Author:BlockBeats

Original title: "The day CZ missed the best investment of his life, Crypto missed AI."

Original author: Azuma, Odaily Planet Daily

In 2014, CZ, who had only been exposed to the concept of cryptocurrency for a year, made the most bold investment of his life—He sold his apartment in Shanghai and went all in on approximately 1500 BTC for a three-figure sum.Twelve years have passed, and if CZ had never sold, this investment would have yielded a substantial profit of over $100 million (peak return of approximately $189 million).

Compared to the subsequent success of founding Binance and its rise to industry leadership, the returns from this investment are insignificant to CZ. However, from an external perspective, this highly idealistic "all-or-nothing" gamble remains one of CZ's most celebrated moves.

But sadly,Even CZ, known for his firm beliefs and decisive actions, once dramatically missed out on an investment with a potential profit a hundred times greater than "selling a house to buy cryptocurrency.".

Rewinding the clock 1555 days: The feinted acquisition

November 9, 2022, was a sleepless night for the cryptocurrency industry.

Just the day before, the once-glorious figure in the industry...FTX has suspended withdrawals due to a liquidity crisis.Community panic escalated rapidly, and the musty smell of impending doom began to permeate the market... As we all know, FTX collapsed, triggering a chain reaction of collapses that plunged the market into a long, multi-year winter.

In a parallel universe, the story could have taken a different turn. In the early hours of November 9th, SBF and CZ issued statements indicating that FTX had reached a preliminary acquisition agreement with Binance.

SBFHi everyone: I have some news to announce. Things have come full circle. FTX's first and last investors are the same group of people—we have reached a strategic transaction agreement with Binance (subject to due diligence).

CZThis afternoon, FTX sought our assistance. The trading platform is currently facing a severe liquidity crisis. To protect our users, we have signed a non-binding letter of intent to acquire FTX in its entirety to alleviate the liquidity crisis. We will conduct comprehensive due diligence in the coming days.

However, the acquisition ultimately failed. Just one day later, Binance officially announced...The problem is beyond our control.The reason given was that FTX announced it was abandoning the acquisition, which became the final straw that broke FTX's back.

Did CZ ever genuinely consider acquiring FTX? Was the hastily concluded acquisition saga a deliberate act of assistance, or merely a prying look at its rival's "health bar"? This may forever remain a mystery. In the end, CZ personally crushed its biggest competitor at the time, solidifying Binance's position as the industry leader.

But no one expected this.What was once an inconspicuous "idle piece" in FTX's asset portfolio has appreciated rapidly in just a few years, and its value now far exceeds the total value of the remaining assets from the unfinished acquisition.

What was once a "casual move" has now become the focus of AI.

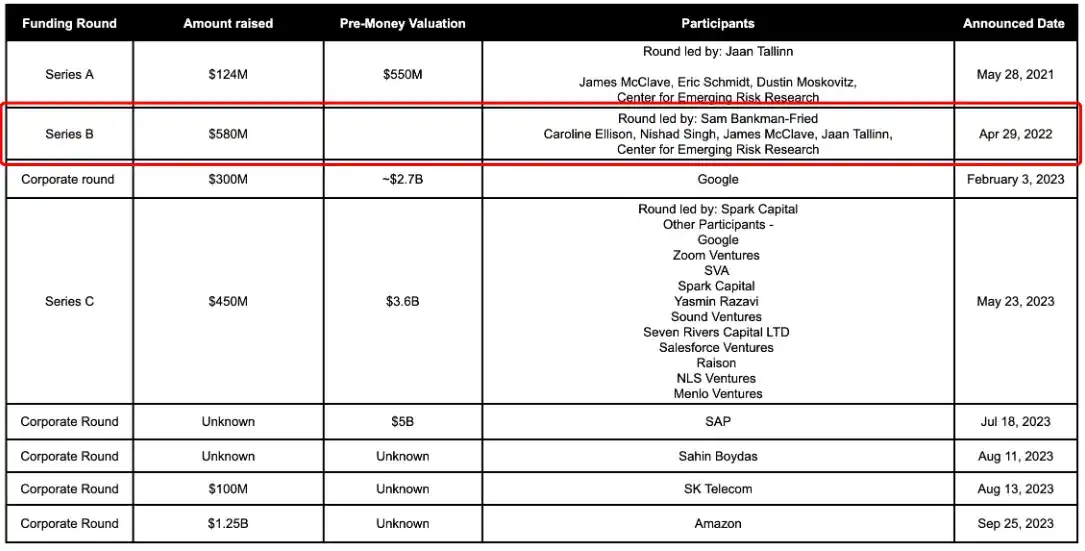

In April 2022 (this is the official announcement date; the transaction was actually completed in 2021), FTX completed its most important investment in the field of AI—They invested $500 million to lead a $580 million funding round for AI startup Anthropic, holding a stake as high as 13.56%, which was later diluted to 7.84% as Anthropic completed several more funding rounds.

That was an era before the imagination of AI had fully blossomed. Just six months later (at the end of November 2022, the same month FTX collapsed), OpenAI's ChatGPT emerged, and the world irreversibly entered the "Age of Exploration" of AI. Anthropic, with its Claude series of products (especially the programming sub-product Claude Code), has repeatedly shocked the world and gradually become one of the most shining star companies in the AI era.

As Claude continues to evolve, Anthropic's valuation continues to rise.Investors are frantically waving their cash, hoping to squeeze onto Anthropic's ship heading towards its IPO. The latest market rumor is...Anthropic is entering the final stages of a new round of large-scale financing, with the funding expected to exceed $20 billion (originally planned for $10 billion, but due to much higher-than-expected investor demand, the final amount is expected to double the expected value), and its valuation may reach as high as $350 billion.The deal could be completed as early as this week..

