Author:深潮TechFlow

The market is projected to reach $44 billion in trading volume in 2025.

Polymarket raised $33.4 billion, while Kalshi raised $43.1 billion. One is an on-chain "truth engine," and the other is an "event exchange" regulated by the CFTC. The two companies battled for a whole year, betting on everything from the US election to the Venezuelan coup, from the Super Bowl to the Fed's interest rate hike. By the end of the year, even ICE, the parent company of the NYSE, invested $2 billion in Polymarket.

Prediction markets have become one of the fastest-growing crypto sectors in 2025.

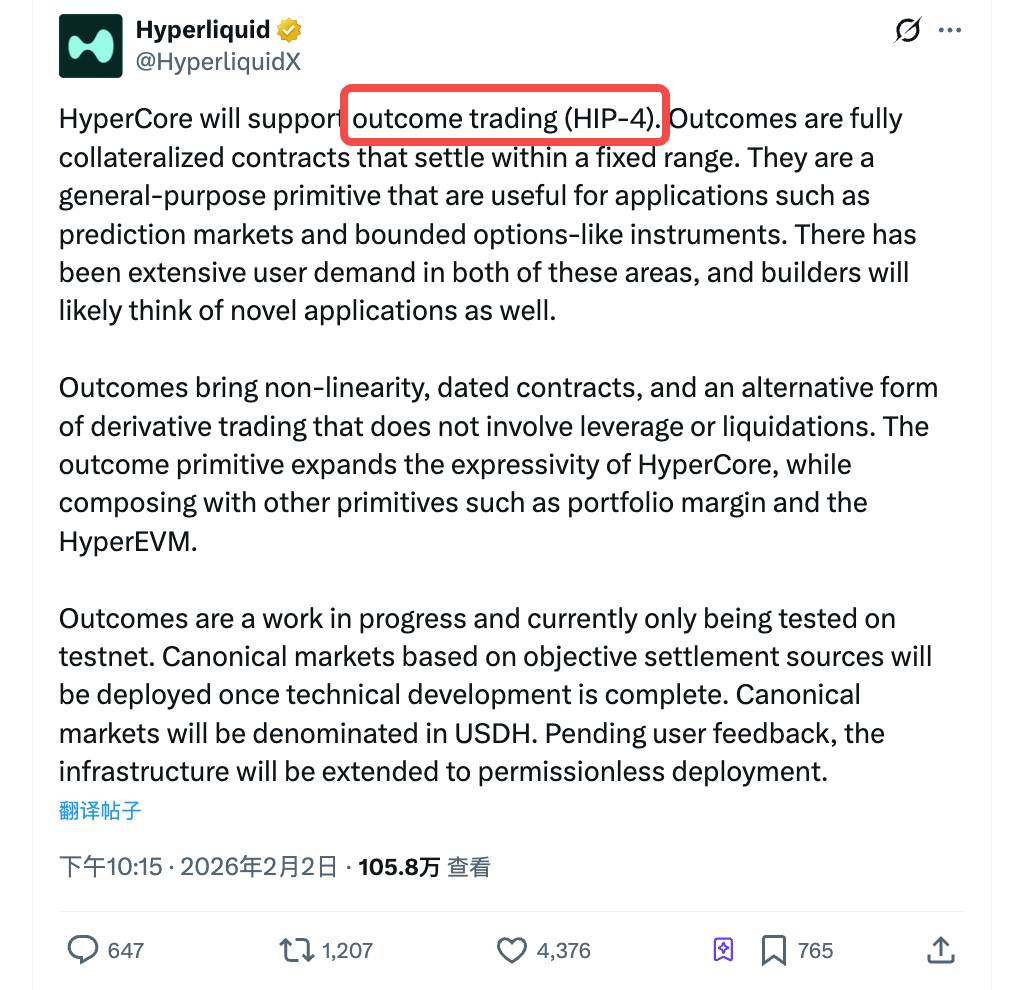

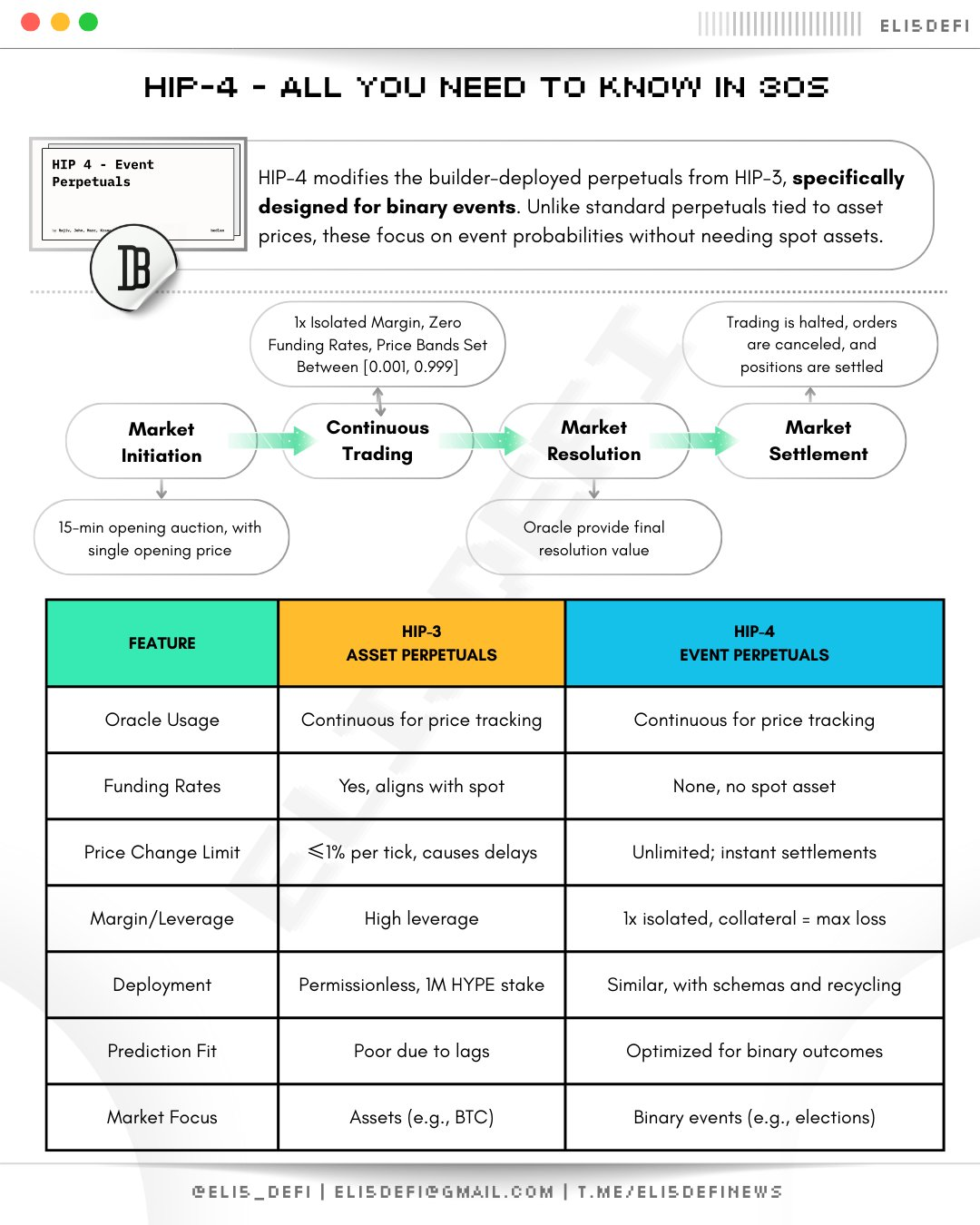

On February 2nd, Hyperliquid announced the launch of its HIP-4 testnet. The official description is "outcome trading," meaning fully collateralized contracts that settle within a fixed price range, suitable for prediction markets and options-like products.

