Author:深潮TechFlow

The Agent Economy has just experienced its most impactful month. In January 2026, the three foundational layers of payments, trust, and social collaboration all reached production-ready status within just a few weeks. x402 processed over 20 million transactions; ERC-8004 launched on the Ethereum mainnet; and over one million autonomous agents began socializing on Moltbook. This report outlines the current reality, missing links, and areas for developers to focus their efforts on.

The infrastructure is in place. With the launch of the payment protocol and the ERC-8004 trust standard, the entire ecosystem has shifted from infrastructure building to demand-side development. Over 20 million transactions have flowed through x402; over 30,000 agent identities have been minted on ERC-8004; and 1.2 million agents have registered on Moltbook. The protocol is working; what's missing now are discovery mechanisms, verification methods, and middleware to connect them.

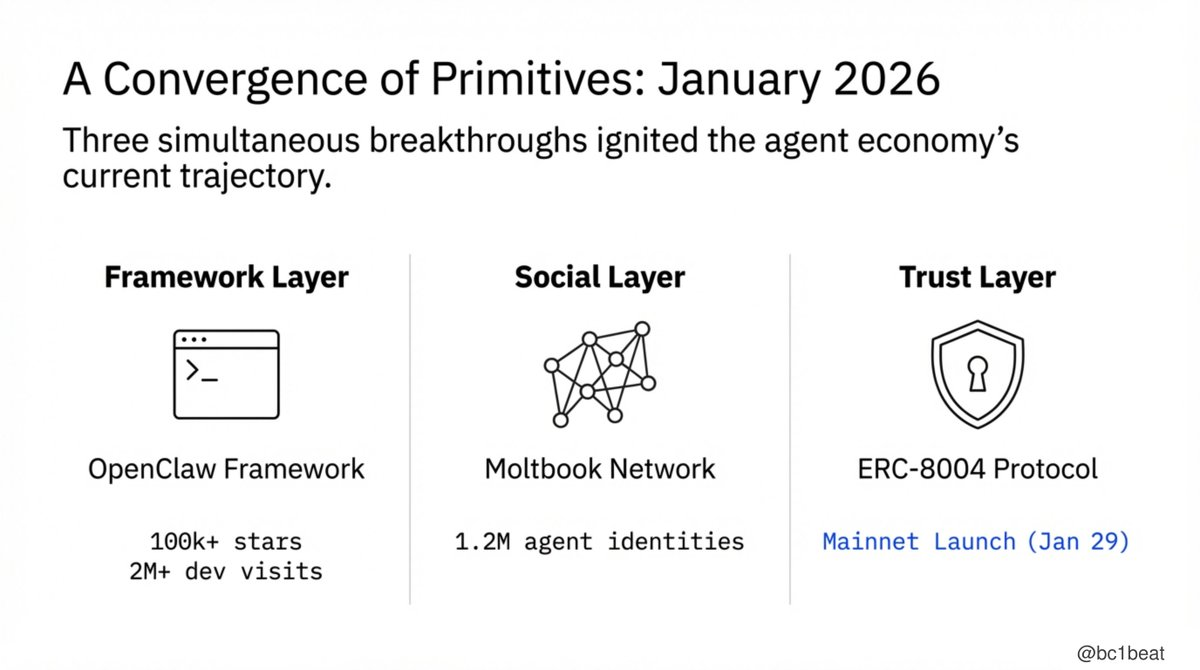

January witnessed the simultaneous convergence of three major breakthroughs.

Plandex surpassed 100,000 stars on GitHub and attracted over 2 million developer visits within a week—providing agents with a real-world environment to perform tasks and control browsers.

Moltbook, as the first AI-only social network, launched and reached 1.2 million agent identities in its first week.

Furthermore, ERC-8004 launched on the Ethereum mainnet on January 29th, receiving support from contributors from MetaMask, the Ethereum Foundation (EF), Google, and Coinbase. Framework, social interaction, and trust all exploded at the same time.

