Author:Wall Street CN

The Hang Seng Index has an 82% probability of rising in the three trading days before the Lunar New Year. However, there is no obvious calendar effect after the holiday, with the probability of rising only between 40% and 60%. The typical window of the Lunar New Year followed by the Two Sessions is not naturally suitable for Hong Kong stocks.But this time might be different. The pricing logic of Hong Kong stocks has been changing in recent years. The correlation between Hong Kong stocks and A-shares is strengthening, while the correlation with US stocks is weakening. There is a certain possibility that Hong Kong stocks will "passively follow" the rise, such as after the Spring Festival in 2024 and 2025.

How should we view the recent negative factors affecting Hong Kong stocks?

(1) The operators are not raising taxes, but adjusting the tax category. In essence, it is a reflection of the industry's technological evolution and business structure changes in tax policy.The current direction of tax policy optimization focuses more on eliminating outdated tax incentives based on the stage of technological development, such as the dynamic review and updating of the certification standards for high-tech enterprises. The aim is to promote the precise application of tax incentives to enterprises that truly possess cutting-edge technologies.

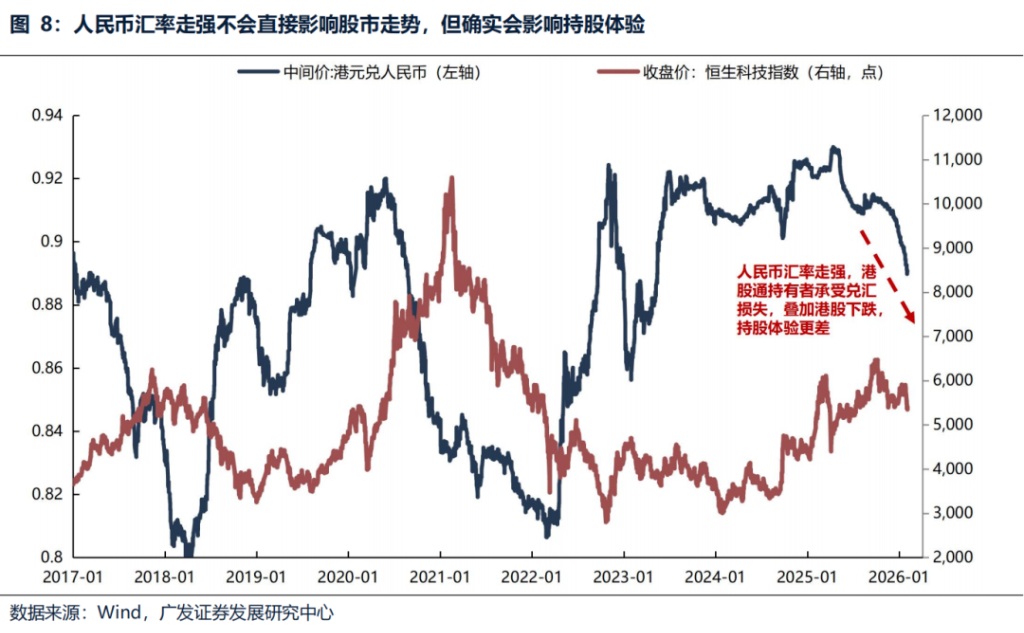

(2) The strengthening of the RMB exchange rate against the Hong Kong dollar will not affect the trend of Hong Kong stocks, but the exchange loss will indeed lead to a worse stock holding experience. However, the RMB does not have the basis for long-term large-scale unilateral appreciation.

