Author:Forever full warehouse

Analysts say Meta’s reported plan to drastically scale back its metaverse spending could mark one of the company’s most significant strategic pivots since its 2021 rebrand and potentially unlock meaningful upside for the stock.

In a new note, Mizuho described Reality Labs, the division behind Meta’s VR headsets and mixed-reality hardware, as an “$80 billion black hole” of cumulative operating losses and argued that cuts of up to 30% would immediately strengthen Meta’s earnings profile.

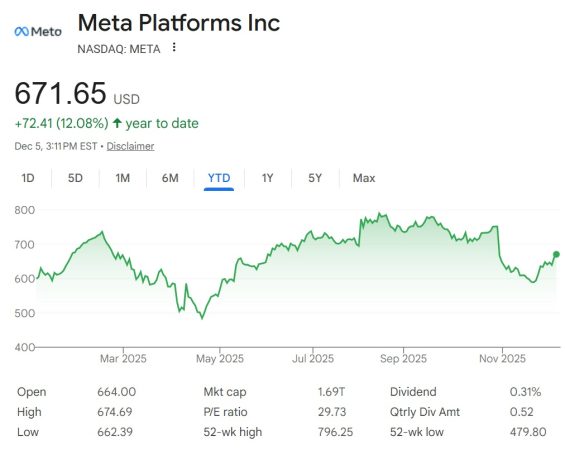

Mizuho’s analysts, under lead coverage from Lloyd Walmsley, estimate the reductions could add roughly $2 per share to 2026 earnings and reiterated its Outperform rating with an $815 price target, alongside a $1,245 bull case tied to faster AI-led growth.

Their $815 target would mark a more than 21% jump from the stock's current price of $672, according to Google Finance data.

Meta (META) stock price YTD chart. Source: Google Finance

Recent investor conversations, the analysts said, have grown increasingly pessimistic, with many viewing a metaverse retrenchment as overdue.

Meta’s own leadership even hinted at the stakes earlier this year. In a memo leaked in early 2025, Meta Chief Technology Officer Andrew Bosworth warned that mixed-reality efforts were entering a make-or-break phase, writing that the coming year would determine whether the project would be remembered as “the work of visionaries or a legendary misadventure.”

Analysts say the reported cuts now under review fit that description. People familiar with Meta’s planning process told outlets this week that executives are evaluating reductions of up to 30% at Reality Labs as part of the company’s 2026 budgeting cycle, far deeper than the roughly 10% savings targets applied to most other divisions.

Such a move could include layoffs early next year, though final decisions have not been made.

Reality Labs has posted more than $70 billion in losses since 2021, while Horizon Worlds continues to struggle for relevance despite CEO Mark Zuckerberg’s past insistence that the company was not drifting away from the metaverse.

The lack of user traction, combined with years of mounting spend, has fueled concerns that the division was siphoning resources from Meta’s AI efforts — worries analysts say these cuts would help alleviate.

Metaverse sector struggles

The broader metaverse ecosystem has also collapsed around Meta.

Tokens tied to virtual-world platforms have shed nearly all their value from early-2025 peaks. Render has fallen out of the top 100 digital assets and has a market cap below $1 billion, while Sandbox and Decentraland are trading near record lows.

The entire metaverse-token category is now valued at under $3.2 billion, down from more than $500 billion at the start of the year, according to CoinGecko data.