Author:Big Fish

In the wave of the cryptocurrency market, the recent performance of Ethereum ETF has been a real whirlwind. According to the latest news from Coin World Net, the capital - attracting ability of Ethereum ETF has broken records, which has undoubtedly caught the attention of many Bitcoin investment enthusiasts and novices. As the market heat continues to rise, how to double the staking returns in this boom has become the focus of everyone's attention. And the activation of the physical redemption mechanism in BlackRock's staking - type ETF proposal has brought new variables and opportunities to the market.

BlackRock's Staking - Type ETF Proposal: Activation of Physical Redemption Mechanism

BlackRock, as a globally renowned asset management company, its every move is highly concerned by the market. In the staking - type ETF proposal put forward this time, the activation of the physical redemption mechanism has become the biggest highlight. In essence, the physical redemption mechanism allows investors to exchange their ETF shares for actual Ethereum, which increases the liquidity and flexibility of assets for investors.

In terms of annualized returns, the activation of this mechanism is expected to bring significant enhancement. On the one hand, investors can obtain Ethereum through physical redemption and then sell it when the market price is right to achieve additional returns. On the other hand, the physical redemption mechanism will also prompt the price of the ETF to be closer to its net asset value, reducing the discount and premium phenomenon, thereby increasing the actual returns of investors.

However, this mechanism is not without risks. From a compliance perspective, the physical redemption mechanism may trigger a series of regulatory issues. Since the trading and holding of Ethereum involve certain legal risks, regulatory authorities may conduct strict reviews of this mechanism. In addition, physical redemption may also lead to an increase in the supply of Ethereum in the market, which may put some pressure on the price.

Analysis of Annualized Return Enhancement Strategies

Seize Market Opportunities

For investors, seizing market opportunities is the key to enhancing annualized returns. After the activation of the physical redemption mechanism, investors can pay attention to the price trend of Ethereum. When the market price is higher than the net asset value of the ETF, they can choose to redeem the ETF shares and sell the Ethereum to obtain the price difference. At the same time, investors can also adjust their investment portfolios reasonably according to the overall market trend to improve the stability of returns.