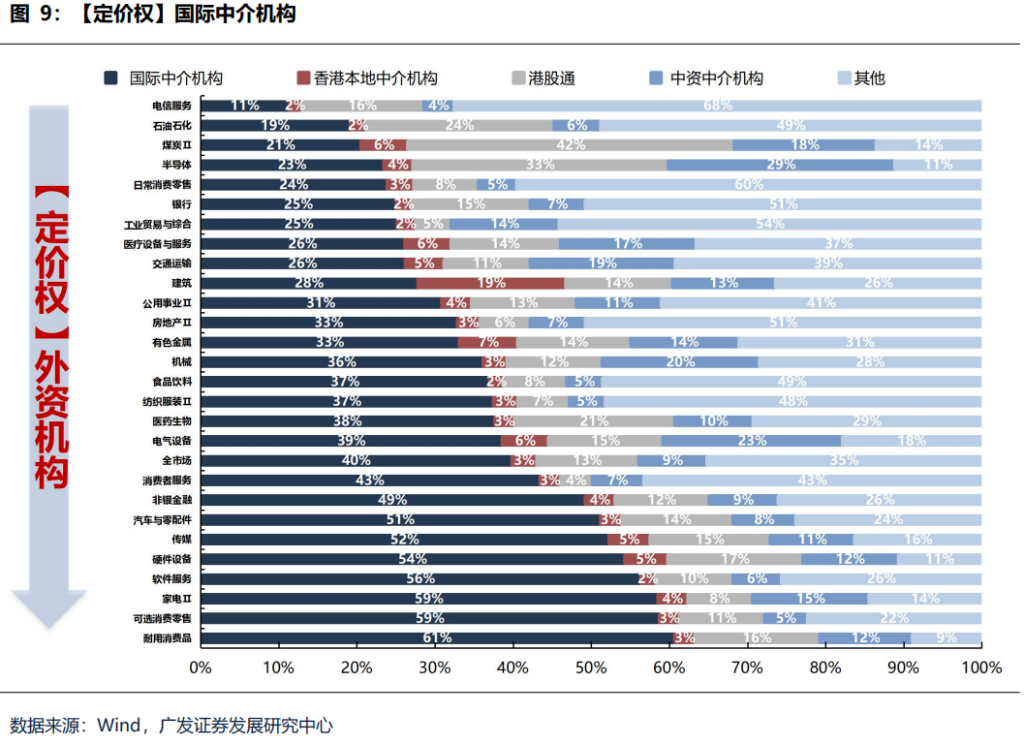

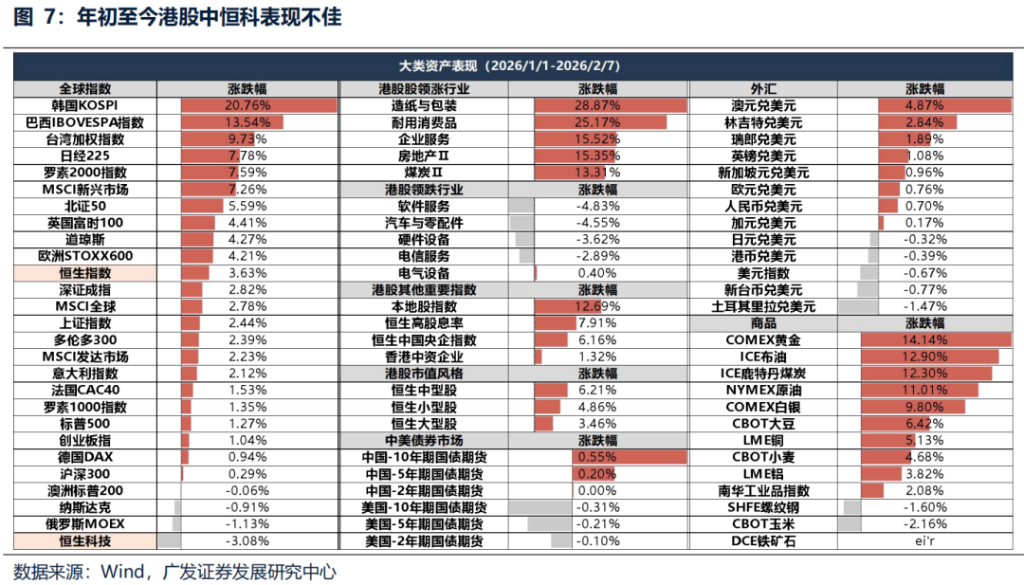

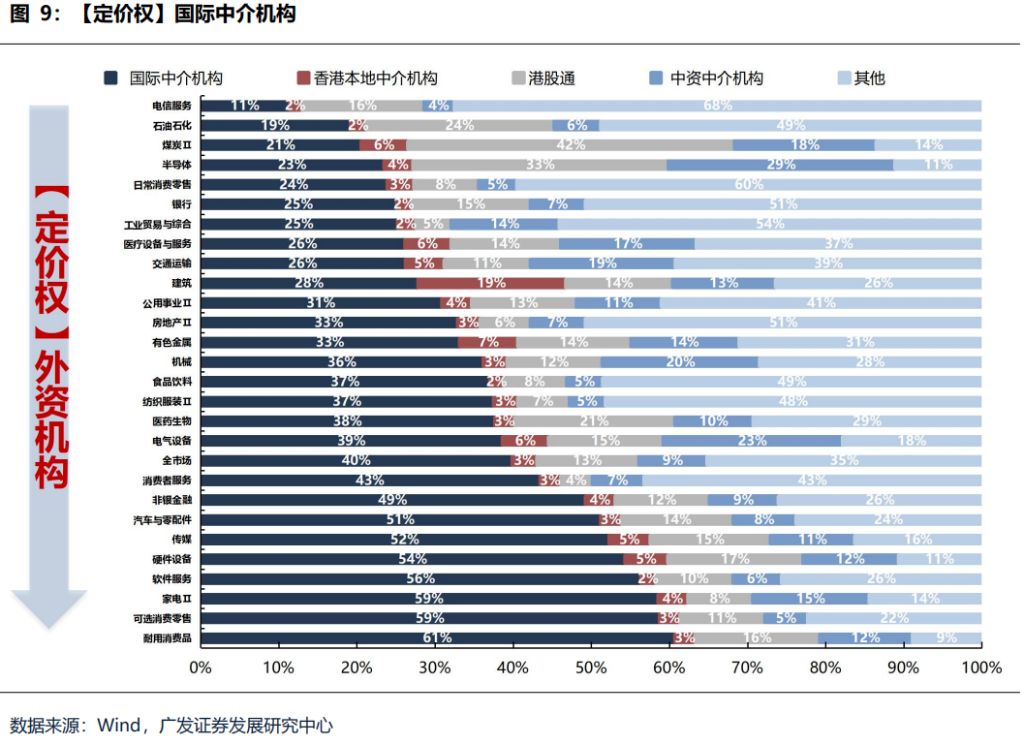

(3) Trump's nomination of Warsh has raised concerns in the market about sectors where foreign capital has pricing power. However, it should be noted that if overseas liquidity recovers more than expected, sectors where foreign capital has pricing power may also face significant net capital inflows. Sectors where foreign capital has pricing power include: Internet, hardware equipment, software services, home appliances, and media. Sectors where Chinese capital has pricing power include: telecommunications services, oil and petrochemicals, coal, semiconductors, and banking.

(4) Record volume in Hong Kong stocksThe IPO itself has little impact on the market; the main impact comes from the peak of share lock-up expirations six months after the IPO.Typical examples include mid-2011, the second half of 2015, March 2019, the second quarter of 2021, and mid-2022, where the unlocking of lock-up periods coincided with declines in Hong Kong stocks. The March 2026 unlocking was primarily driven by non-ferrous metals (Zijin Mining International, Nanshan Aluminum International) and tea beverages (Mixue Ice Cream), with the unlocking scale of medium-to-large-sized companies reaching HK$87.2 billion, higher than the small peak at the end of last year.Since Hong Kong Stock Connect accounts cannot participate in IPOs and enjoy the listing benefits of scarce companies, but must bear the risks brought by the lifting of restrictions on the sale of shares, this may indeed be one of the main concerns of southbound funds regarding Hong Kong stocks in 2026.