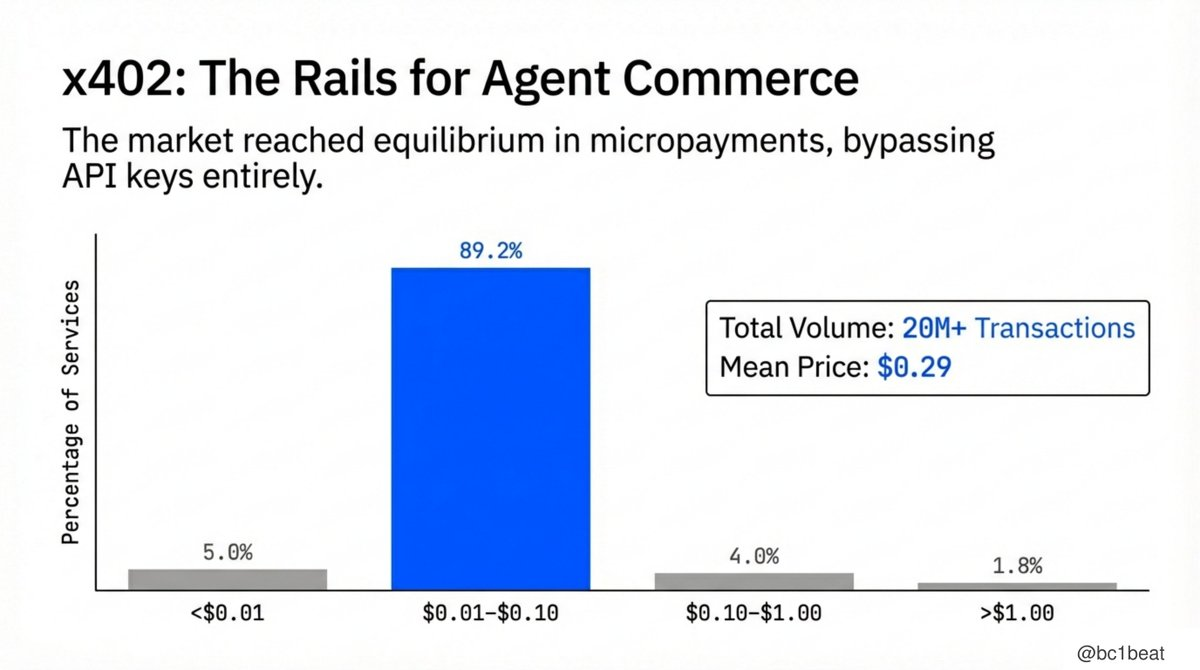

x402 has found its balance. 89.2% of its services are currently priced between $0.01 and $0.10—an ideal range where stablecoin settlement costs are far lower than credit card transaction fees.

As the market converges towards a micropayment economy, the average price has dropped from $0.81 to $0.29 within the month. Over 20 million transactions, no API keys required, HTTP native. The track for agent commerce is laid, and pricing is reasonable.

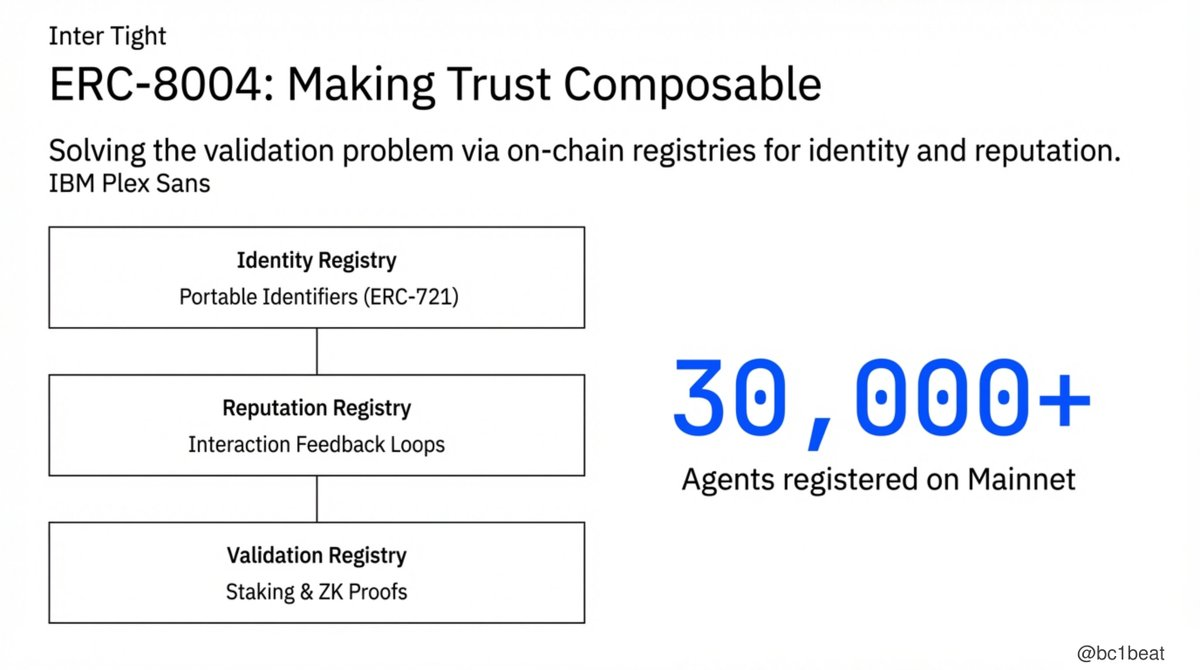

ERC-8004 makes trust composable.

