Author:Encryption Tracker

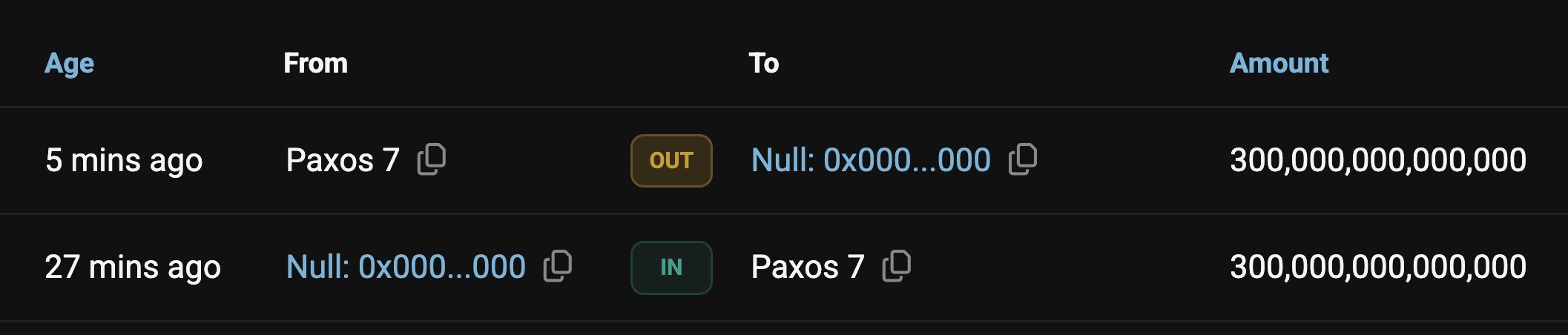

Stablecoin issuer Paxos accidentally minted an astonishing 300 trillion PayPal USD (PYUSD) tokens on Wednesday after a technical error disrupted its minting system.

The incident occurred at 3:12 p.m. ET, and the company resolved it immediately, according to its official update.

Paxos Responds to Technical Issue

In a post on X (formerly Twitter), Paxos confirmed that the error had been identified and addressed. Specifically, the company stated that it has “resolved the root cause” and that the system has returned to its normal state.

A Brief Moment of Impossible Wealth

Remarkably, the unintentional minting of 300 trillion PYUSD, equivalent to $300 trillion due to its 1:1 peg to the U.S. dollar, temporarily created more value than the U.S. national debt ($37 trillion) and even the global GDP (about $117 trillion) combined.

Although Paxos quickly destroyed the tokens, the brief existence of such an enormous supply attracted attention across the cryptocurrency community.

DeFi Market Impact and Recovery

The incident caused a short-term disturbance in decentralized finance (DeFi) markets. Lending protocol Aave reacted by freezing PYUSD markets as a precautionary step. The token’s price briefly slipped from its $1 peg but quickly stabilized after the burn.

Following the fix, Paxos resumed normal operations and minted 300 million PYUSD as part of its regular issuance cycle.

Current Standing of PYUSD

Despite the temporary glitch, PYUSD remains one of the leading stablecoins in circulation. According to CoinMarketCap, it currently ranks as the sixth-largest stablecoin globally, holding a market capitalization of around $2.6 billion.

Paxos’ quick response and transparent communication helped maintain confidence among PYUSD users and the broader crypto market.