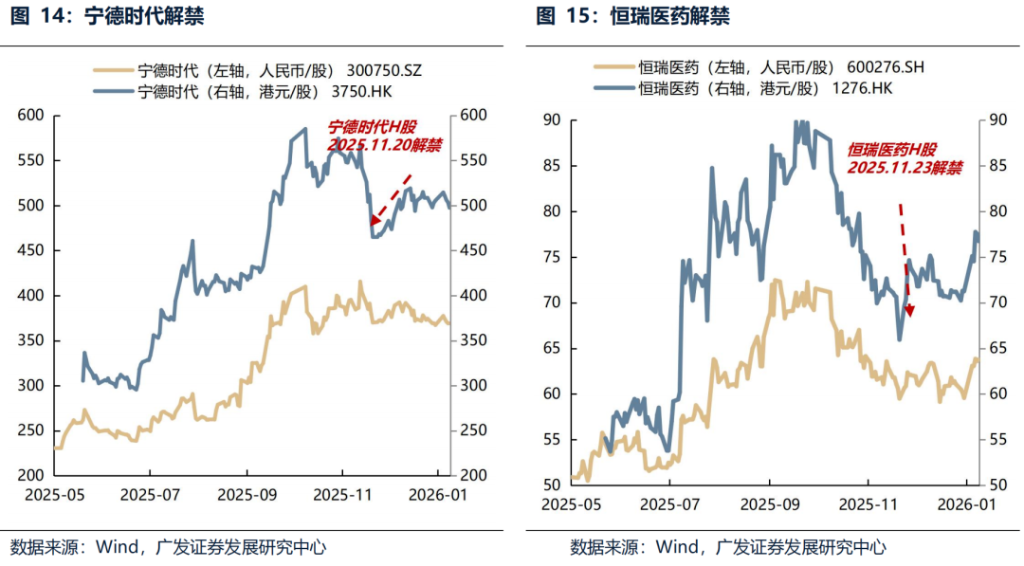

Outlook: Market sentiment is digesting, creating opportunities for strategic positioning; pay attention to the potential turning point brought about by the post-holiday peak in share lock-up expirations.. At the low point of sentiment, we should make phased investments in (1) leading technology companies that benefit from the AI industry trend, such as Internet companies; (2) high-dividend stocks whose valuations have been digested and whose fundamentals are sound; and (3) high-quality companies that may rebound after the release of the lock-up period. For example, CATL and Hengrui Medicine both experienced a sharp “preemptive” correction a week before the lock-up period expired in mid-to-late November 2025 due to market concerns about liquidity shocks, and the risks were priced in in advance; once the lock-up period expired, the negative news was exhausted, which prompted the stock price to quickly bottom out and stabilize or even rebound.

