Author:Digital Coin God

Ethereum price today trades near $2,957.50 after breaking below the descending channel that contained price action since the December low. The move marks the first close below $3,000 since early December, shifting the technical structure bearish even as institutional buyers step in.

Bitmine Buys $106 Million During Selloff

Not everyone is selling. Bitmine Immersion disclosed Tuesday that it purchased 35,268 ETH last week, worth $106.2 million at current prices. The buy brings the firm’s total Ethereum holdings to over 4.2 million tokens valued at $12.5 billion.

Chair Tom Lee pointed to the improving ETHBTC ratio as motivation for the purchase. The metric has climbed steadily since mid-October, suggesting that Ethereum is gaining relative strength against Bitcoin despite the broader market weakness.

Institutional accumulation during selloffs often signals longer-term conviction. When treasuries add exposure as retail exits, it creates a potential floor beneath price that can support future recovery attempts.

Spot Inflows Confirm Accumulation

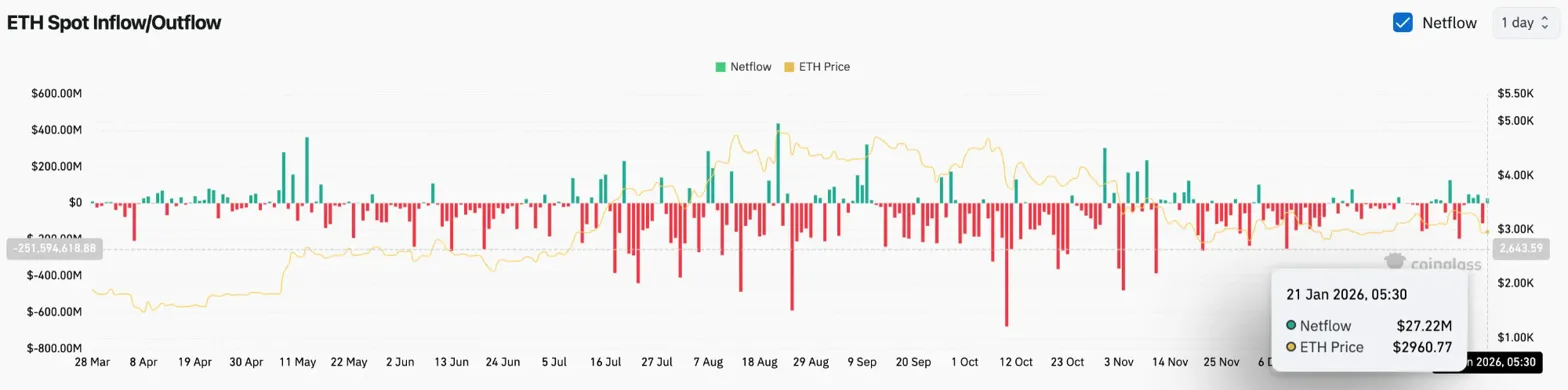

Exchange flow data supports the buying thesis. Coinglass recorded $27.22 million in net inflows on January 21, meaning coins are moving off exchanges into private wallets rather than being staged for sale.

Related: Axie Infinity Price Prediction 2026: GameFi’s $380M Volume Surge Signals Turnaround Play

The inflow follows the pattern established earlier this week when accumulation occurred during the broader crypto selloff tied to tariff concerns and geopolitical tensions surrounding Greenland. Price has dropped 8% over the past 14 days, yet buyers continue to absorb supply.

This divergence between price action and flow data creates a potential setup for recovery. Accumulation at lower prices reduces available supply on exchanges, which can accelerate rallies when sentiment shifts.

Channel Breakdown Shifts Structure Bearish

On the daily chart, Ethereum broke below the descending channel lower boundary that held throughout December and early January. The pattern had offered support near $3,100, but Monday’s selloff sliced through that level without hesitation.

Price now trades below all four EMAs, with the gap widening as the correction extends. The EMA stack reflects the technical damage:

The Supertrend indicator flipped bearish at $3,321 and now sits nearly 12% above current price. Reclaiming this level would require a significant reversal in momentum.

Intraday Momentum Hits Oversold Extremes

Shorter timeframes show the severity of the decline. On the hourly chart, ETH dropped from $3,370 to a low of $2,920 over just three sessions. The Parabolic SAR sits at $2,937.73, just below current price, suggesting that the immediate downtrend may be pausing.

Related: Bitcoin Price Prediction: BTC Faces Short-Term Pressure After Failed Breakout

RSI crashed to 30.39, entering oversold territory. Readings at this level often precede short-term bounces as selling pressure exhausts. However, oversold conditions can persist during strong trends before meaningful reversals occur.

The $2,900 to $2,920 zone has attracted buying interest on multiple intraday tests. Holding this level would confirm that accumulation is building a base. Losing it opens the path toward $2,800.

Outlook: Will Institutional Buying Support Price?

The setup presents a conflict between technical weakness and fundamental strength. The chart says sell while institutions say buy. Resolution will come when one side overwhelms the other.

Ethereum faces a test of conviction at broken support. Institutional buying suggests the dip has value, but bulls need a close above $3,000 to stabilize the structure.

Related: Cardano Price Prediction: ADA Faces Fresh Pressure as Outflows Fade but Structure Stays Weak