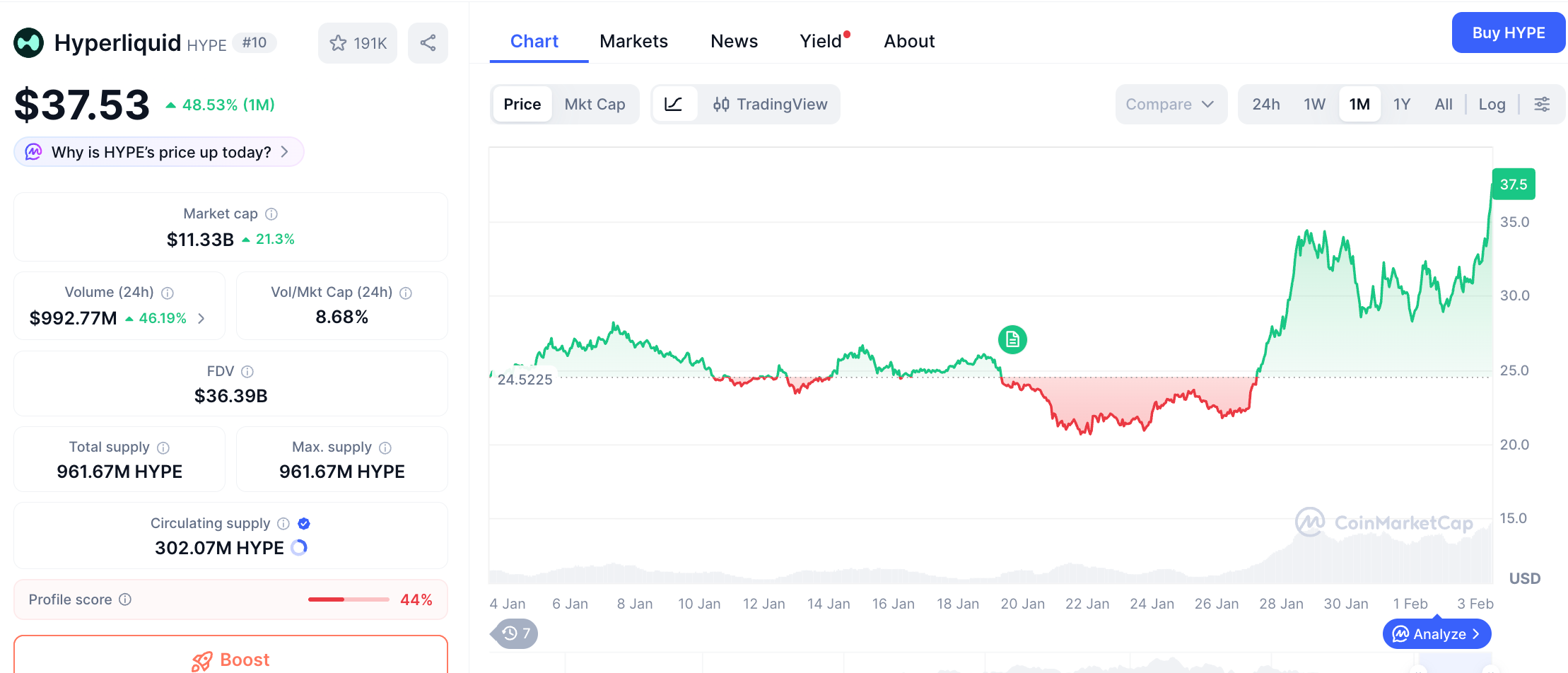

Following the news, HYPE rose 10%. It has accumulated a gain of over 40% in the past week; in contrast, BTC once fell to $75,000 during the same period.

The market clearly views HIP-4 as a positive development. However, if you only understand HIP-4 as "Hyperliquid doing prediction markets," you may be underestimating the intention behind this move and misjudging Hyperliquid's value in the current crypto ecosystem.

First, let's talk about what HIP-4 is.

Hyperliquid's core business was previously perpetual contracts: contracts with no expiration date, leverage, and the risk of liquidation. This was the category with the largest trading volume of on-chain derivatives, and it was Hyperliquid's bread and butter.

However, the outcome contracts introduced by HIP-4 are almost the opposite.

It has a maturity date, is fully collateralized, requires no leverage, and will not result in liquidation.The contract settles within a fixed price range, and the buyer will at most lose their principal and will not owe the platform money.

For example.

If you believe BTC will rise above $100,000 by the end of March, you can buy a corresponding outcome contract. If BTC does indeed break $100,000 at expiration, the contract will be settled at the maximum, and you will make a profit; if not, it will be settled at the minimum, and you will lose your initial purchase price. There are no margin calls and no forced liquidation in the middle of the night.

This structure is naturally suited to two types of scenarios:Prediction markets (betting on the outcome of events) and option-like products (expressing directional views within a fixed range).

On Polymarket, betting on whether Trump will be re-elected essentially follows the same logic: full collateralization, binary settlement.

HIP-4 makes this logic a universal primitive, not limited to yes or no, and supports continuous price ranges.

(Image source:@Eli5defi)

Currently, HIP-4 is still in the testnet phase.

Upon official launch, the first batch of markets will be officially planned and denominated in USDH (Hyperliquid's native stablecoin). Subsequent plans include enabling permissionless deployment based on user feedback, allowing anyone to create outcome markets.

Doesn't this sound like "Hyperliquid version of Polymarket"?

It's not that simple.

Composability—a cliché, but its most valuable aspect.

Polymarket is an independent prediction market platform.

The contracts you buy on it have absolutely no relation to your positions on Aave, your liquidity on Uniswap, or your positions on any other protocol. The same applies to Kalshi. Each contract is an island.

HIP-4 is different. Outcome contracts run directly on HyperCore, sharing the same trading engine and the same portfolio margin system as perpetual contracts.

Ignas, a well-known DeFi researcher on the international internet, pointed out a classic scenario after the release of HIP-4:

While you are holding a long ETH perpetual contract, you can also buy an outcome contract that pays out if ETH falls below a certain price at expiration. The two positions are hedged against each other under the same margin account, and the system automatically identifies when the risk exposure decreases and releases excess margin.

Let me translate:

You use one position to indicate direction and another position to cover losses. Combining the two together requires less capital than opening a position separately.

In traditional finance, this is called a structured product.