Report text

I. How did the Hong Kong stock market react around the Spring Festival?

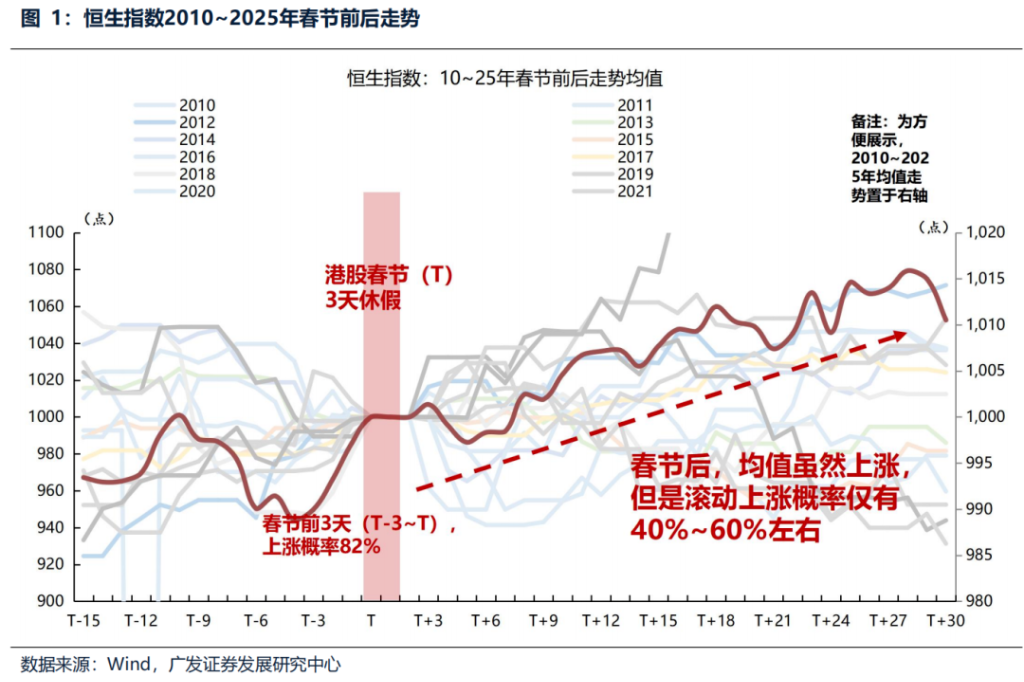

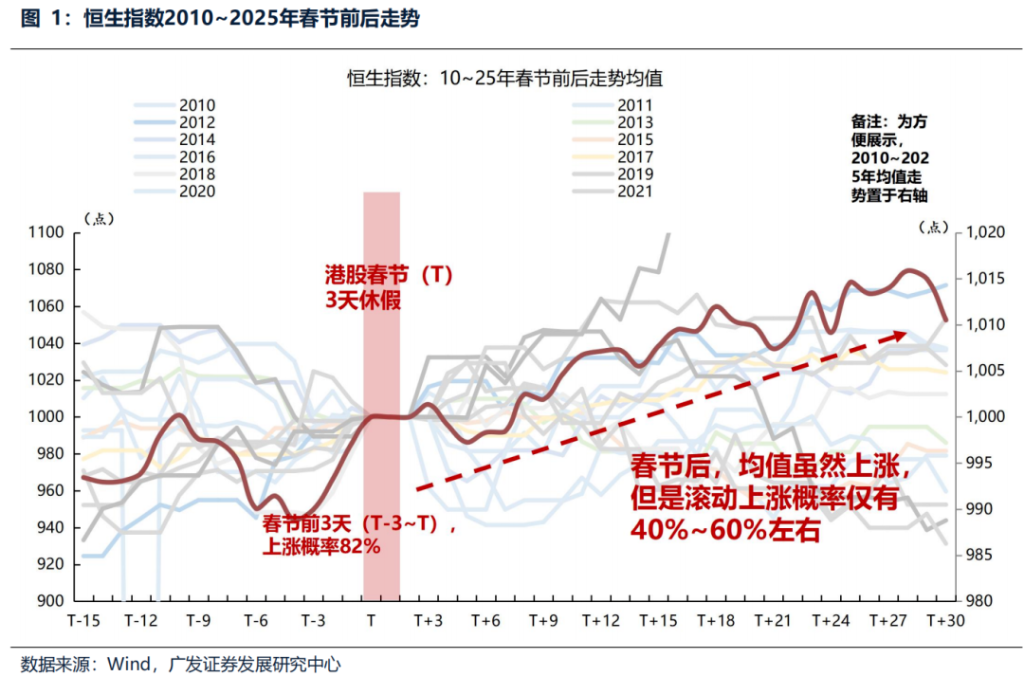

The Hang Seng Index has an 82% probability of rising in the three trading days before the holiday. Based on the historical performance of the Hang Seng Index during the Spring Festival window from 2010 to 2025, the probability of the index rising in the last three trading days before the holiday (between T-3 and T) is 82%. The average value in this period shows a steeper slope and a more consistent upward trend, reflecting that the pre-holiday capital behavior is more similar and the short-term bullish consensus is stronger.

There was no significant calendar effect after the holiday. Within the month-long trading window following the holiday, the average trend remained generally upward with fluctuations. However, this upward trend was more likely driven by larger gains in a few years, causing the post-holiday uptrend success rate to drop to approximately 60%. Therefore, a post-holiday average increase does not equate to a general rise in most years; its tradability lies more in the tail-end contribution of potential gains rather than a high-certainty directional advantage, resulting in overall higher volatility compared to before the holiday.

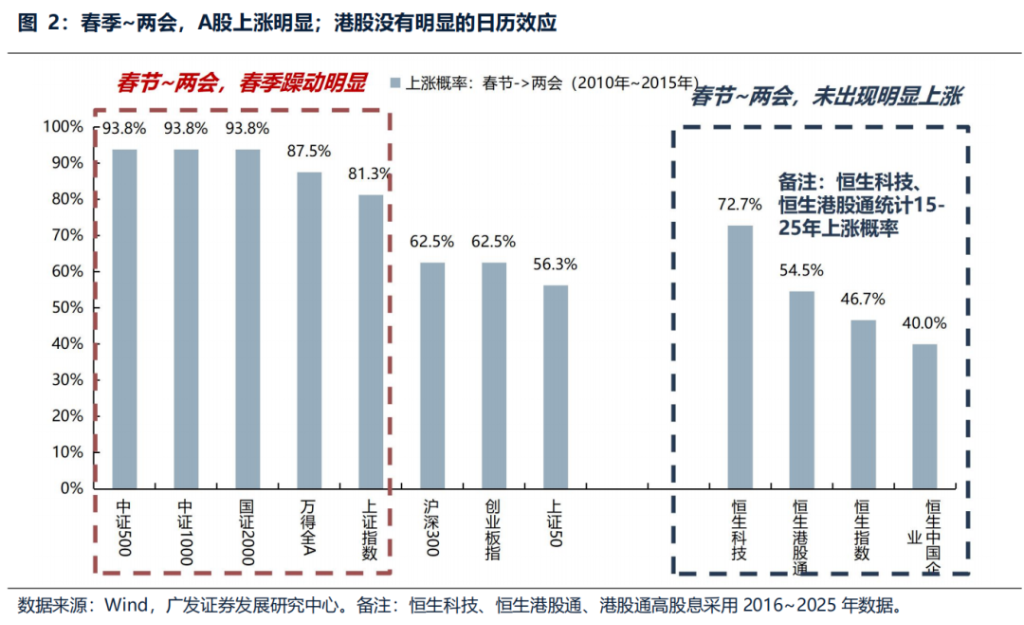

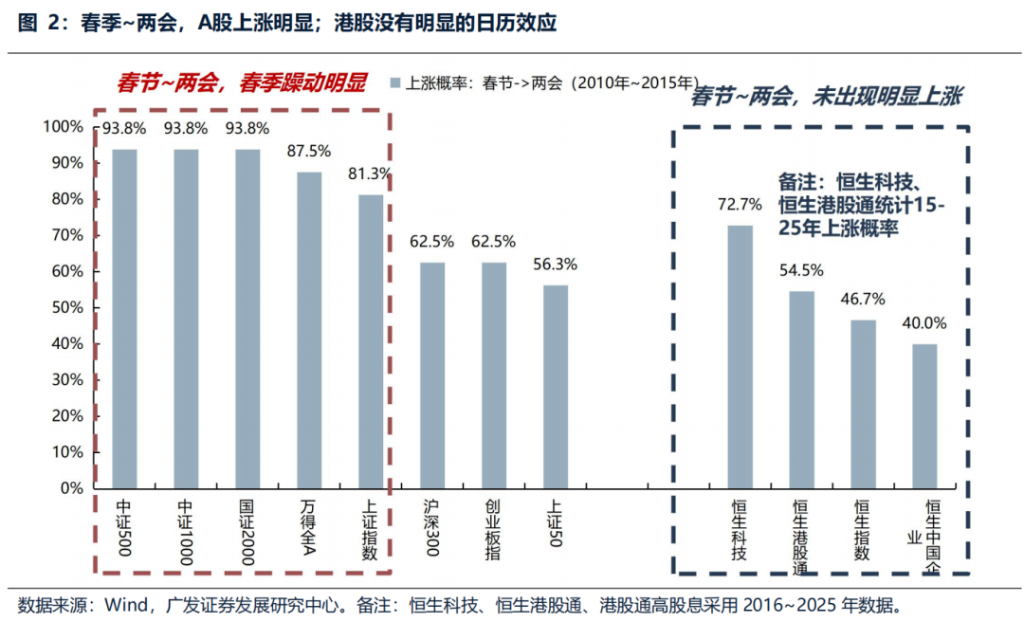

A-shares spring rallyThe surge typically occurs between the Spring Festival and the Two Sessions. This is because investors reduce their positions to avoid the uncertainties during the Spring Festival holiday, and these positions may return after the holiday. At the same time, the period leading up to the Two Sessions is often a time when expectations for reforms and easing policies are relatively high.

