Author:Currency Explorer

AI Podcast: A New Way to Listen to the News Download MP3

Audio is generated from button space.

Given the continued strong outlook for U.S. economic growth, JPMorgan strategists recommend selling 2-year U.S. Treasuries as a "tactical" trade.Strategists believe that once Kevin Warsh is approved and appointed as chairman, it will be difficult for him to get the Federal Open Market Committee (FOMC) to fully comply with his wishes.

JPMorgan Chase expects the U.S. core Consumer Price Index (CPI) to rise by a "firm" 0.39% in January, influenced by early-year price pressures and the fading effects of the federal government shutdown. The bank's strategists point out that the economic fundamentals remain solid.This will make it difficult for the Federal Reserve to take aggressive interest rate cuts.

“The underlying support for the economy is very strong,” wrote strategists led by Jay Barry in a report. “Once Warsh is appointed and assumes the chairmanship, he will face the challenge of guiding the committee members toward their policy objectives.”

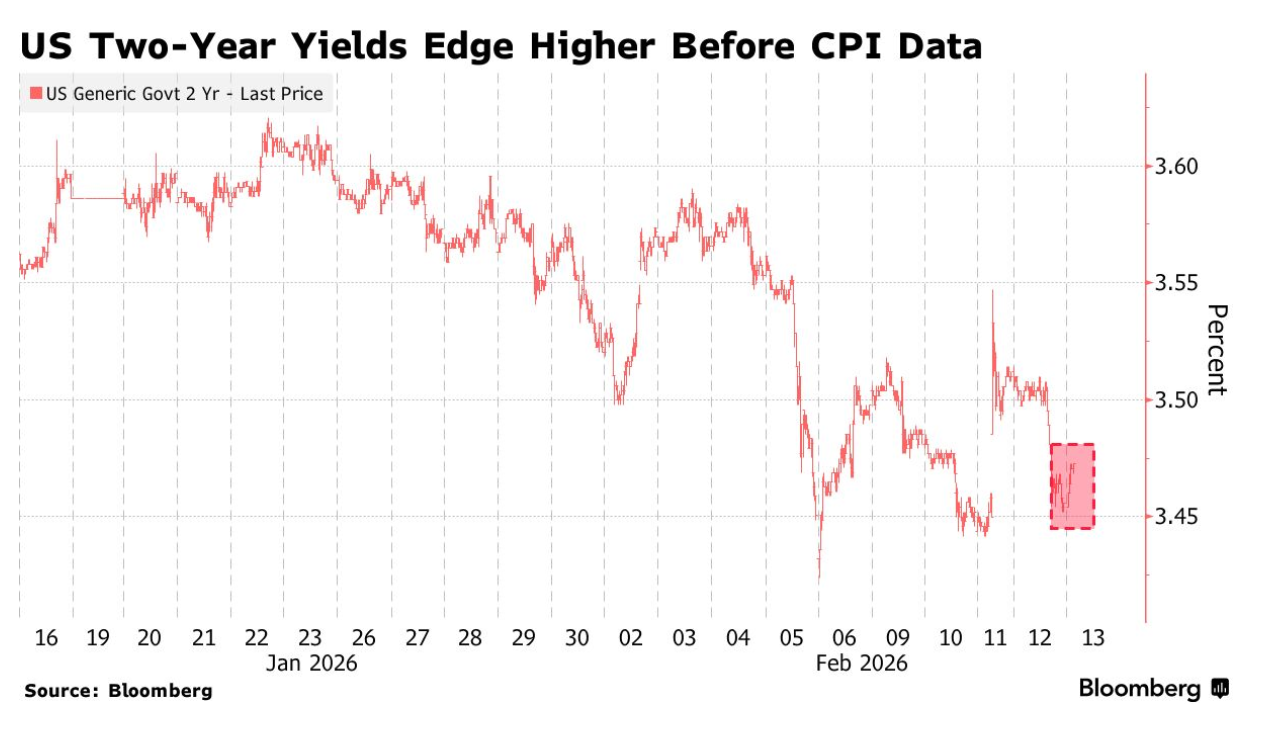

This Wall Street giant's views were released ahead of Friday's key U.S. inflation report, which could provide new clues about the Federal Reserve's next move. Any signs of easing inflationary pressures typically stimulate demand for policy-sensitive short-term Treasury bonds. U.S. Treasury yields fluctuated sharply this week, primarily driven by a sell-off in tech stocks and strong U.S. jobs data. These factors have also sparked discussions about how Warsh, Trump's nominee for the next Federal Reserve chairman, will handle policy.

Traders currently expect the Federal Reserve to cut interest rates by 25 basis points in July and then cut rates again before the end of the year.The market had almost fully priced in a June rate cut ahead of the better-than-expected jobs data released earlier this week. In Asian trading on Friday, the 2-year U.S. Treasury yield rose slightly by 2 basis points to 3.47%, after falling by about 5 basis points in the previous session.

However, some investors hold a different opinion.Hedge fund manager David Einhorn is betting that the Federal Reserve, under Warsh's leadership, will cut interest rates "significantly more" than current market expectations.The co-founder of Greenlight Capital said he has bought secured overnight funding rate (SOFR) futures, anticipating a rise in the rate if the Federal Reserve more aggressively lowers borrowing costs.

JPMorgan Chase believes that due to price adjustments at the beginning of the year, the core CPI, excluding food and energy, will rise by 0.39% month-on-month in January. In contrast, Bloomberg Economics research and market consensus forecasts are both 0.31%.

JPMorgan strategists concluded in their report: "We believe that..."Front-end interest rates are unlikely to decline significantly from current levels..