Author:Wall Street CN

Zijin Mining has significantly raised its future gold production target.With gold prices remaining high, the plan is to increase gold production from mines to 130 to 140 tons within three years.The target has been raised by nearly 30% compared to the previous plan.This adjustment underscores the company's confidence in the market outlook and its strategic intent to accelerate the release of gold production capacity.

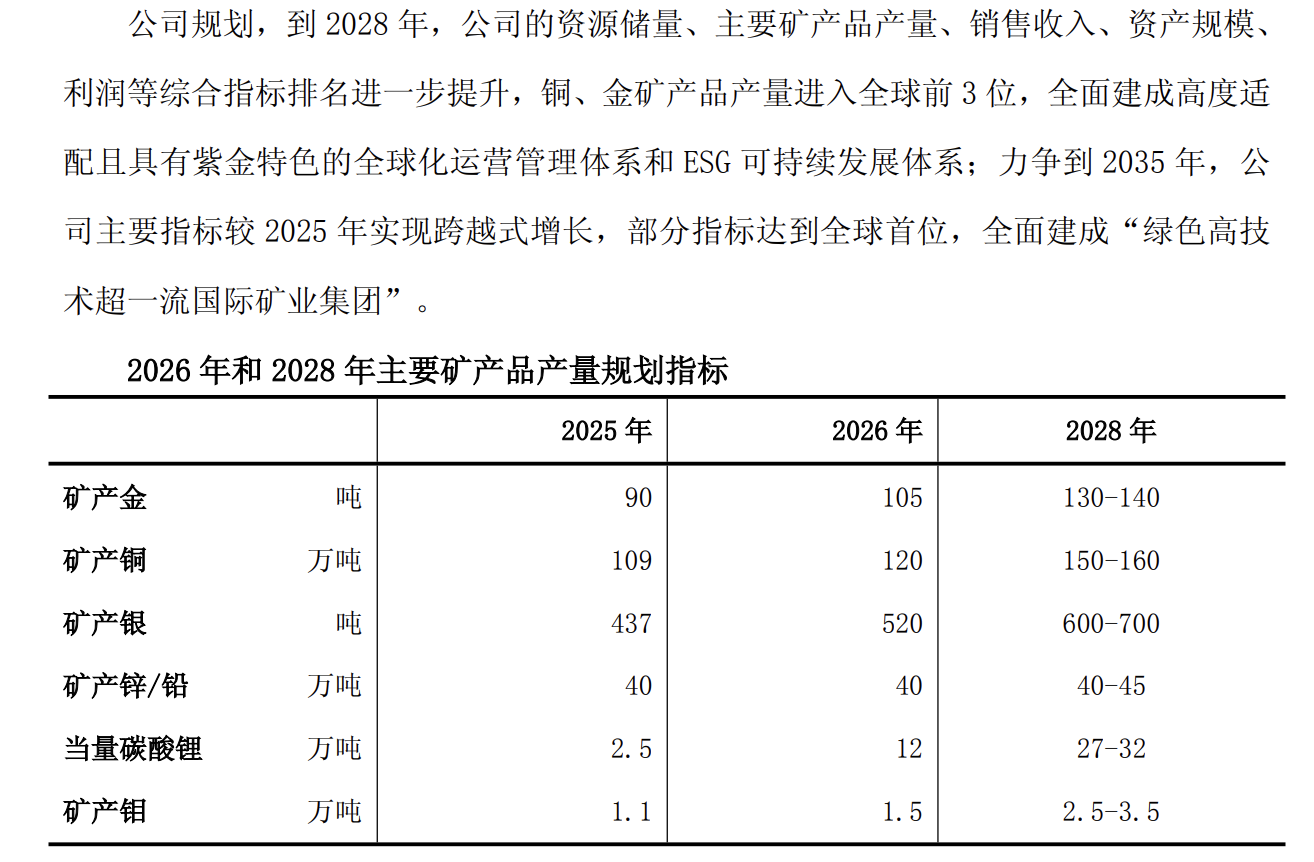

According to an announcement released by Zijin Mining on February 9, the board of directors approved a three-year (2026-2028) production plan for major mineral products, raising the 2028 gold production target from the previously set 100-110 tons in 2024 to 130-140 tons. Meanwhile,The production targets for mined copper and mined silver remain unchanged at 1.5 to 1.6 million tons and 6 to 7 million tons, respectively.