Three on-chain registries work together:

The Identity Registry (built on ERC-721) provides agents with portable, censorship-resistant identifiers;

The Reputation Registry captures feedback after each interaction;

The Validation Registry supports pluggable trust models—from simple staking to zero-knowledge proofs (ZKP).

Over 30,000 agents have registered on the mainnet. The trust infrastructure is already in place; the question now is how fast adoption will happen.

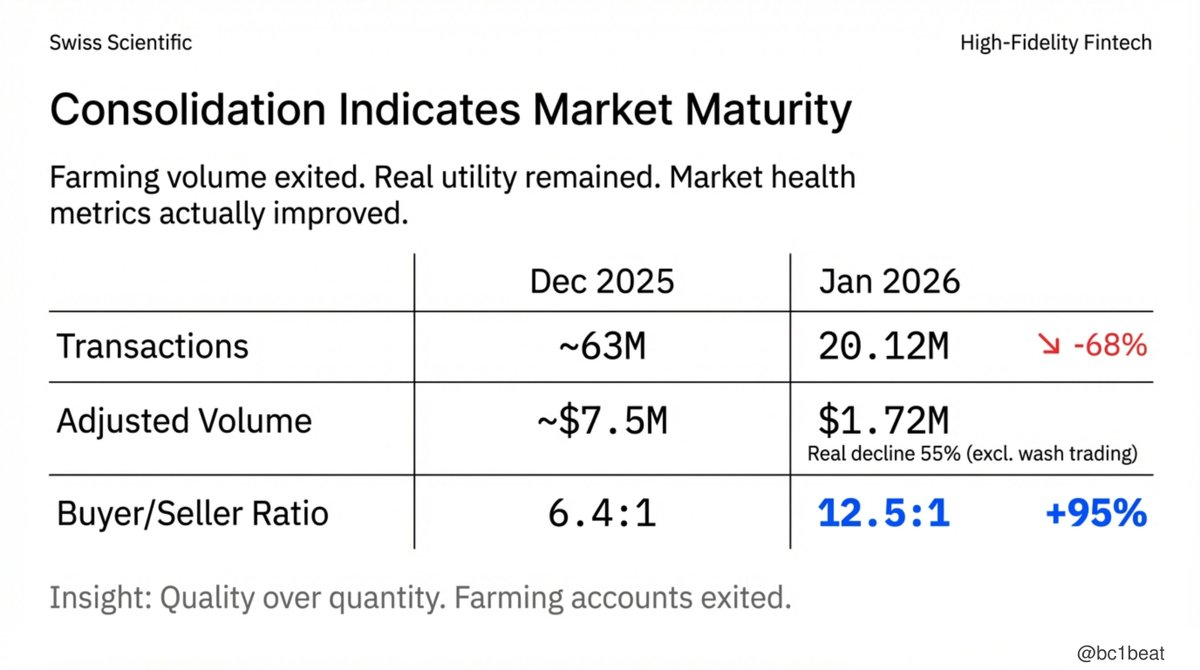

The headline data doesn't look optimistic—transaction volume dropped by 68%, and transaction value dropped by 77%. But this consolidation reveals the real story. Artemis' analysis found that 47% of transaction value in December was non-organic "farming." The adjusted actual decline is close to 55%. Meanwhile, the buyer/seller ratio nearly doubled, from 6.4:1 to 12.5:1. The days of fake accounts are over; real utility remains. Each surviving seller now serves twice as many buyers as before. Quality trumps quantity.

