Author:The Coin Republic

Key Insights:

- ASTER price jumped 15% upon a major partnership with World Liberty Financial.

- The DEX will work with Trump family-backed DeFi company to boost USD1 adoption.

- Aster CEO Leonard confirmed the partnership, with more announcements expected at Binance Blockchain Week.

ASTER price jumped 15% after Binance-backed Aster DEX announced a partnership with World Liberty Financial (WLFI) on Tuesday.

The DEX will collaborate with the Trump family-backed DeFi company to expand the adoption of the USD1 stablecoin. The move sparked significant buzz in the crypto community.

Aster Confirms Partnership with World Liberty Financial

Aster DEX has partnered with World Liberty Financial (WLFI), a crypto startup linked to the Trump family. The Aster founder and CEO Leonard confirmed an X post on December 2.

He confirmed that the decentralized exchange will help boost the adoption of WLFI’s USD1 stablecoin. The collaboration will also boost DeFi adoption by bridging stablecoin utility with perpetual trading capabilities.

A crypto community member first shared the development on X that Aster and WLFI representatives discussed their plans during a private event at the Binance Blockchain Week

Aster, Opinion, and World Liberty Financial held a closed meeting. Leonard later confirmed this news on his official X account, saying:

“Word travels fast in this space. Had an amazing time with World Liberty Financial and everyone who joined us in Dubai. We’re exploring ways to expand USD1 adoption together. Stay tuned.”

Notably, more than 176 people attended the event, which included traders, protocol founders, researchers, and digital asset leaders.

The event started at noon with registration, opening remarks, and a mixer that lasted over three hours.

Will Leonard Announce More Partnerships at the Binance Blockchain Week?

Leonard will attend the two-day Binance Blockchain Week at the Coca-Cola Arena on December 3 and 4. In a post on Tuesday, the exchange invited attendees to visit its booth as it makes further announcements.

“We’re at Binance Blockchain Week! Find us at booth P4 or join us at the events below, and we’d love to connect in person,” the company posted.

During the forum, Aster’s schedule features a main-stage talk called “Perp DEXs and the Freedom to Trade,” a StableFi networking dinner, and a DeFi forum after BBW titled “New Era of DeFi: From Stablecoin to Autonomous Neo Banking” on December 5.

Recently, Binance founder Changpeng “CZ” Zhao endorsed Aster, causing a massive demand for the perpetual exchange. It even caused Hyperliquid to lose its market share as CZ family office YZi Labs has invested in Aster.

ASTER Price Skyrockets 15%

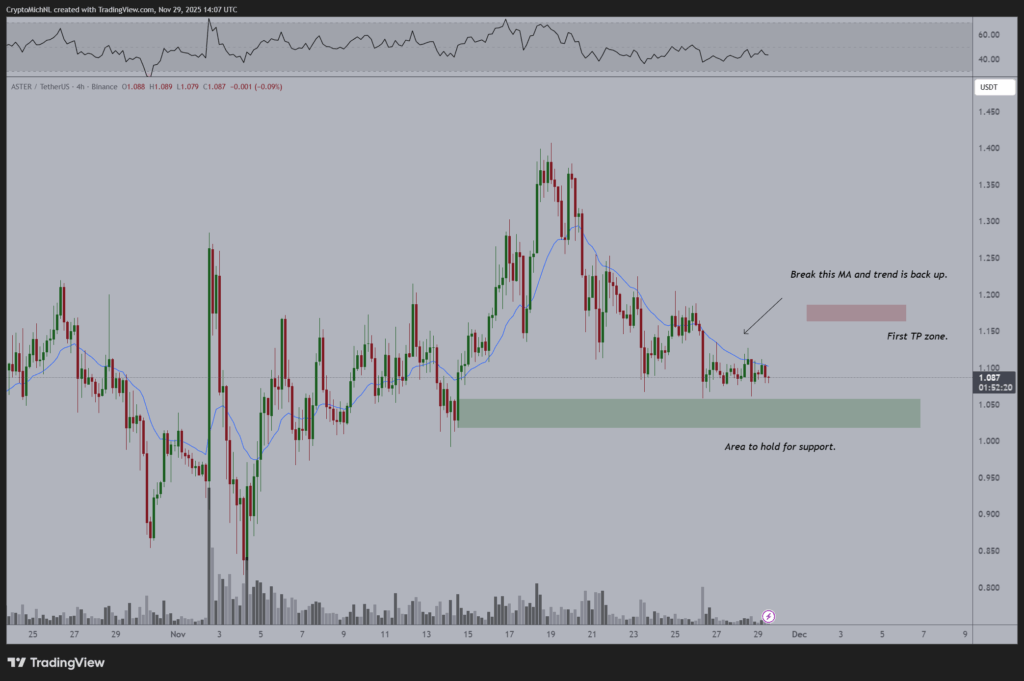

ASTER price jumped 6% in just 2 hours and 15% over the past 24 hours. The price was trading at $1.01, with a 24-hour low and high of $0.884 and $1.029, respectively.

Trading volume saw a 14% increase over the last 24 hours. This indicated a rise in interest among traders.

In addition, Aster beginning the fourth round of token buybacks today has further supported the price recovery. The buyback program was launched to support holders amid the current volatile crypto market environment.

Analyst Michael van de Poppe predicted an upcoming upside in ASTER. He shared a 4-hour time frame chart, claiming the token will break above the 20-moving average.

The derivatives market saw selling in the last few hours, per CoinGlass data. At the time of writing, the total ASTER futures open interest dropped 2% in an hour amid profit booking.

The 24-hour ASTER futures open interest was up more than 8%. Notably, the futures OI on Binance climbed by more than 10%.