Based on the latest valuation of $350 billion, FTX's stake in Anthropic was worth approximately $27.44 billion, enough to cover the reserve gaps that led to its bankruptcy several times over... But history has already happened, and the outcome is already set.

It's hard not to admire SBF as a rare venture capital genius (besides Anthropic, he also invested in the now-popular Cursor in its seed round), but he's clearly not a competent business operator, especially lacking in risk control. CZ's profile is completely different. He's a top-notch business operator; Binance's dominance is inseparable from his numerous correct strategic decisions. However, CZ often describes himself as not a traditional investor simply pursuing investment returns, not trading cryptocurrencies, but rather wanting to be a builder of the industry.

A rushed ending: This should have been the best intersection of Crypto and AI.

You might be wondering, what happened to FTX's shares in the end?

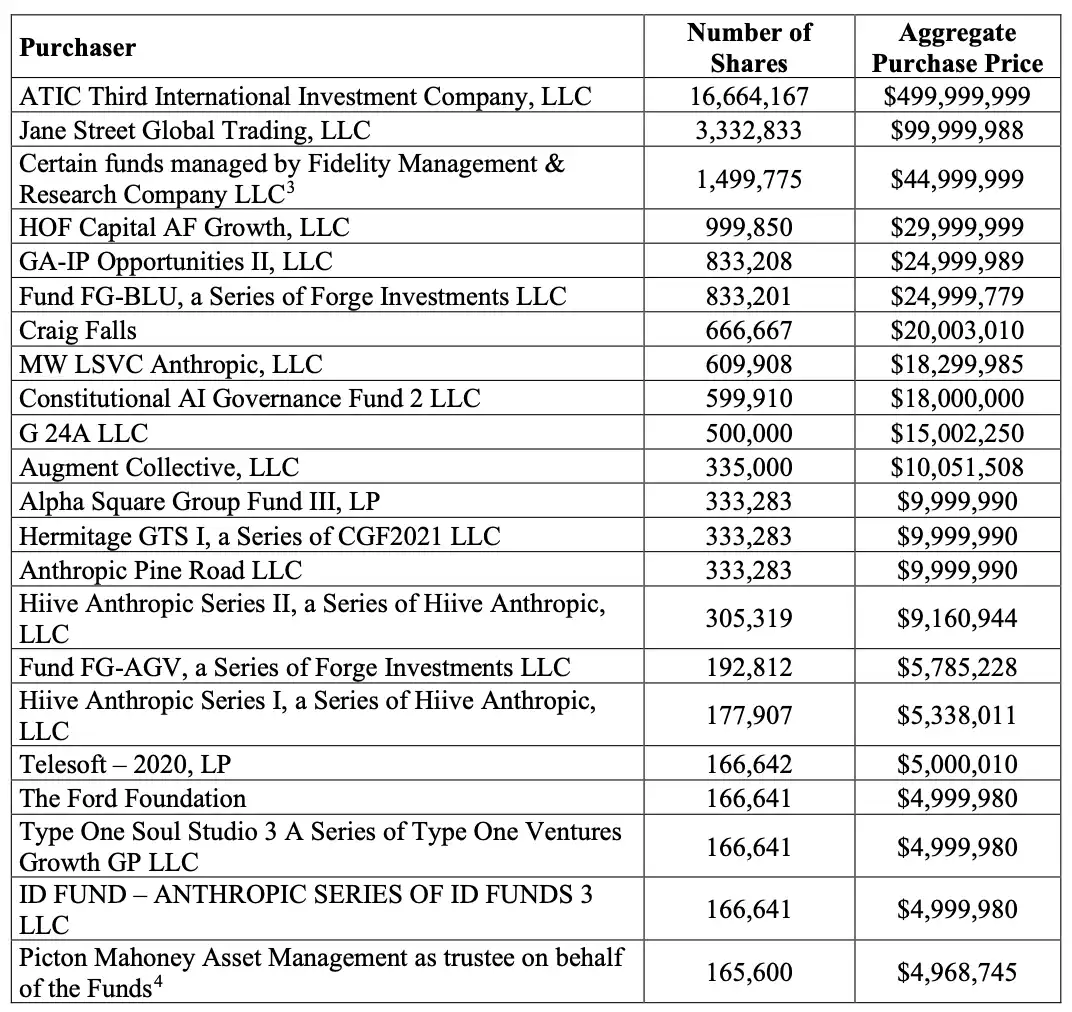

The outcome was not complicated. After FTX's bankruptcy, all assets, including the Anthropic stake, were disposed of by FTX's bankruptcy administration team. In February 2024, the court approved the FTX bankruptcy administration team's right to sell these shares;In March and June of the same year, FTX's bankruptcy administration team sold 29.5 million shares and 15 million shares for a total of $884 million and $450 million respectively, totaling over $1.3 billion.

The buyers of these shares were primarily ATIC Third International Investment from Abu Dhabi, as well as traditional financial institutions from Wall Street such as Jane Street and Fidelity. In other words, no cryptocurrency companies got a share of this pie.

Whether these shares were deliberately sold at a low price or whether there was any transfer of benefits under the guise of bankruptcy liquidation is no longer important to the crypto industry.

This should have been the best intersection of Crypto and AI.On another timeline, regardless of whether these shares are held by SBF or CZ, if leading companies in the crypto world can gain a voice in the development of the most successful companies in the AI world, then more innovative attempts around Crypto + AI may emerge, leading to unexpected results.

CZ wasn't the only one who broke his own thigh in frustration.