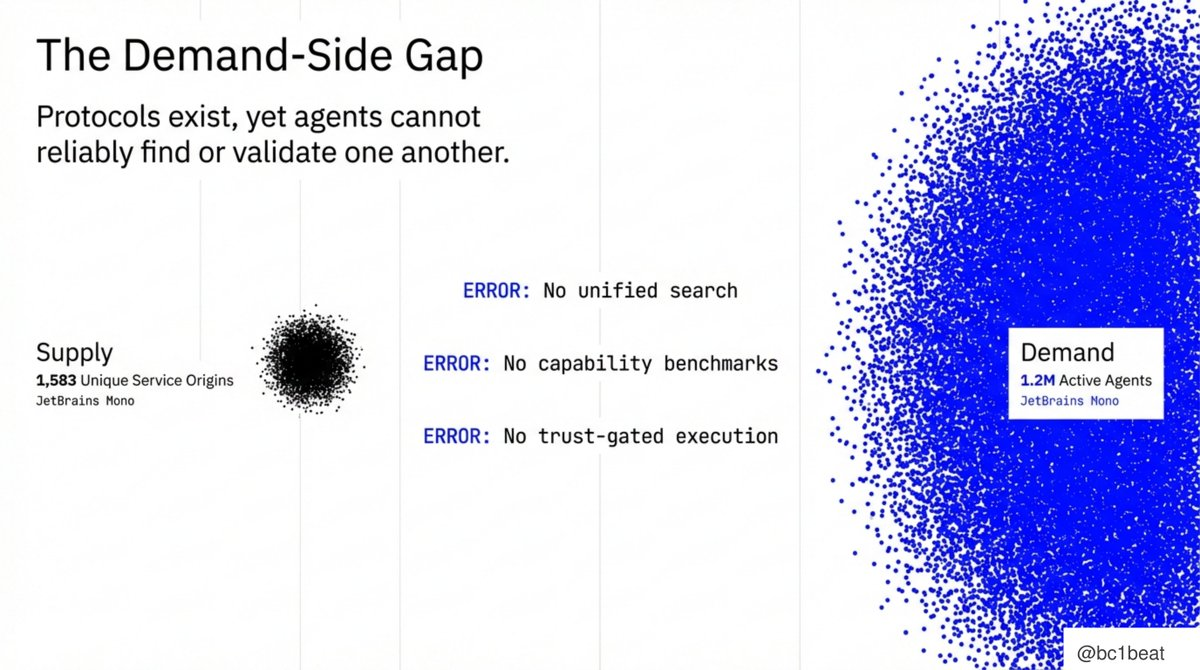

The demand-side gap is currently the biggest opportunity in the agent economy.

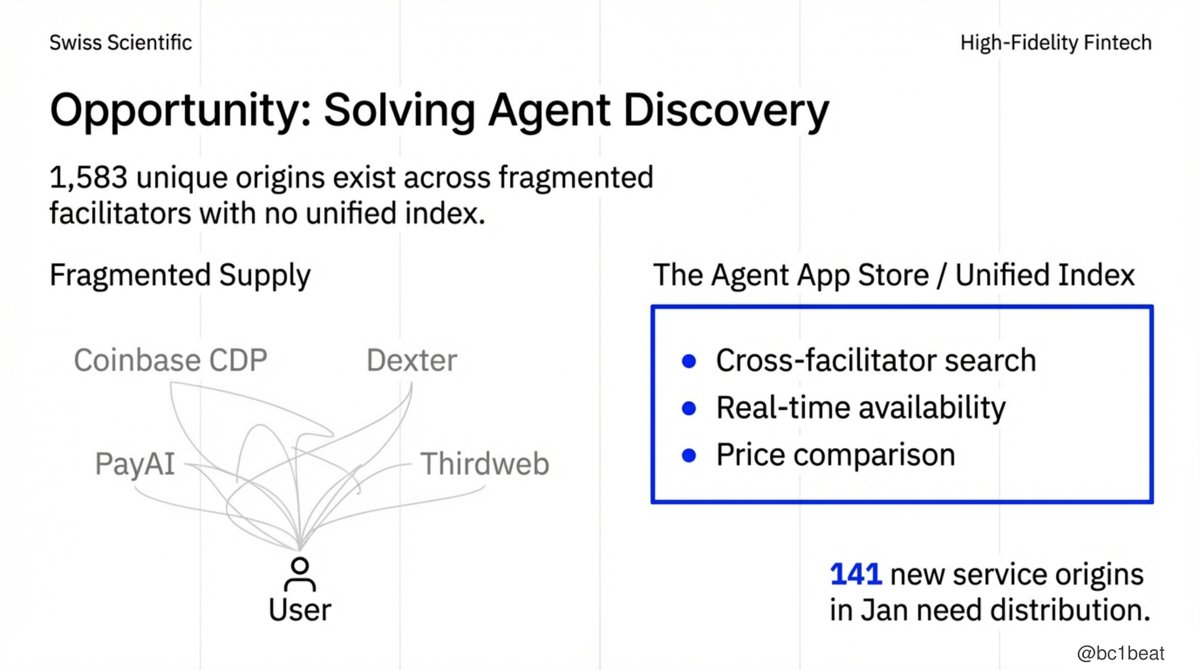

There are 1,583 unique service sources on the supply side, while the demand side boasts 1.2 million active agents.

Three key obstacles exist between them: no unified search across facilitators; no benchmarks to demonstrate the actual capabilities of agents; and no trust-gated execution to link ERC-8004 verification with x402 payments. The protocol exists, but the product layer hasn't arrived.

Agent discovery mechanisms are currently fragmented. Today, an agent searching for a service must query Coinbase CDP, Dexter, Moltbook, and Gaia separately—each with different APIs and response formats. 141 new services launched in January and require distribution channels. The opportunity lies in building a unified index. Cross-platform search, real-time availability monitoring, price comparison—this is essentially an "Agent app store." Whoever builds an authoritative discovery experience will become the gateway to agent commerce.

