credit repair:

As of the end of 2025, the credit reporting system had collected credit information on 810 million individuals, providing over 20 million daily inquiries. A current pain point is that overdue information for repaid loans is retained for five years, meaning some individuals, despite full repayment, still have their overdue records displayed, impacting their access to subsequent financing. The core policy aims to remove overdue information for individuals with single overdue amounts ≤ 10,000 yuan from January 1, 2020 to December 31, 2025 from the credit reporting system if they fully repay their overdue debts by March 31, 2026 (inclusive).

This is a typical example of improving access to financing through credit infrastructure, allowing some people who have already repaid their loans but are long-term burdened by historical delinquency records to return to a financing-available state more quickly. It is in line with the logic of "expanding domestic demand": improving the accessibility of consumer/microcredit and improving the credit constraints of the household sector.

IV. Conclusions and Implications

Regarding the potential monetary policy operations in 2026, without incorporating external data, and using only the "targets" and "tools" given in the Q4 report for projection, the following scenarios are possible: First, the baseline scenario: policy interest rates will remain largely unchanged, structural tools will continue to expand and reduce costs (as seen at the beginning of the year with a reduction in the relending rate to 1.25% and a 200 billion yuan risk-sharing tool), while stabilizing funds and the yield curve through open market operations and government bond trading. Second, triggering conditions for interest rate cuts: if the trend of "supporting a reasonable recovery in prices" weakens again, or if the recovery in domestic demand falls short of expectations, policy interest rates may still see a small reduction. The report itself emphasizes "increasing counter-cyclical and cross-cyclical adjustments" and "continuously expanding domestic demand." Third, policy constraints: with the strengthening of the macro-prudential and financial stability framework, the constraint of "stabilizing finance" is stronger, and policies may lean more towards a "combination punch" rather than a one-off large stimulus.

Regarding the RMB exchange rate, the core statements in the Q4 report are mainly focused on three points: adhering to a managed floating exchange rate system based on market supply and demand and referencing a basket of currencies; enhancing exchange rate flexibility; maintaining the basic stability of the RMB exchange rate at a reasonable and balanced level; and emphasizing the role of the exchange rate as an "automatic stabilizer".

Compared to previous Q4 reports, the noteworthy aspect of the exchange rate statement for Q4 2025 is that while the past few years have emphasized "basic stability," this report places greater emphasis on "enhanced flexibility." This implies that the exchange rate can fluctuate in both directions, and the policy tolerates a certain degree of market adjustment, without aiming for a unilateral direction.

This article is sourced from: