Author:Odaily 星球日报

Original | Odaily Planet Daily (@OdailyChina)

Author | Dingdang@XiaMiPP)

At the start of 2026, DAT (Digital Asset Treasury) was dealt a heavy blow.

BTC retreated from its peak of $120,000 in 2025 to around $60,000, a drop of nearly 50%. ETH was not spared either, falling below the $2,000 mark and almost erasing all gains since May 2025. That was precisely the time when a group of DAT companies, represented by SharpLink and Bitmine, announced their strategic transformation and heavily allocated to crypto assets.

What does this mean? It means that listed companies and institutions that once regarded BTC and ETH as "strategic reserves" are now collectively mired in unrealized losses, with paper losses often reaching tens of millions.Hundreds of millions or even billions of dollarsLeading players like Strategy and Bitmine are still stubbornly increasing their holdings, attempting to maintain the narrative of "long-term believers"; however, more small and medium-sized or highly leveraged DAT companies have begun to emerge.Substantial reduction of holdings or even phased liquidation.

Crypto is never short of stories. If 2025 was the year of "putting faith into financial statements," then 2026 will be the test of "how faith can weather a bear market." When prices pull back, leverage tightens, and the financing environment reverses, can these DAT companies still hold up their balance sheets?

Odaily Planet Daily will analyze several representative cases of companies that have already begun "selling tokens to stop the bleeding," examining how much they have sold, why they are selling, and what their next move will be after the sale.