The upward revision of the production target is based on the company's rapid growth in performance. According to preliminary calculations,Zijin Mining's operating revenue in 2025 is approximately RMB 345 billion, an increase of approximately 28% compared to 2022; total profit is approximately RMB 80 billion, an increase of approximately 167%; and net profit attributable to the parent company is approximately RMB 51 billion to RMB 52 billion, an increase of approximately 155% to 160%.

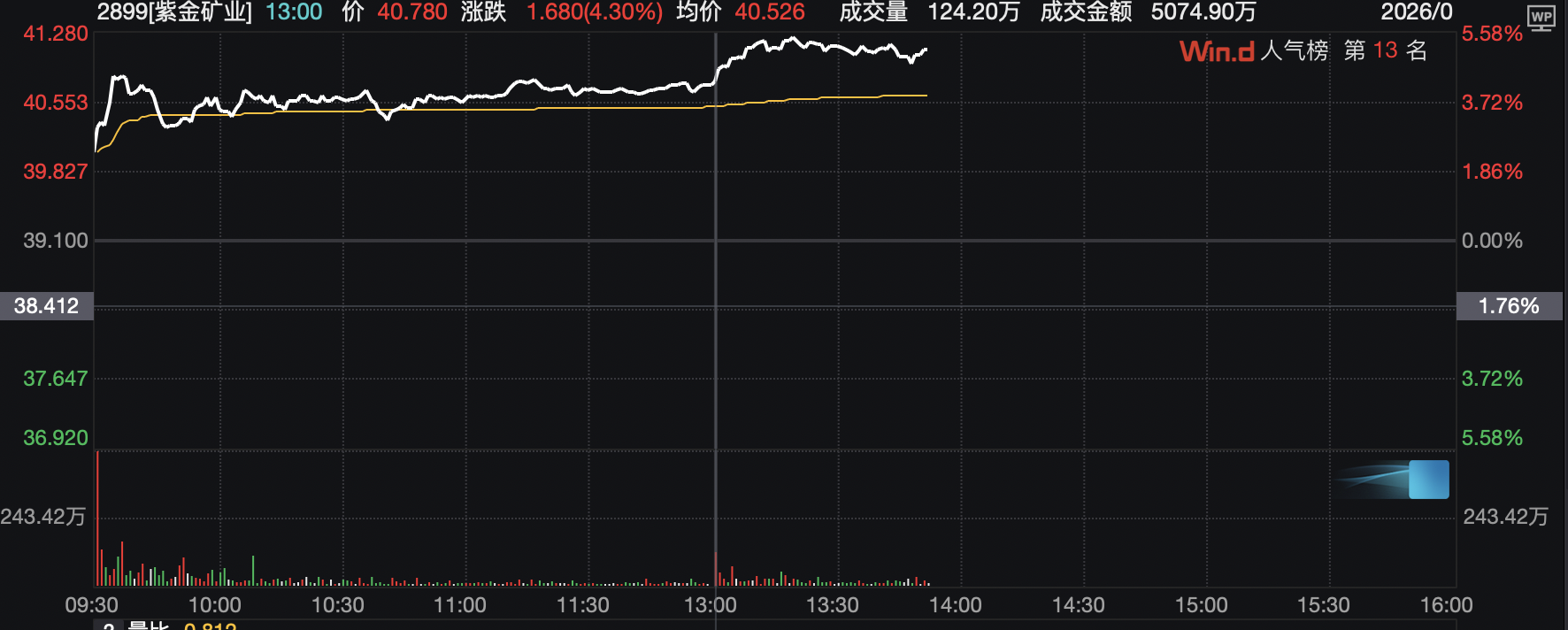

After the news was released,Zijin Mining's share price rose 4.1% to HK$40.72 that day.

In its announcement, the company stated that it will "increase its efforts to acquire strategic mineral resources, with gold and copper as the key minerals to be developed," and will focus on key regions in western China domestically, while paying close attention to countries that share land borders with China and other friendly countries with good markets and legal environments overseas.

Production capacity targets for gold, lithium, and molybdenum have been raised.