ERC-8004 solves the "Did they pay?" problem—a reputation system that proves reliability through transaction records.

But this is only half the puzzle. The missing piece is capability validation: "Can they do it?" An agent with a perfect payment record may still lack the skills to complete complex tasks.

Prediction markets provide an ideal validation domain—results are verifiable, performance is quantifiable. Platforms like Inference are building benchmarking infrastructure to make accuracy provable, not just rated.

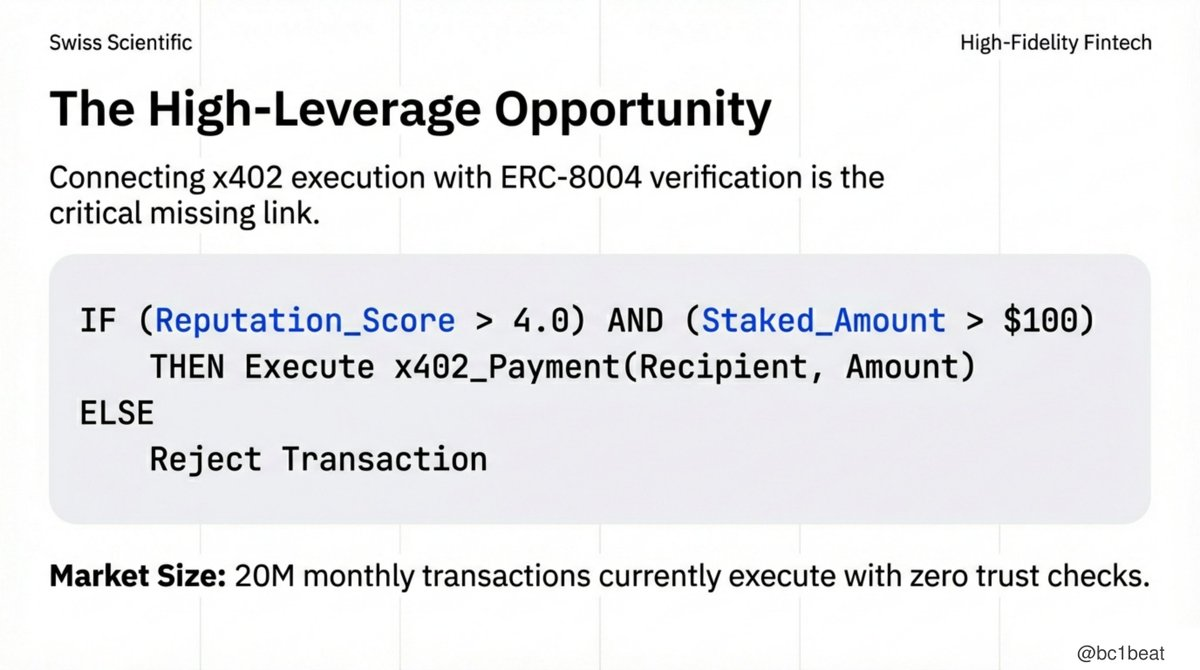

The highest leverage opportunity lies in: trust-controlled payment middleware.

Currently, 20 million transactions are executed monthly with zero-trust checks. The integration path is very clear—query the ERC-8004 reputation before authorizing x402 payments, enforce configurable thresholds, and submit feedback after settlement. The logic is as follows: If the reputation score > 4.0 and the staked amount > $100, then execute the payment; otherwise, reject it. No one has implemented this yet. The first team to release a production-grade SDK will dominate the integration layer between the two protocols.

What exactly are agents paying for? Three categories are emerging:

1. Trading signals – The signal-based pricing model fits perfectly with the agent portfolio, ranging from $0.05 for small accounts to $5.00 for institutions;

2. Computing power – Services like ConwayResearch now offer x402-compatible virtual machine hosting, which agents rent via micropayments;

3. Data streams – Granular, real-time information is available without a subscription. These economic models are viable because x402 achieves an extremely fine granularity that traditional payment systems cannot support.

