Author:Shuzang Metaverse

JPMorgan analysts signaled on Tuesday that Bitcoin and other digital assets could have more room to run, despite fears sparked by the original cryptocurrency’s plunge over the last month.

Although some onlookers may be convinced that crypto prices are primed for prolonged downturn following Bitcoin’s fall as low as $81,000 last month, the investment bank doesn’t foresee a so-called crypto winter brewing on the horizon.

“The sell-off this past month triggered worries throughout crypto media and markets that the crypto ecosystem may be entering the next crypto winter,” they wrote. “While we don't anticipate the end of the current bull cycle, we do acknowledge this November pullback as meaningful.”

Decrypt has reached out to JPMorgan for further comment.

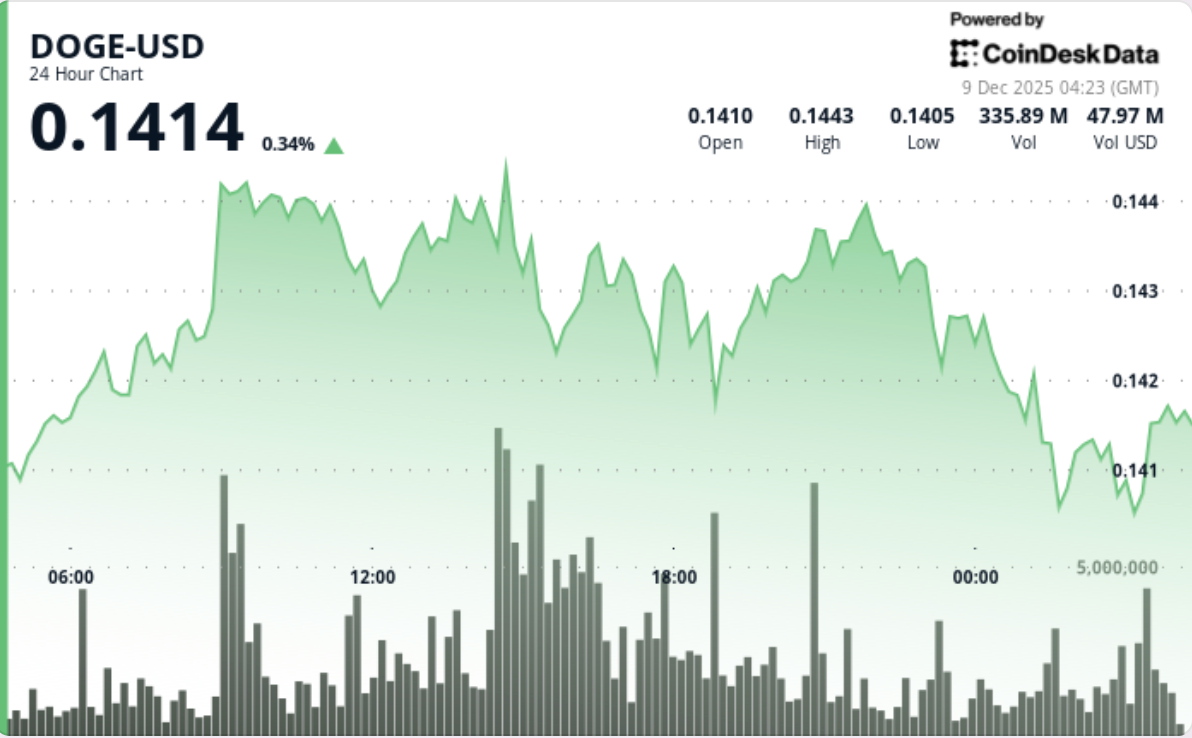

The analysts noted that Bitcoin finished the month 9% below its starting price in January, showing a year-over-year decline in the asset’s price for the first time since May 2023. As of Tuesday, Bitcoin changed hands about 1.5% below the mark at $93,000.

Over the past year, Bitcoin’s price has still fallen 5%, according to CoinGecko. Still, JPMorgan analysts acknowledged that digital asset prices were “inflated immediately following the 2024 U.S. general election,” alongside President Donald Trump’s re-election.

As the market caps of various tokens contracted by over 20%, the analysts wrote that trading volumes also took a noticeable hit. Still, they highlighted the “resiliency” of stablecoins, which saw their total volume expand for a 17th consecutive month despite the volatility.

“Overall, we struggle to see these recent market pullbacks as emblematic of broader structural degradation within the crypto ecosystem, and thus we continue to be positive on the space,” the analysts wrote.

JPMorgan’s latest note is significant in the sense that it effectively points to the end of four-year cycles that Bitcoin’s price has historically followed. The dynamic has been linked to Bitcoin’s so-called halving, but the market for it has changed drastically in recent years.

On Tuesday, users on Myriad—a prediction market platform from Decrypt’s parent company, Dastan—penciled in just a 6% chance that a crypto winter emerges by February 2026. They placed those odds at 16% four days ago.

For some, 80% drawdowns appear unlikely to happen again. Those investing in Bitcoin through exchange-traded funds are “more stable owners” that should lead to “more stable prices,” Bloomberg Intelligence Senior ETF Analyst Eric Balchunas told Decrypt in August.

The sentiment was echoed in a note from British multinational bank Standard Chartered on Tuesday, which highlighted expectations of looser monetary policy at the Federal Reserve. However, it also acknowledged that inflows for spot Bitcoin ETFs have recently tapered off.

“This time really is different,” Geoffrey Kendrick, the bank’s head of digital assets, wrote. “We think crypto winters are a thing of the past.”