Zijin Mining's latest planning adjustments are significant. According to the announcement,The target for gold production in 2026 is 105 tons, a 17% increase from 90 tons in 2025; by 2028, the midpoint of the target range is 135 tons, a 50% increase from the actual production in 2025, and an upward revision of about 29% from the original planned target of 105 tons.

Regarding the copper sector, the production target is 1.2 million tons in 2026 and 1.5 to 1.6 million tons in 2028, consistent with previous plans. The targets for mined silver are 600 to 700 tons in 2028, and for mined zinc/lead, 400,000 to 450,000 tons, both unchanged.

It is worth noting thatThe company has significantly increased its lithium production capacity plan.The target for equivalent lithium carbonate production is 120,000 tons in 2026 and 270,000 to 320,000 tons in 2028, while the actual production in 2025 was only 25,000 tons, indicating that the lithium sector will become an important growth engine.The target for molybdenum production in 2028 has also been raised from the original plan to 25,000 to 35,000 tons.

The company clearly stated in its announcement that by 2028, its copper and gold mining output will rank among the top three in the world; and it strives to achieve the world's number one position in some indicators by 2035, and fully build itself into a "green, high-tech, world-class international mining group".

Strong performance supports expansion

The upward revision of the production target is based on the company's rapid growth in performance. According to preliminary calculations,Zijin Mining's operating revenue in 2025 is approximately RMB 345 billion, an increase of approximately 28% compared to 2022; total profit is approximately RMB 80 billion, an increase of approximately 167%; net profit attributable to the parent company is approximately RMB 51 billion to RMB 52 billion, an increase of approximately 155% to 160%; and net operating cash flow is approximately RMB 73 billion, an increase of approximately 154%.

Regarding resource reserves, as of 2025,The company's consolidated copper resources amounted to 108.84 million tons, a 16% increase compared to 2022; gold resources amounted to 4,537 tons, a 26% increase; and silver resources amounted to 30,993 tons, a 29% increase.The company's copper production is projected to reach 1.09 million tons and gold production to reach 90 tons by 2025, ranking 4th and 5th globally, respectively.

The company's performance in the capital market was equally impressive. In January 2026, its market capitalization peaked at over RMB 1.1 trillion, and the combined market capitalization of the "Zijin Group," comprising its three listed subsidiaries, peaked at over RMB 1.8 trillion. The company ranked 251st on Forbes' 2025 Global 2000 list of the world's largest public companies, 4th among global metals mining companies, and 1st among global gold companies.

In 2025,The company completed two major capital operations: the acquisition of control of Zangge Mining and the spin-off listing of Zijin Gold International, further optimizing the capital landscape of the "Zijin Group".

Focusing on the three major sectors of gold, copper and lithium

To achieve its production targets, Zijin Mining has formulated a detailed capacity release plan. In the gold sector, the company will rely on Zijin Gold International to maintain stable and high production at mature projects such as the Porgera gold mine in Papua New Guinea, the Norton Gold Fields in Australia, the Buritica gold mine in Colombia, and the Aurora gold mine in Guyana. It will also accelerate capacity release at projects such as the Rosbel gold mine in Suriname, the Akim gold mine in Ghana, and the Rigodo gold mine in Kazakhstan, while simultaneously speeding up the completion and commissioning of gold mines in the Shandong sea area.

In the copper sector, the company will accelerate the release of production capacity from its three major copper mines: promote the early production of Phase II of the Julong Copper Mine in Tibet, and put the Juno Copper Mine and Xietongmen Copper-Gold Mine into operation; accelerate the resumption of production in the Kakula section of the Kamoa-Kakula Copper Mine in the Democratic Republic of Congo and the production of Phase III; and promote the development of the lower ore belt of the Chukalu-Pegi Copper-Gold Mine in Serbia and the JM Copper Mine and Mag Copper-Gold Mine projects.

The lithium sector is seen as a new and important growth engine.The company will accelerate the production ramp-up of the 3Q Salt Lake in Argentina, the Lagoco Salt Lake in Tibet, and the first phase of the Xiangyuan Lithium Mine in Hunan, and expedite the completion and commissioning of the Manono Lithium Mine in the Democratic Republic of Congo, propelling the company to become one of the world's largest lithium producers. Simultaneously, it will deeply empower Zangge Mining, accelerating the release of its lithium resource potential.