Author:Big Fish

Sharding: Reinventing Blockchain Throughput

XBIT's dynamic sharding architecture divides the network into parallel processing chains. Each shard handles transactions independently while maintaining consistency through a main chain. The system supports runtime scaling, automatically adding shards during peak loads. Benchmarks show single-shard capacity at 650 TPS, with 32 shards achieving 10,400+ TPS network-wide - 200x Uniswap V3's capability.

Cross-shard transactions leverage an atomic commit protocol with 99.999% success rate. Optimized Merkle trees enable inter-shard verification under 100ms, solving traditional sharding latency issues.

Zero-Knowledge Proofs: Optimizing Security & Efficiency

XBIT innovatively applies zk-SNARKs for batch verification. The system generates a ZK proof for 500 transactions every 500ms, with verification completing in 50ms. This approach boosts efficiency 1000x while reducing node hardware requirements by 90%.

ZK proofs also enhance privacy by encrypting transaction details while revealing only necessary data to validators. XBIT's zk circuits received CertiK's highest security rating in Q3 2024 audits with zero vulnerabilities found.

Intelligent Routing: Dynamic Network Optimization

XBIT's load-balancing system continuously monitors network states, updating shard metrics every 10s. The algorithm distributes transactions optimally based on queue depth, gas prices, and latency, maintaining ±5% load balance across shards.

A multi-layer circuit-breaker activates backup nodes during traffic spikes. During recent NFT minting events, the system withstood 20,000 TPS while keeping fees at $0.001.

Performance Benchmarks: Setting New Standards

XBIT outperforms major DEXs: 0.8s confirmation time vs Uniswap's 45s and Solana DEXs' 2.3s. It maintains $0.001 gas fees even when Ethereum reaches $50+. With 10,000+ TPS capacity, XBIT supports institutional-grade trading strategies previously exclusive to CEXs.

Developer Ecosystem & Roadmap

XBIT provides comprehensive SDKs featuring shard-aware smart contract templates, ZK proof generators, and load prediction APIs. Over 30 DeFi projects including major derivatives protocols have migrated.

Upcoming upgrades include instant inter-shard communication (Q4 2024) and elastic sharding (2025) for millisecond-level scaling. These innovations will solidify XBIT's leadership in high-performance DEX technology.

A New Era for DEX Performance

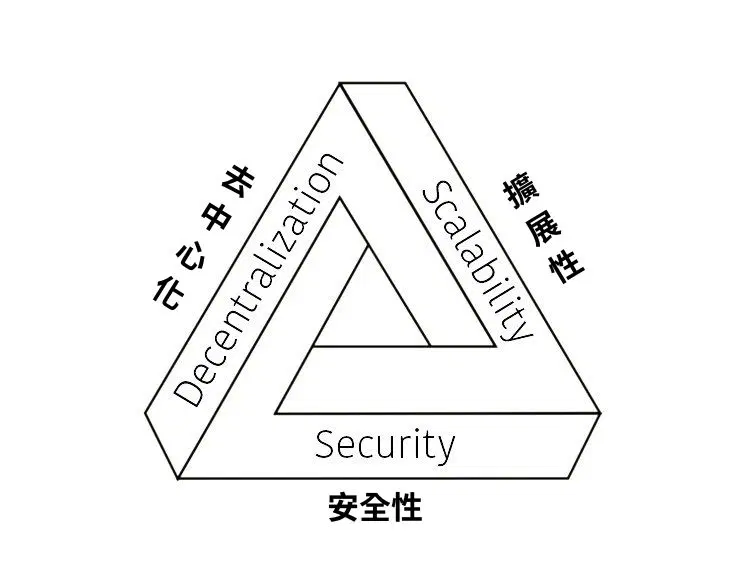

By combining sharding, ZK proofs, and intelligent routing, XBIT delivers CEX-like performance while preserving decentralization. This breakthrough not only solves congestion and high fees but also enables complex on-chain applications. As development continues, XBIT is positioned to become foundational infrastructure for Web3 finance.