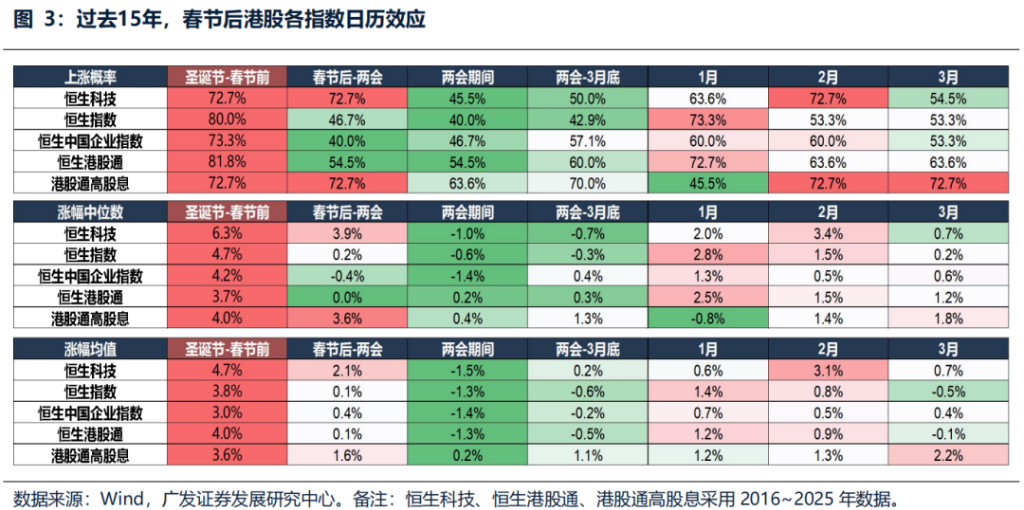

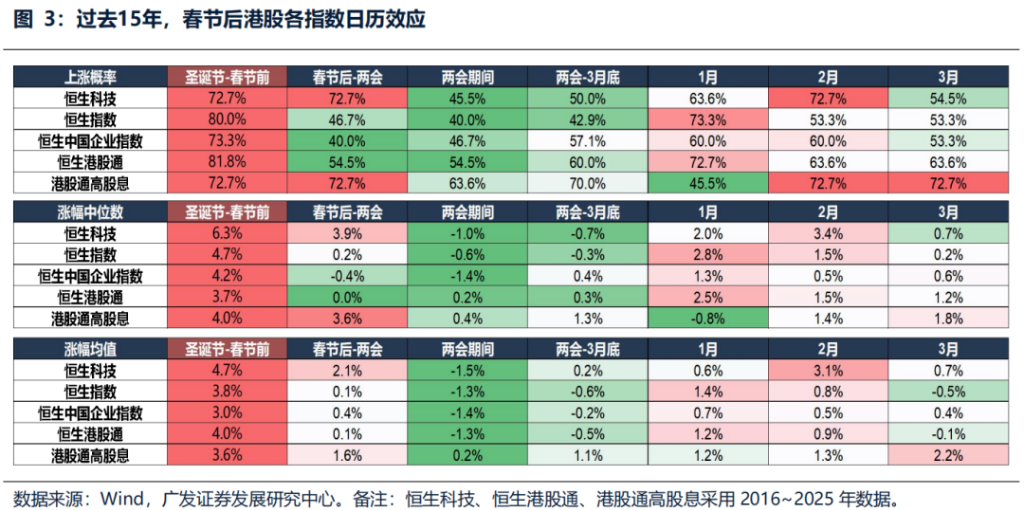

However, from a logical and data verification perspective, the typical window of the Spring Festival followed by the Two Sessions does not naturally align with Hong Kong stocks, and Hong Kong stocks do not exhibit a significant calendar effect after the Spring Festival. (1) Logically speaking,Although the Hang Seng Index and Hang Seng Tech are also highly pro-cyclical, from the perspective of industry structure, the constituent stocks are mainly related to the Internet. The expansionary fiscal policies that may be introduced at the Two Sessions usually affect the real estate chain and infrastructure chain, and have little direct pulling effect on the Internet.(2) The data does not support this either.The effect of the Spring Festival-Two Sessions period on Hong Kong stocks was not significant. Over the past 15 years, the Hang Seng Index has only risen about 46.7% of the time during this period. While the Hang Seng Tech Index has a 72.7% probability of rising during the same period, the statistical period is relatively short (from 2016 to present), and the median and average gains are significantly lower than those before Christmas and the Spring Festival. In addition, the Hang Seng Stock Connect and Hang Seng China Enterprises Index have only a 40.0% and 54.5% probability of rising, respectively, without showing a clear spring rally.