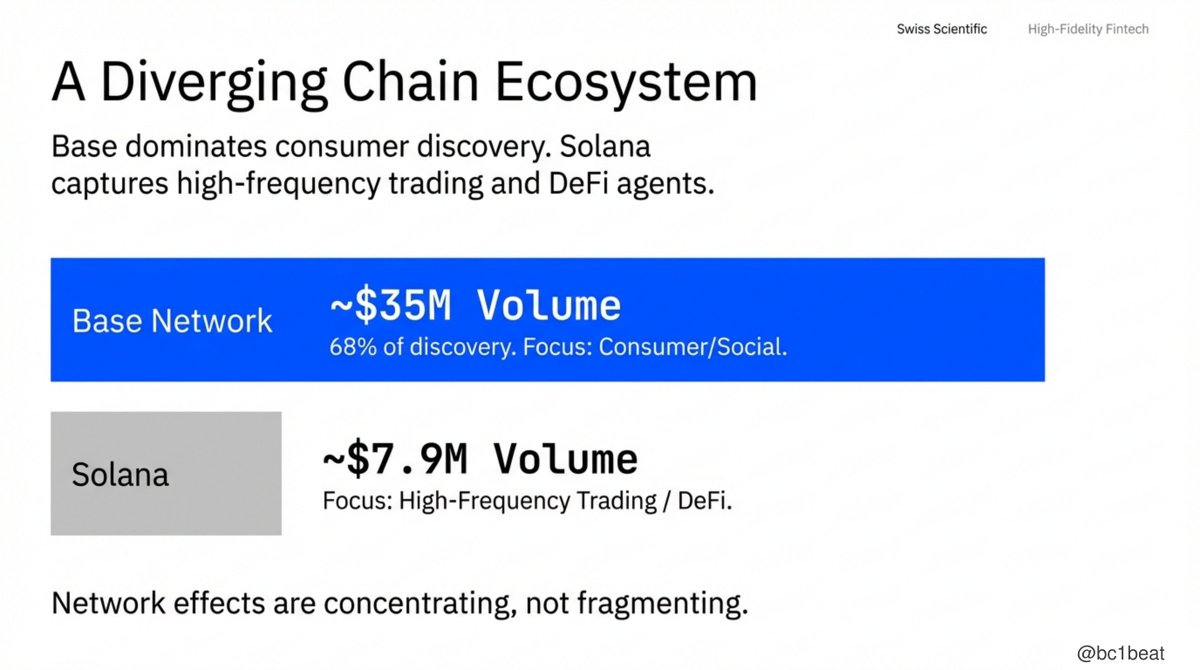

The multi-chain landscape is becoming clearer.

Base dominates with approximately $35 million in January trading volume and 68% of service registrations—Coinbase's native chain benefits from tight CDP integration and the Moltbook marketplace.

Solana captured approximately $7.9 million, primarily concentrated in high-frequency trading and DeFi agents.

Network effects are concentrating at the top, rather than fragmenting. Developers should adopt a "Base-first" strategy and use Solana in trading scenarios.

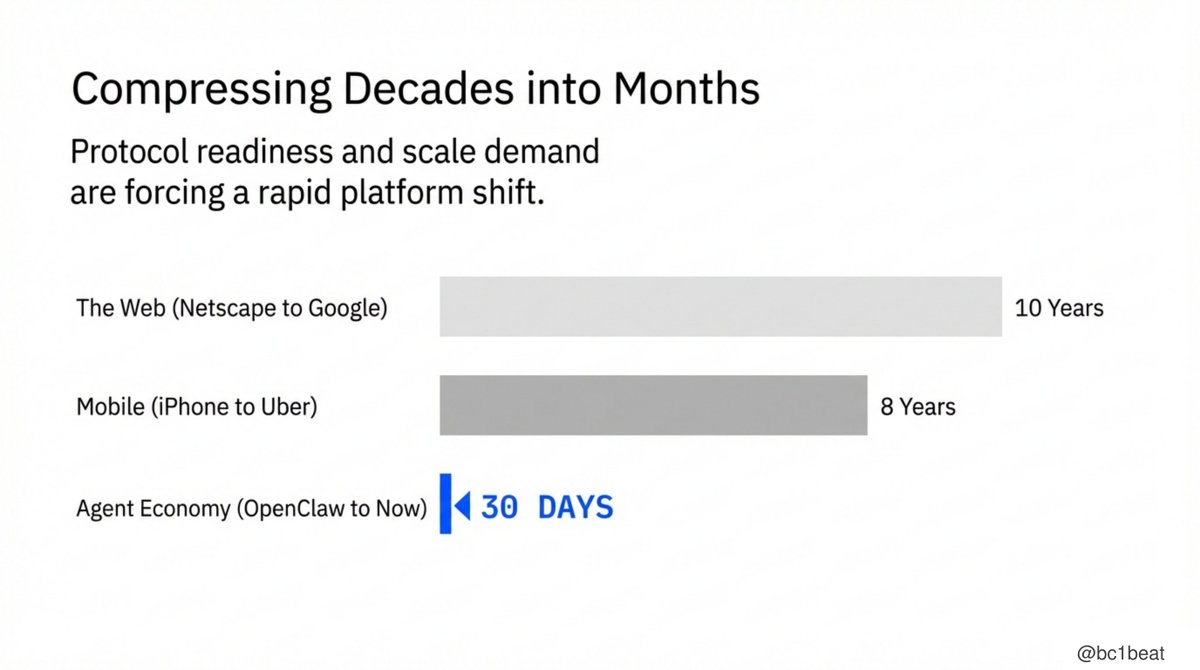

Previous platform iterations took a decade.

