Author:Currency Explorer

JPMorgan global research analysts believe thatSilver prices are establishing a higher bottom in 2026, but the top remains unclear.The surge in global demand presents both upside and downside risks to price forecasts.

In a report released on Tuesday, analysts said silver is trying to emerge from gold's shadow by 2026, but whether it will succeed remains to be seen.

"Like Robin to the gold version of Batman, silver has always played a perpetual supporting role in the world of precious metals—often overlooked by its more illustrious counterparts," they wrote. "Despite silver's practical value in industrial production processes and outputs, including as a conductive paste coated on solar panels and arrays to collect and transmit current, the gold-to-silver price ratio sometimes still exceeds 100 to 1."

“However, the ratio is currently at its closest level in 15 years,” they added, “because both gold and silver prices experienced extreme volatility in early 2026 – during one period, at least in terms of net value gains, silver’s gains have begun to outpace gold.”

JPMorgan Chase believes a significant portion of these gains stems from U.S. tariff policies. "For months, the U.S. Department of Commerce has been reviewing critical minerals under Section 232 of the Trade Expansion Act of 1962, a provision that allows the president to impose tariffs or other trade restrictions when he determines that imported products threaten national security," analysts wrote. "This period of uncertainty ended in mid-January when President Trump suspended new tariffs on imports of critical minerals, including silver, instead seeking bilateral agreements with trading partners to ensure adequate supply. Silver prices initially fell after the executive order but subsequently rebounded."

The next immediate trigger for silver's decline came on January 30, when Trump announced his nomination of Kevin Warsh as the next Federal Reserve Chairman. "Silver plummeted 27%, while gold fell 10%," they noted.

Analysts say that while Warsh's nomination, coupled with a short-term strengthening of the dollar, appears to have dampened the extraordinary demand for precious metals, certain structural drivers remain and may continue to constrain silver supply.

"First, silver is generally mined as a byproduct of other metals, meaning its production is relatively inelastic to price increases," they noted. "Second, silver plays a role in industrial processes, such as the manufacture of solar panels."

Gregory Shearer, head of base and precious metals strategy at JPMorgan Chase, believes there is a scenario where high silver prices could force solar panel manufacturers to adopt silver-free technologies to control costs while trying to reduce the amount of silver used per solar panel.

“In the long term, we believe the biggest risk to silver comes from the wider adoption of silver-free technologies, such as cadmium telluride thin-film technology,” Shiller said, referring to such silver-free technologies. “While silver is essentially a precious metal, it is also a very industrial metal, with industrial applications accounting for about 60% of its total demand (excluding ETF flows).From a fundamental perspective, we believe that the recent surge in silver prices has likely accelerated the substitution and reduction trend, which will have a lasting impact on the silver supply and demand balance in the coming quarters.”

However, Shiller acknowledged that these changes could take several years to materialize.In the short term, he still believes that fluctuations in investment demand are the main driver of prices.

JPMorgan Global Research believes that silver prices have correctly established a higher bottom, but the top is still unclear.

“One reason why gold demand is more robust than silver is its broader buyer base, which includes central banks around the world that buy gold both to diversify their dollar reserve assets and because of its characteristics as an inflation hedge and a liquid asset with no counterparty risk,” the report notes. “Silver does not enjoy the same benchmark demand—which partly explains why a fair price for silver may be more difficult to determine.”

"Due to the lack of central bank buying as seen in the gold market during structural pullbacks,"We do believe there is still a risk that the gold-to-silver price ratio may rise further.“Shiller said, but added that global demand—particularly in China and India—will play a key role in determining where silver prices will find support after their recent pullback,” he said.

“With amplified Asian investment demand significantly influencing price formation across the entire metals sector, we believe this remains another catalyst to watch in the silver market in the coming weeks,” Shiller said. “Ultimately,We are more cautious about resuming large-scale investment in silver in the short term.Until recently, some of the bubble in prices has been more fully deflated.

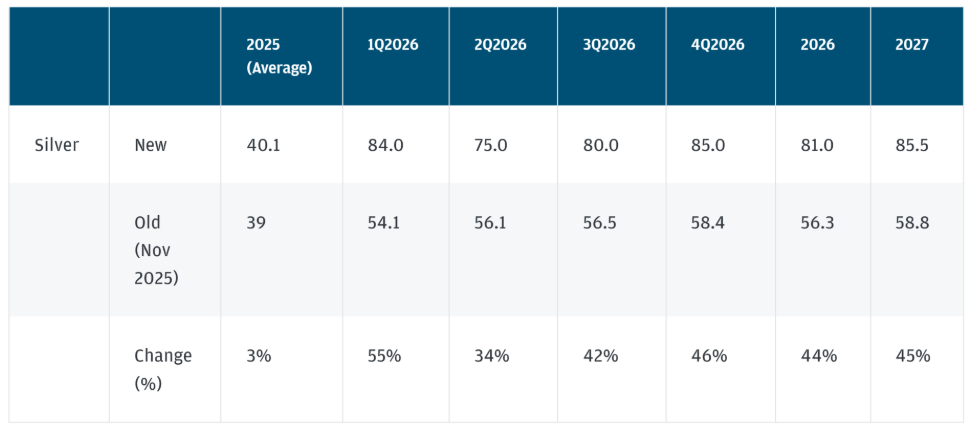

JPMorgan Global Research predicts that the average price of silver will be $81 per ounce in 2026, with the highest average price expected in the fourth quarter, reaching $85. The agency also predicts that the average price of this grayish-white metal will be $85 in 2027.