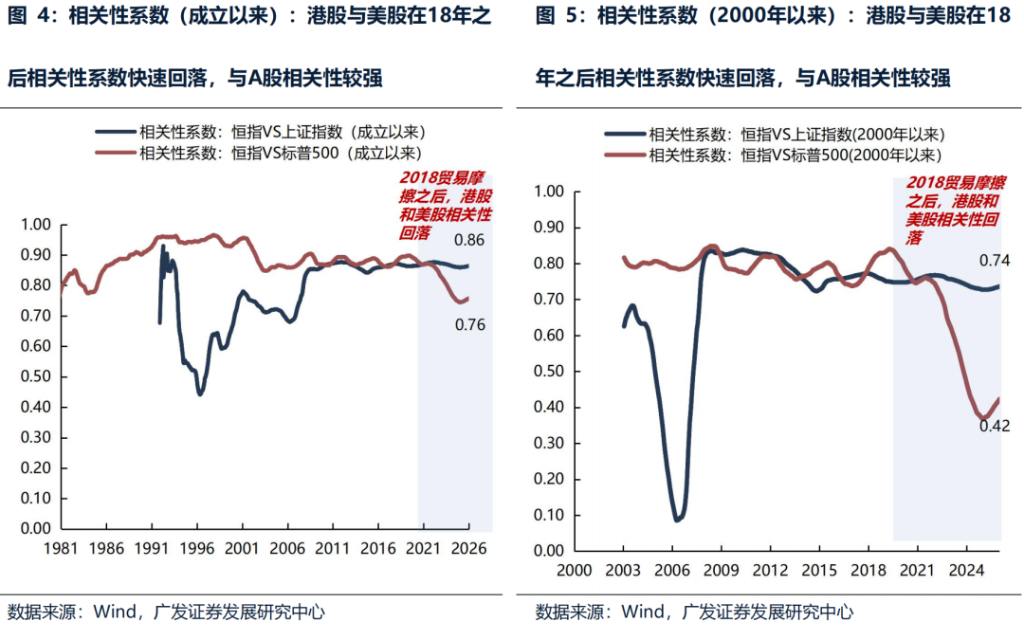

But this time might be different; the pricing logic of Hong Kong stocks has been changing in recent years.Rolling correlation analysis shows that, both since its inception and since 2000, the correlation between Hong Kong stocks and US stocks has significantly declined since 2018, while the correlation with A-shares has strengthened. This suggests that against the backdrop of a significant increase in risk appetite in the mainland market, Hong Kong stocks may experience a certain degree of "passive following" upward movement. If A-shares experience a strong spring rally during the period between the Spring Festival and the Two Sessions, Hong Kong stocks may also rise. The recent years of 2024 and 2025 saw Hong Kong stocks experience a similar phase of growth, coinciding with a strong post-Spring Festival performance in A-shares.

II. How should we view the recent negative factors affecting Hong Kong stocks?

(i) Concerns about increased tax rates on dividend-related assets in Hong Kong stocks due to rising operator tax rates.

The operators are not raising taxes, but rather adjusting the tax category. Essentially, this reflects the evolution of industry technology and changes in business structure in terms of tax policy.The core of this adjustment is to reclassify basic communication services, such as mobile data and broadband access, which are already widely used, from the original "value-added telecommunications services" (6%) to "basic telecommunications services" (9%), reflecting their transformation from supplementary services to social infrastructure.

This is actually consistent with the underlying reason for the market's concern about the tax rate increase for Internet companies mentioned in our 2026 Hong Kong Stock Annual Strategy Report "Accumulating Steps Every Day, Rising with the Tide". The current direction of tax policy optimization focuses more on cleaning up the outdated tax incentives formed based on the stage of technological development in the past, such as the dynamic review and updating of the certification standards for high-tech enterprise qualifications, which aims to promote the precise application of tax incentives to enterprises that are truly at the forefront of technology. (1) At present, the actual effective tax rate of Alibaba/Tencent is around 20%, and there is not much room for increase. Only a small number of subsidiaries enjoy the high-tech enterprise certification. At present, the overall effective tax rate is around 20% (19% for Tencent and 22% for Alibaba in the latest annual report). (2) The main reason for the incident is that the "National Key Supported High-tech Fields" has not been revised since 2016. More than a decade ago, old technologies were still considered high-tech and enjoyed a tax rate of 15%. The latest "National Key Supported High-tech Fields" will be jointly formulated by the Ministry of Industry and Information Technology, the Ministry of Science and Technology, the Ministry of Finance, the State Administration of Taxation, and other departments. In 2024, the average random inspection rate of high-tech enterprise registration nationwide reached 16.5%, far higher than the level of previous years. After the release of the 15th Five-Year Plan, the identification of high-tech enterprises began to be strictly investigated, which was mistakenly interpreted by the market as a negative factor of the increase in the Internet tax rate.

Therefore, it should not be simply extrapolated to other sectors benefiting from tax cuts; the main policy focus remains on promoting industrial upgrading and more efficient resource allocation through structural tax optimization.

(ii) The recent appreciation of the RMB will not affect the performance of Hong Kong stocks, but the exchange rate loss will indeed lead to a worse stock holding experience.

Since the beginning of the year, the Hong Kong stock market has shown a structural divergence. While the Hang Seng Index has recorded gains, its performance has significantly lagged behind major emerging markets such as South Korea and Brazil, and the Hang Seng Tech Index has bucked the trend and fallen. For RMB investors investing through the Stock Connect program, the experience is under double pressure: on the one hand, the overall excess returns of Hong Kong stocks are limited, with key sectors such as technology experiencing corrections; on the other hand, the exchange rate has also had a significant negative impact. During this period, the RMB appreciated by 0.70% against the US dollar, while the Hong Kong dollar, due to its linked exchange rate system, fluctuated with the US dollar and showed a depreciation trend against the RMB. This resulted in Hong Kong stock assets denominated in Hong Kong dollars incurring additional exchange losses after being converted back to RMB, further eroding the investment returns denominated in local currency. However, considering the People's Bank of China's large foreign exchange reserves and powerful management tools, one of its policy objectives is to maintain the basic stability of the RMB exchange rate at a reasonable and balanced level. If the RMB experiences a short-term, rapid appreciation, the central bank is highly likely to intervene to smooth out fluctuations. This institutionally limits the space for a long-term, unilateral, and significant appreciation of the RMB, and the RMB does not have the basis for a long-term, significant, unilateral appreciation.