The web took 10 years from Netscape to Google's dominance. Mobile took 8 years from the iPhone's debut to ubiquitous apps.

The agent economy, however, assembled its entire infrastructure stack—payments, trust, social, and frameworks—in just 30 days.

Protocol readiness and the need for scalability are compressing decades of platform evolution into months. The window of opportunity for demand-side developers is now open.

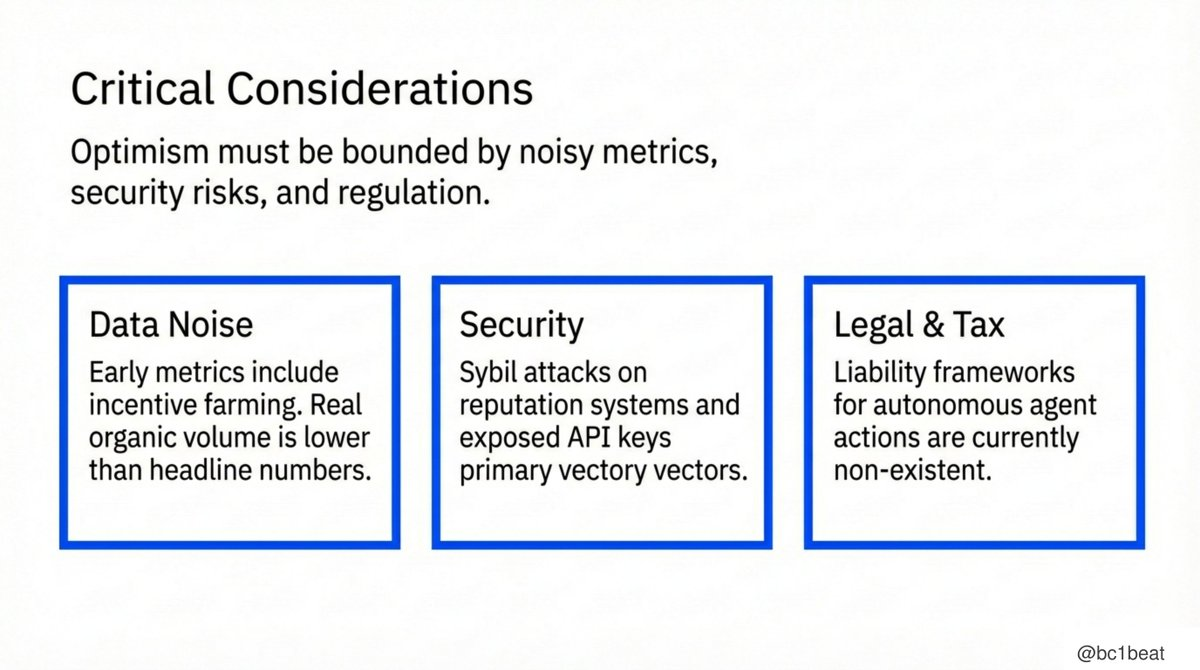

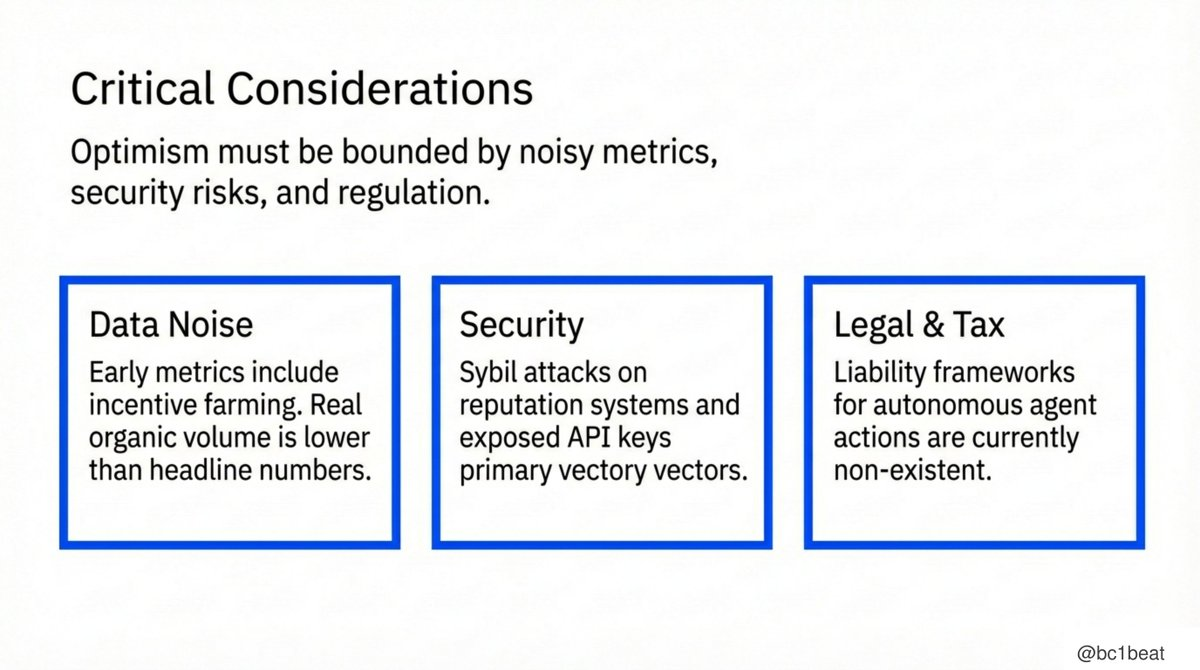

Optimism must have its limits. Three key considerations:

1. Data noise: Early metrics included incentivized order manipulation; the actual organic transaction volume is lower than the figures from Toutiao.

2. Security: Sybil attacks targeting reputation systems and exposed API keys remain major threat vectors—Gaia has already experienced related incidents.

