Author:99Bitcoins

Quant network, or QNT, has been quietly pushing higher even as most of the crypto market stays red. While major coins struggle to hold support, Quant has managed to nudge its way toward the mid $90s after an 11% jump, giving it an unusual bit of strength in a gloomy week.

A lot of this comes down to Quant Network’s slow-burn progress with Overledger, the London-based company’s interoperability system that aims to connect blockchains with the traditional financial rails that institutions still rely on.

Between shrinking exchange supply and growing attention from the crypto community, there are a few reasons QNT crypto keeps climbing while everything else looks heavy.

Why QNT Crypto Is Climbing?

One of the biggest stories behind this move is simple: There just isn’t much QNT crypto left on exchanges. Reserves have slipped to just 3.06 million tokens, which is the lowest ever recorded. Since the total supply is capped at 14.88 million, any meaningful reduction in circulating liquidity magnifies price swings.

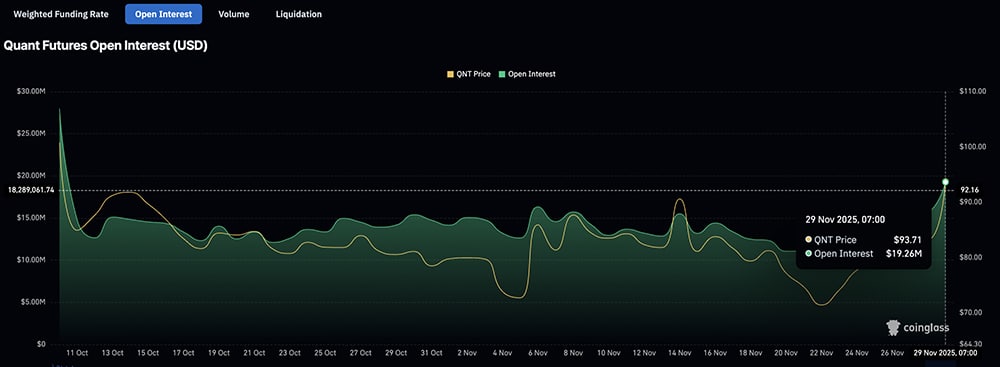

On top of that, futures open interest has jumped to around $15 million as more people are taking positions after sitting on the sidelines.

Whales have been contributing to the squeeze as well. Several large wallets, likely institutional players, have been scooping up QNT and moving it straight into crypto cold storage. One entity added 2,666 tokens in a single move, lifting its stash to just under 50K tokens.

What’s crazy is the lack of ETH deposits, which can be interpreted as these whales are not hunting quick flips. With regulators now giving banks the green light to hold native tokens for fee payments, the timing of this accumulation isn’t surprising.

Meanwhile, Quant’s Overledger technology continues to gain traction behind the scenes. It’s being used in trials for projects involving the digital euro, the BIS unified ledger, and tokenized-asset pilots. Partnerships with SWIFT and Oracle reinforce the idea that QNT crypto is becoming more tightly linked to real financial infrastructure rather than speculative hype.

What’s Next for QNT Crypto?

From a crypto charting perspective, QNT has finally broken its long downtrend after forming a double-bottom around the $70 to $80 range, and is now bumping into resistance at $108. Quant also records a rising volume, which, ever so often, is above $25 million; recent spikes send it near $74 million. These add some weight to the move.

Analysts watching momentum indicators think a clean breakout could open the door to the $100 level and possibly more, they just need Bitcoin to act supporting it. With supply drying up, institutions accumulating, and real-world adoption inching forward, QNT is one crypto to watch

Bonus: The Next Quant?

While QNT is expected to hit $100, the fact that it is already at $94 makes it unappealing for traders with small portfolio sizes. Yes, Quant might pump above $120, but its return ratio won’t be as big as a promising new project.

Why HYPER? Bitcoin Hyper is building an infrastructure play as the first mover: a Bitcoin Layer-2 crypto network that enables faster, low-cost Bitcoin transactions, plus a bonus staking yield of 40% APY, unmatched compared to others.

It’s revolutionary with a bonus. It’s the first and only Bitcoin Layer-2 solution.

The presale has crossed more than $28 million as of today, and it accepts and supports multiple chains for buying. Another ease of access that it offers, multi-chain support, showing developers’ adaptability.

Nearly a million tokens have already been staked, showing a really strong interest. At a low entry price of under 2 cents and $100 potential, Bitcoin Hyper aims to bring memecoin hype into DeFi’s backbone. Once the meme season is pacing at full speed, Bitcoin Hyper could 100-1000X in a flash.

Buy HYPER now before the price increases incrementally soon.