(iii) If overseas liquidity changes unexpectedly, attention should be paid to industries where foreign investors have pricing power.

On January 30, Trump nominated Warsh as the next Federal Reserve Chairman. Warsh's most recognizable policy mix is expected to be "simultaneous interest rate cuts and balance sheet reduction." On the one hand, this would involve responding to the White House's demands for lower financing costs through moderate interest rate cuts; on the other hand, it would advocate for balance sheet reduction to restore the Fed's credibility and inflation anchor. Against the backdrop of maintaining the Fed's independence and strengthening rule constraints, this "cautious easing" approach...The logic of "structural tightening" aims to reduce the excessive reliance on unconventional monetary tools and forward guidance in the past. In the short term, it may constrain liquidity transactions and also cause market concerns about industries where foreign capital has pricing power, leading to adjustments in related industries in Hong Kong stocks.However, it should be noted that if overseas liquidity recovers more than expected, industries where foreign capital has pricing power may also face significant net capital inflows.

Chinese capital has pricing power:Sectors include telecommunications services, oil and petrochemicals, coal, semiconductors, and banking.

Foreign companies have pricing power in the following sectors: durable consumer goods (Pop Mart), discretionary consumer retail (Alibaba, Meituan, JD.com), home appliances (Midea, Haier), software services (Tencent, NetEase, Baidu), hardware equipment (Xiaomi, Lens Technology), and media (Kuaishou, Tencent Music, NetEase Cloud).

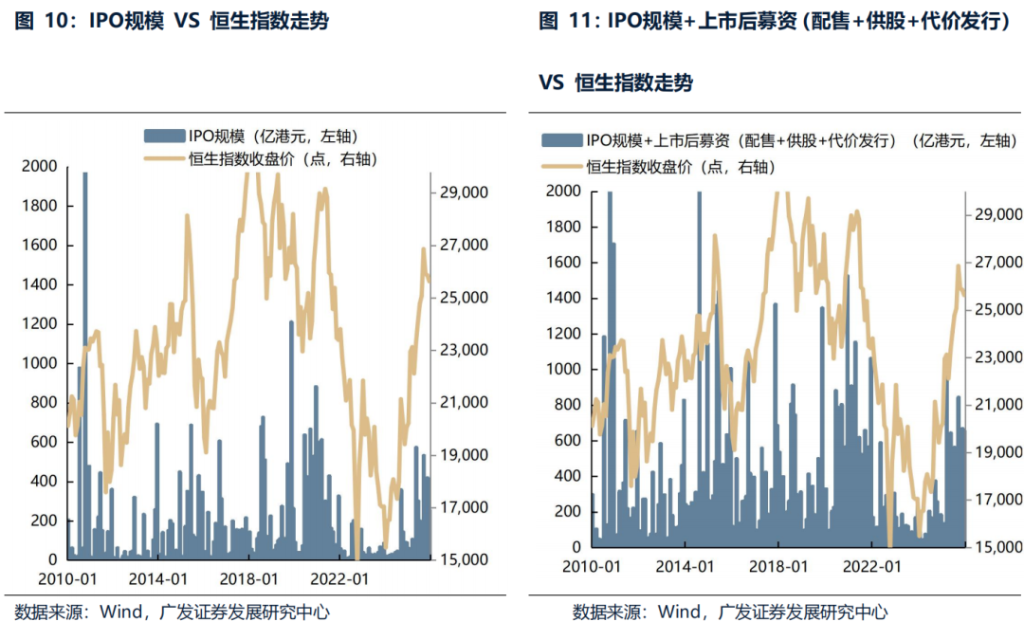

(iv) The massive number of IPOs in Hong Kong stocks will not have a significant impact on the market. The main impact will be the peak of share lock-up expirations six months after the IPOs.

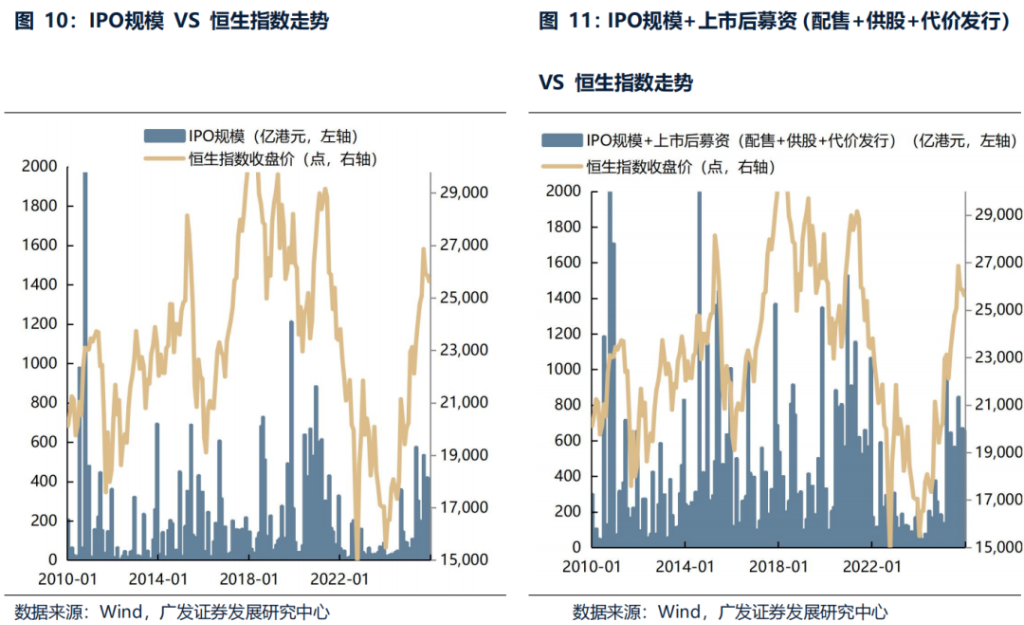

The peak in IPO size and fundraising (including post-listing fundraising, i.e. placement + rights issue + consideration issuance) will not reverse the trend of Hong Kong stocks.Typical examples include the fundraising peaks in Hong Kong stocks in 2010, 2014-2015, 2017, 2020, and 2025, none of which affected the bull market in Hong Kong stocks. This may be because the Hong Kong stock market has improved significantly, and some companies have expansion needs, choosing to raise funds in the capital market at relatively high points.