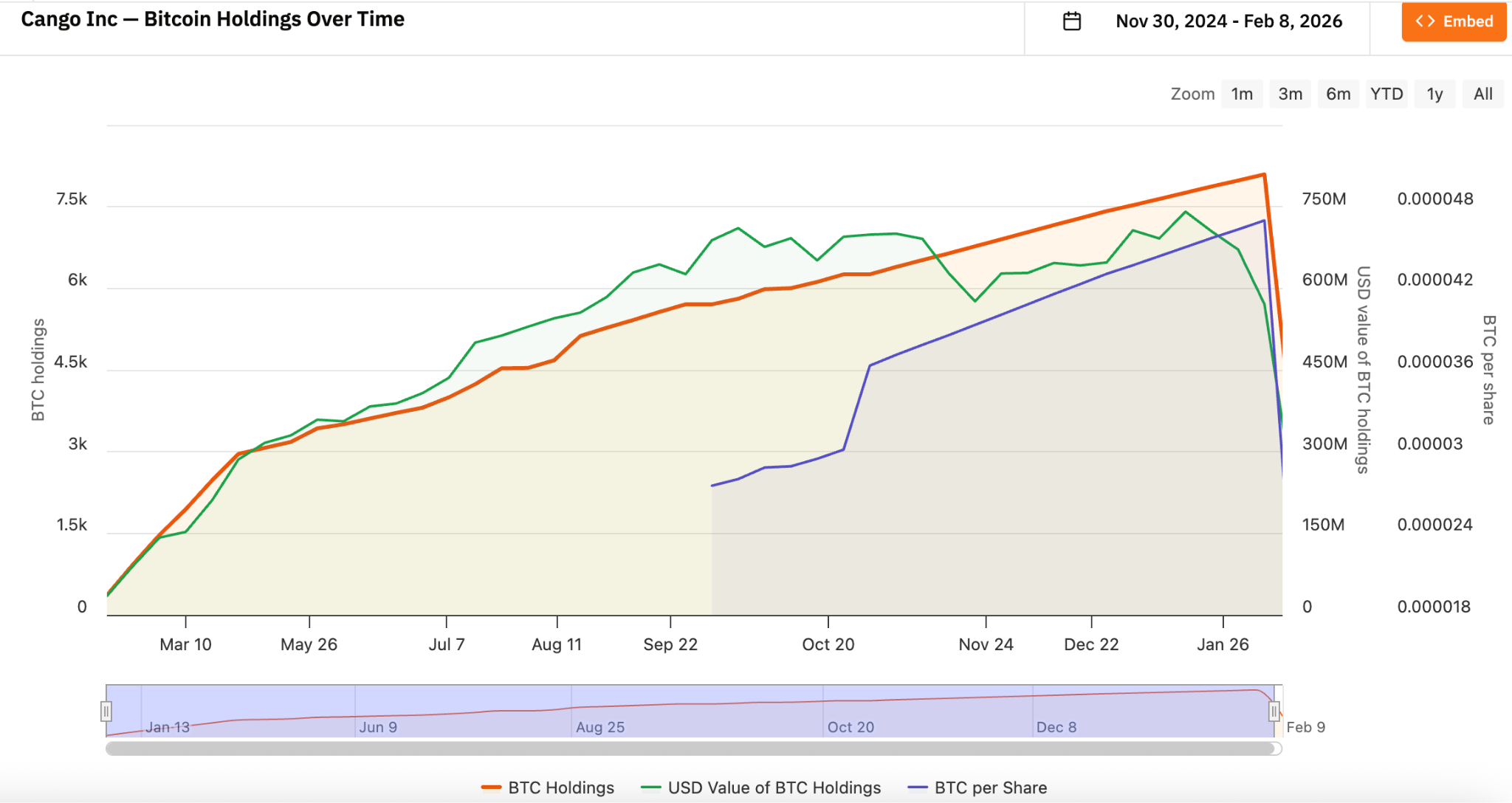

Cango Inc. (NYSE: CANG): The Leverage Limits of the Mining Model

On February 9, Cango disclosed that it had sold shares on the open market.4451 BitcoinsNet income approximately305 millionThe US dollars were used to repay a loan secured by BTC.This transaction is close to half of its previous holdings.After the sale, only 3645 BTC remained in the account.

Founded in 2010 and headquartered in China, Cango initially operated as a well-known car trading service platform. Starting in November 2024, Cango officially entered the digital asset field, transforming itself into a Bitcoin mining company through business restructuring and strategic shift, and regarding BTC as a core reserve asset. Cango's early Bitcoin strategy leaned towards...HODL + Mining AccumulationThis means not selling coins but continuously increasing holdings through computing power. This model can be self-reinforcing during price increase cycles: rising coin prices increase net asset value, which in turn increases financing capabilities, which in turn support the expansion of computing power.

Cango has been accumulating Bitcoin since November 2024, and its Bitcoin holdings were once the world's second largest mining company, second only to MARA Holdings.

Related readingFinding Potential Crypto Stocks: How Cango went from an automaker to the world's second-largest Bitcoin mining company.》

However, the mining industry is inherently leveraged. Mining equipment procurement, mine construction, and electricity contracts all require upfront capital expenditures. Mining companies often use their own held BTC as collateral to obtain equipment from manufacturers and delay payments, or borrow USD/stablecoins from institutions/platforms to expand their mines, purchase equipment, and maintain operations. The drawback of this model is...When the price of BTC experiences a significant correction, the collateralization ratio deteriorates rapidly, amplifying leverage risk, while fixed costs such as electricity, maintenance, and equipment depreciation do not decrease accordingly, leading to extreme pressure on cash flow.

According to data released in the third quarter of 2025, the average total cost of mining Cango (including depreciation) was approximately$99,000 per pieceCash cost excluding depreciation is approximately$81,000 per pieceThe price of Bitcoin is now far below its shutdown price, and the only way to "stop the bleeding" is to reduce BTC holdings, improve the balance sheet, and reduce financial leverage.

It is worth noting that Cango has announced that it will shift some resources to [the following].Artificial intelligence computing infrastructureThey seek to diversify their business to reduce their reliance on the price of a single asset.

Empery Digital Inc. (NASDAQ: EMPD): Counter-pressures on the bull market financing logic

Empery Digital was founded in February 2020 (originally named Frog ePowersports Inc., later renamed Volcon Inc.), headquartered in Texas, USA, and was originally a company focused on all-electric off-road vehicles.

In July 2025, the company announced its Bitcoin treasury strategy. Looking back, this timing coincided with the peak of the current Bitcoin price cycle. The company raised approximately $450-500 million through private placements and credit financing, and gradually increased its holdings between July and August 2025.4000 Bitcoinsaverage costApproximately US$117,000 per pieceBased on current prices, the unrealized loss is close to...57%.