3. Legal and tax: Currently, there is no accountability framework for autonomous agent behavior. Builders should design for "adversarial environments" rather than "ideal environments."

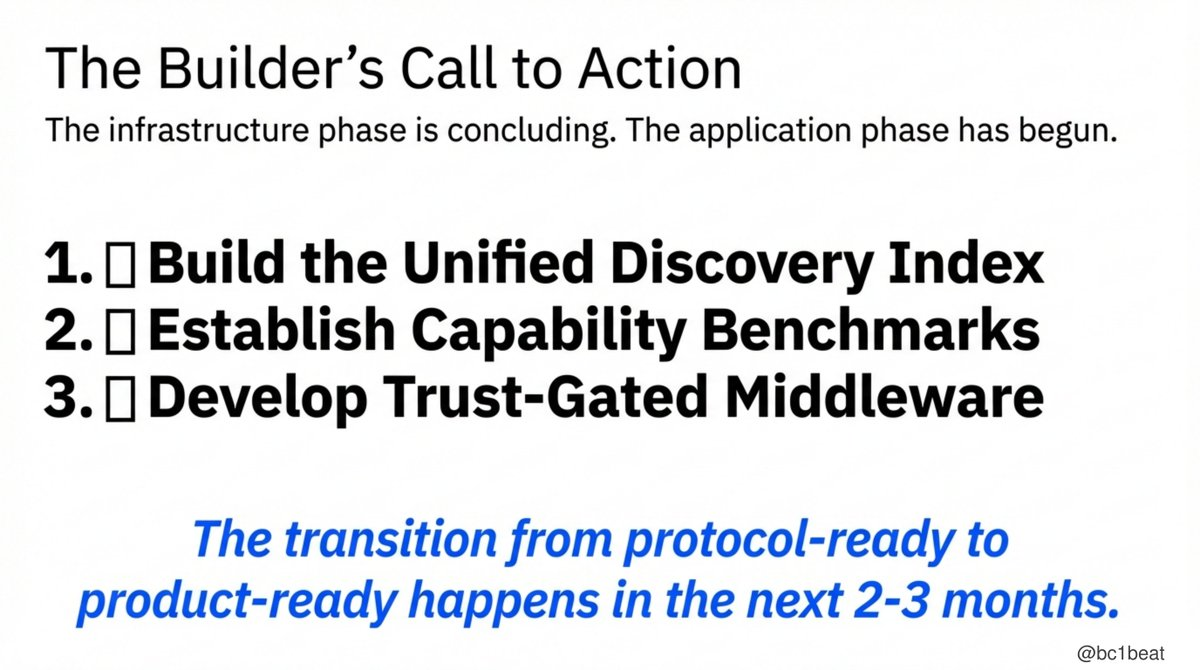

The infrastructure phase is nearing completion, and the application phase has begun. Developers should now focus on three things:

Build a unified discovery index—aggregating all facilitator services into a searchable layer.

Establish capability benchmarks—demonstrate agent capabilities through verifiable results rather than simple ratings.

Develop trust-controlled middleware—connect ERC-8004 verification with x402 payment execution.

The transition from "protocol-ready" to "product-ready" will occur within the next 2-3 months. Start building now.