Author:Web3 Explorer

Strategy (NASDAQ: MSTR) would only face existential risk if Bitcoin (BTC) were to crash to roughly $8,000 and remain there for years, according to comments made by CEO Phong Le during the company’s latest earnings call.

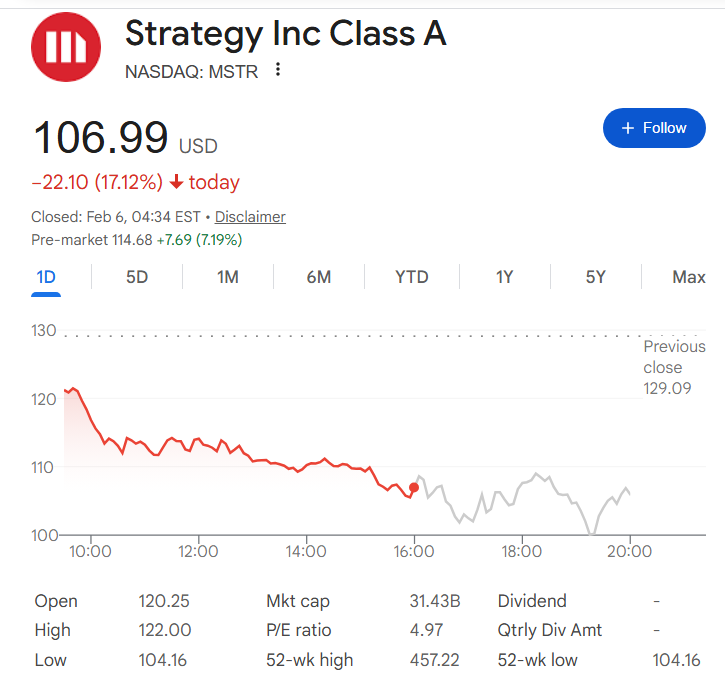

The disclosure comes amid sharp volatility across crypto-linked stocks, after Bitcoin plunged more than 20% in a week and MSTR shares suffered a steep, 17.12% single-day sell-off. Its impact was, however, evident already in the extended session as Strategy stock rallied 7.19% by press time.

Specifically, during the webinar that accompanied the release, the firm’s chief executive said BTC would have to crash another 90% to $8,000 before Strategy’s cryptocurrency reserves value equals its net debt.

Furthermore, he revealed that Bitcoin would have to remain at such a low price for years before Michael Saylor’s company is truly at risk.

Why Strategy remains solvent despite crypto volatility

Phong Le’s remarks were welcomed by investors who were – as evidenced by MSTR stock performance – fearful that the company is at severe risk of collapse due to Bitcoin’s recent plunge.

The company formerly known as MicroStrategy has been regularly purchasing BTC for years, including during the cryptocurrency’s highs in the second half of 2025. Bitcoin’s price more than halved between the peak near $125,000 last October and the February 5, 2026, lows just above $60,000.

MSTR stock is itself, along with the massive one-session Thursday crash, down 31% year-to-date (YTD).

Remittix Wallet Sees Over 100,000 Downloads After Project Gives Back to Investors With 300% Bonus

The revelation that Strategy is likely to be fine as long as the Bitcoin price does not crash to $8,000 is also welcome due to the fact that BTC is extremely unlikely to fall to such lows.

Historically, the world’s premier cryptocurrency has suffered severe retracements on multiple occasions during periods commonly referred to as ‘crypto winters,’ but has tended to stabilize in each new cycle well above the previous cycle’s lows.

For example, after hitting the 2017 highs above $19,000, Bitcoin never fell back into the hundreds of dollars. Similarly, following the climb above $60,000 in 2021 and 2022, BTC retraced to a range close to $15,000.

After the latest bull market, the world’s premier cryptocurrency is expected by multiple experts, including the on-chain analyst Ali Martinez, to find the cycle bottom no lower than $38,000.

Featured image via Shutterstock