Investment banks help institutional clients create such portfolios and charge hefty fees. Now Hyperliquid wants to implement this natively on-chain, eliminating the need for intermediaries and automatically identifying hedging relationships between contracts.

Polymarket can't do this, and neither can Kalshi. They are independent event exchanges, not derivatives engines.

Therefore, the HIP-4 outcome contract is less a product and more a primitive that enhances Hyperliuqid itself; a building block that can be assembled with other parts.

Predicting markets is just the most obvious use of this building block.

From HIP-1 to HIP-4, the four-step process of on-chain Perp

The logic becomes clearer when you put HIP-4 into the context of Hyperliquid's product evolution.

HIP-1 defines the token standard.

Launched in 2024, HyperCore allows any asset to be natively issued on HyperLiquid. The first token minted using this standard was PURR, which is equivalent to Ethereum's ERC-20 but runs on HyperLiquid's own chain.

HIP-2 addresses liquidity issues.

Automatically place buy and sell orders near the current token price, maintaining a price spread of approximately 0.3%. The token has market depth from the very first second after listing, without needing to wait for market makers to enter.

HIP-3, an open, permissionless perpetual contract.

Anyone can deploy their own perpetual contract market by staking 500,000 HYPE, customizing the underlying assets, oracles, leverage, and collateral types. Since its launch, the cumulative trading volume has approached $42 billion, and the open interest has exceeded 1 billion. Stocks, commodities, meme coins—people are opening contracts for everything.

HIP-4, join the outcome contract.

It has a maturity date, full collateral, and non-linear settlement.

If you look at these four steps together, it's very similar to the continuous iteration and expansion of an internet product: issuing assets, providing liquidity, opening a contract market, and adding settlement tools.

Thus, Hyperliquid has transformed from a perpetual contract DEX into a full-category on-chain derivatives platform covering spot, perpetual, prediction markets, and options-like products.

Each step involves adding components to the same trading engine.

Jeff Yan, the founder of Hyperliquid, once said:

"The house of all finance must be credibly neutral."

The four hips are more like the four walls of this house.

Price $HYPE

HYPE has risen more than 40% in the past week. While the broader market is bleeding, HYPE is bucking the trend.

This is certainly not entirely due to the HIP-4 message being sent.

Several things have been happening at Hyperliquid in the past few weeks: the HIP-3 permissionless perpetual contract market has seen continued growth, the hot precious metals trading has generated impressive data, and HYPE's buyback mechanism has been accumulating tokens, with 97% of the platform's transaction fees going towards buying back HYPE.

However, HYPE rose 10% on the day of the HIP-4 announcement, indicating that the market at least considered the information valuable.

The author would like to point out the role of USDH.

All outcome contracts for HIP-4 are denominated and settled in USDH. USDH is Hyperliquid's native stablecoin, issued by Felix Protocol and backed by short-term U.S. Treasury bonds. The yield is used to buy back HYPE and incentivize DeFi activities within the ecosystem.

This strengthens the previous flywheel:

More product types launched (HIP-3 perpetual, HIP-4 outcome) --> Increased trading volume --> Increased trading volume generates more transaction fees --> Transaction fees repurchase HYPE --> More markets settle in USDH, driving up USDH demand --> USDH Treasury yields further support HYPE repurchase --> Increased HYPE price --> Increased real value of raising the HIP-3 staking threshold --> Attracting more powerful builders to deploy new markets.

The cycle continues, but only if Hyperliquid's trading volume continues to grow, and given the current highly competitive crypto market environment and prediction landscape.

The settlement of the Outcome contract relies on external data sources. Information such as who won the election, the price of BTC at expiration, and whether a certain event occurred must be accurately and immutably fed to the on-chain contract.

Hyperliquid says it will use "objective settlement data sources," but doesn't specify whose oracle it will use or how it will prevent manipulation. In the history of prediction markets, oracle controversies have been the most common trigger for market crashes.

Regulation is also a variable.

In January 2026, a Massachusetts judge issued an injunction against Kalshi, a platform regulated by the CFTC, finding its sports contracts to constitute illegal gambling. Even compliant exchanges cannot escape state-level litigation; decentralized protocols will not remain outside the reach of regulation forever.

There is also a more fundamental question: how large is the demand?

Breaking down the $44 billion, over 90% of Kalshi's volume is in sports betting, while Polymarket's volume is concentrated on mega-events like elections and geopolitical events. Liquidity for daily forecasting demand remains thin. Whether HIP-4 can attract new users or simply add another button for existing traders remains to be seen.

However, Hyperliquid clearly doesn't want to become the next Polymarket; it wants prediction to be a native capability of its existing trading engine, as fundamental and natural as perpetual contracts.

As a Perp DEX begins to evolve, the valuation logic may change.

Author: David