On February 6th, Empire Digital announced the sale of 357.7 BTC at an average price of approximately $68,000 per BTC, raising approximately $24 million. The proceeds will be used to fund share buybacks and repay some debt. Empire Digital has already repurchased over 15.4 million shares at an average price of $6.71, aiming to narrow the NAV discount. Currently, Empire's remaining holdings are approximately...3724 Bitcoins.

The case of Empery Digital exemplifies the typical predicament of small and medium-sized DAT (Digital Assets and Technologies) tokens. They initially pursued aggressive transformations, relying on bull markets for funding, but were forced to "sell tokens to buy back shares and deleverage" when prices corrected. Compared to Cango's mining background, Empery's approach was more akin to "pure financial maneuvering." Its original core business became unsustainable, so it leveraged the bull market to heavily purchase BTC, attempting to replicate Strategy's path. However, the significant BTC correction exposed its leverage risks and its lack of long-term issuance and capital market maneuvering. If prices continue to fall, continued selling becomes almost inevitable.

Bitdeer Technologies Group (NASDAQ: BTDR): From Price Betting to Cash Flow Priority

Bitdeer was founded in December 2021 by crypto OG Jihan Wu (former co-founder of Bitmain) and is considered one of the world's major Bitcoin mining companies, alongside MARA and Riot.

Bitdeer, through a vertically integrated model, provides end-to-end solutions from equipment procurement, logistics, data center design/construction, equipment management to daily operations, while also expanding into cloud computing power, hosting services, and its own ASIC mining machine R&D. This has enabled Bitdeer's business to expand from...Pure mining shifts to diversified high-performance computingThis has, to some extent, buffered the impact of Bitcoin price fluctuations.

frombitcointreasuries.netData shows that since November 2025, Bitdeer's BTC strategy has shifted to..."Dig and sell simultaneously"Instead of going all-in on HODL, they are maintaining cash flow and operational stability through partial monetization.Prioritizing cash flow over long-term holdingIs this the industry sensitivity that OGs have developed after experiencing multiple bull and bear market cycles?