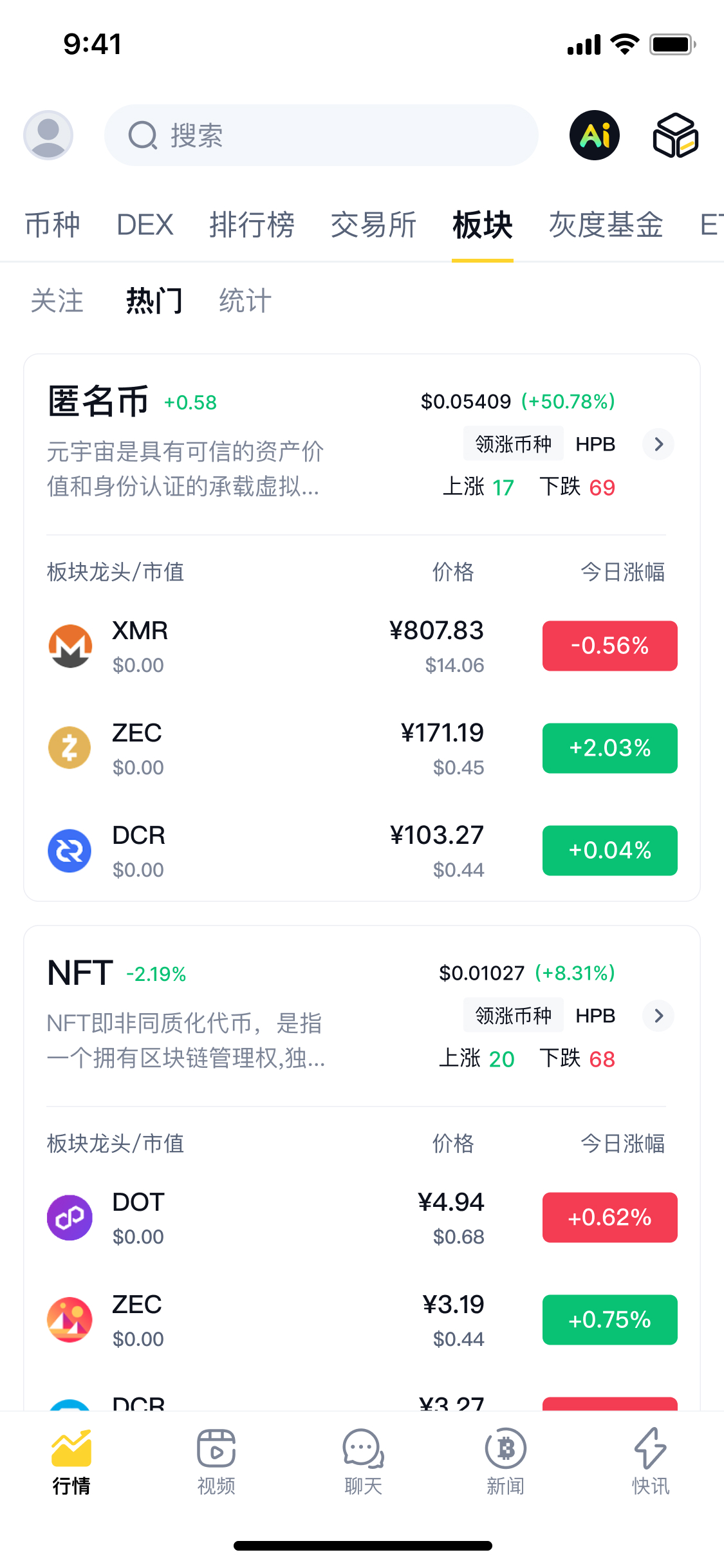

Diversify Investments

Diversification is an important strategy to reduce risks and increase returns. Investors can diversify their funds into different Ethereum - related investment products, such as Ethereum ETFs and staking projects. This can avoid losses caused by the fluctuations of a single investment product and also achieve an overall increase in returns through the complementary returns of different products.

Use Leverage

On the premise of controllable risks, investors can appropriately use leverage to increase investment returns. By borrowing funds for investment, investors can get higher returns when the market rises. However, leveraged investment also comes with higher risks, and investors need to operate carefully and control the leverage ratio reasonably.

Comparison between Coinbase Custody Solution and Retail Staking Threshold

Coinbase Custody Solution

Coinbase, as a globally well - known cryptocurrency trading platform, its custody solution has high security and reliability. Investors who deposit their Ethereum with Coinbase for custody can obtain certain staking returns. Coinbase will conduct strict security management of investors' assets, using technologies such as multi - signature and cold storage to ensure the security of assets.

However, the Coinbase custody solution also has certain limitations. On the one hand, the custody fee is relatively high, which will reduce the actual returns of investors to a certain extent. On the other hand, Coinbase has a certain degree of control over investors' assets, and investors may be restricted in the use and redemption of their assets.

Retail Staking Threshold

Retail staking refers to ordinary investors directly participating in Ethereum staking activities. Compared with the Coinbase custody solution, the threshold for retail staking is relatively low. Investors only need to own a certain amount of Ethereum and have basic technical knowledge and operation ability to participate in staking.

However, retail staking also faces some challenges. First of all, the staking process is relatively complex and requires investors to have certain technical knowledge and operation experience. Secondly, due to the relatively small capital scale of retail investors, they may not be able to obtain high staking returns. In addition, retail staking also faces certain security risks, such as the loss of private keys and network attacks.

Low Gas Fee Operation Schedule

In the Ethereum network, Gas fees are an important factor affecting transaction costs. To reduce operation costs, investors can choose to operate during periods with low Gas fees. According to the statistical analysis of Coin World Net, the following are some low - Gas - fee operation schedules:

Early Morning Hours

The early morning hours are usually the periods when the usage of the Ethereum network is relatively low, and the Gas fees are relatively low at this time. Investors can choose to conduct staking, redemption and other operations between 2 am and 5 am to reduce costs.

Non - Peak Trading Hours on Weekdays

During non - peak trading hours on weekdays, such as from 10 am to 12 pm and from 3 pm to 5 pm, the usage of the Ethereum network is relatively low, and the Gas fees will also be correspondingly reduced. Investors can operate during these periods to increase returns.

In conclusion, the fact that Ethereum ETF has broken the record in attracting capital brings new opportunities and challenges to investors. By in - depth analyzing BlackRock's staking - type ETF proposal, annualized return enhancement strategies, Coinbase custody solution and retail staking threshold, and reasonably using the low - Gas - fee operation schedule, investors are expected to double their staking returns in this boom. However, investors also need to pay attention to market risks and compliance issues and invest carefully.