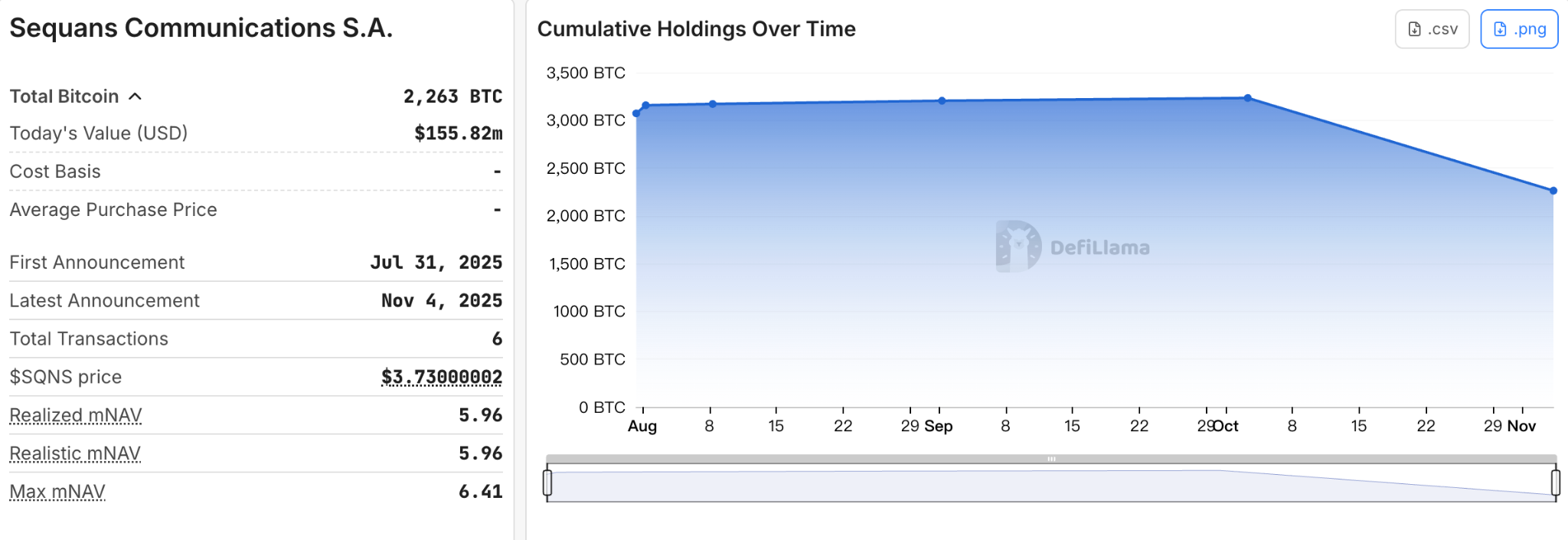

Sequans Communications S.A. (NYSE: SQNS): Selling cryptocurrency to pay off debts marks a turning point for the industry.

Founded in October 2003, Sequans was originally a semiconductor company focused on wireless cellular technology chips and modules. In June 2025, the company raised approximately $380 million through private equity and convertible bonds to accumulate Bitcoin, transforming itself from a pure IoT chip manufacturer into a "IoT + BTC DAT" hybrid.

Between July and October 2025, Sequans cumulatively increased its holdings.3233 BitcoinsA rough estimate suggests that the average cost is approximately$116,000about.

November 2025,First major sale of 970 BTCThe funds were used to redeem approximately 50% of the convertible bonds, reducing the company's total debt from $189 million to $94.5 million. The company described this as a "strategic asset reallocation," not an abandonment strategy. However, in the market's view, Sequans was the starting point for the "bubble burst" in the BTC treasury—The first DAT company to publicly admit to needing to sell cryptocurrency to pay off debts..

ETHZilla Corporation (NASDAQ: ETHZ): A Deleveraging Example of the ETH Treasury

ETHZilla Corporation was originally a clinical-stage biotechnology company focused on drug discovery and treatment development in areas such as chronic pain, inflammation, and fibrosis. The company faced problems including cash shortages, poor liquidity, and slow R&D progress, resulting in a prolonged period of low stock prices.

In August 2025, ETHZilla raised $425-565 million through a private placement. Investors included crypto institutions such as Electric Capital, Polychain Capital, and GSR, as well as entities associated with Peter Thiel holding approximately 7.5% of the shares. These funds were used directly to purchase ETH and establish an Ethereum treasury. At its peak, ETHZilla increased its holdings by approximately [amount missing].102,000 ETH, worth approximately $210 million.The cost of establishing a position per unit is$3,841.

On November 13, 2025, ETHZilla began its first reduction of its holdings, selling 8,293 ETH. On December 25, ETHZilla disclosed that it had sold 24,291 ETH, raising approximately $74.5 million. This transaction was part of the redemption of outstanding senior secured convertible notes.The first ETH treasury reduction sampleCurrently, ETHZilla holds approximately 65,700 ETH.

Similar to Empery, ETHZilla is also forced to sell tokens to deleverage. However, the company is accelerating its efforts to...RWA (Real-World Asset Tokenization) TransformationThe company focuses on areas such as auto loans, housing loans, and land/commercial real estate, and plans to launch its first RWA token product in early 2026, attempting to reshape value through business innovation.

Conclusion

The above are just a few representative examples. Most of them are in the middle range of the industry, lacking the pricing power of a strategy company in the capital market, and unlike the smallest companies, they cannot quietly exit the stage. Beyond them, some smaller, more fragile DAT companies have quietly disappeared in this round of pullback; and some companies that originally planned to transform but had not yet truly implemented their financial strategies chose to press the pause button after the sudden tightening of the financing environment, or even announced the termination of projects before they even started.

The correction in 2026 served as a mirror, revealing the fragility and resilience of the DAT model. Companies that built their fortunes solely on "storytelling + leverage" are now paying the price for their aggressive expansion. The crypto faith may still exist, but it must ultimately coexist with real-world cash flow, leverage management, and business sustainability.

The gap between leading players and small and medium-sized companies is widening in this process. Rather than seeing this as the end of the DAT model, it's more accurate to say it's the beginning of a tiered structure.