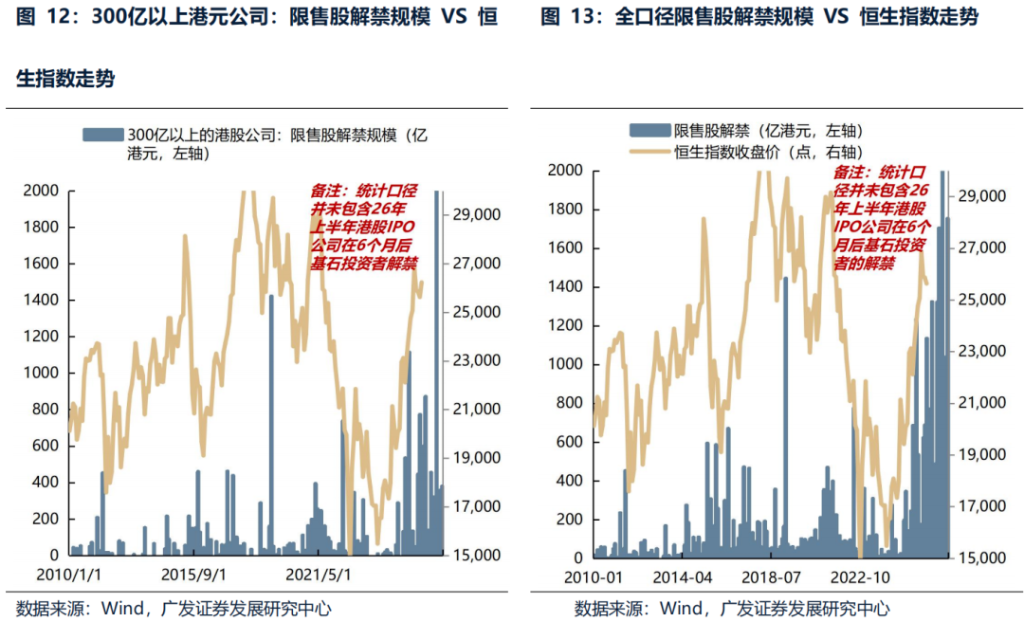

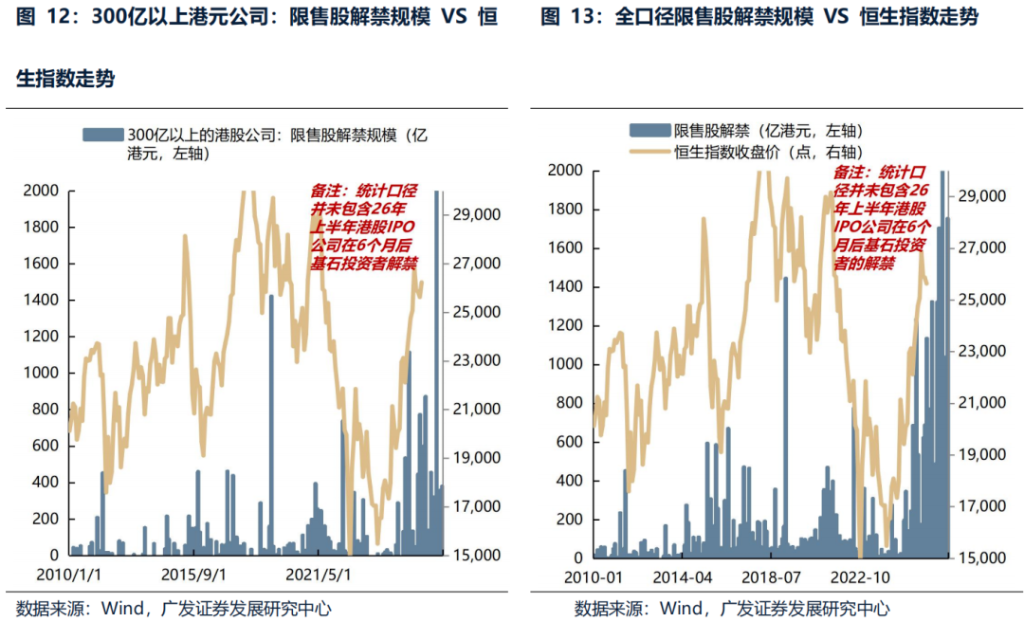

IPOThe real impact on the Hong Kong stock market may lie in the wave of share lock-up expirations six months after a company's main board listing:(1) The controlling shareholder shall be subject to a 6-month lock-up period and shall not lose its controlling shareholder status within 6 months after the lock-up period expires. (2) Cornerstone investors shall be subject to a lock-up period of at least 6 months.Typical examples include mid-2011, the second half of 2015, March 2019, the second quarter of 2021, and mid-2022, where the lifting of share lock-up restrictions coincided with the decline in Hong Kong stocks within similar timeframes.

In March 2026, there will be a new wave of restricted shares becoming tradable for medium-to-large-sized companies (with a market capitalization of over HK$30 billion).For example, March mainly saw a wave of share lock-up expirations for non-ferrous metals (Zijin Gold International, Nanshan Aluminum International) and tea beverages (Mixue Ice Cream). The total value of shares released from lock-up for medium and large-sized companies reached HK$87.2 billion, higher than the small peak at the end of last year.It is important to note that the statistical scope of the restricted shares to be released in 2026 does not include the cornerstone investors of Hong Kong IPO companies in the first half of 2026 whose shares were released six months later.

Furthermore, since Hong Kong Stock Connect accounts cannot participate in IPOs and enjoy the listing benefits of scarce companies, but must bear the risks brought about by the lifting of restrictions on the sale of shares, this may indeed be one of the main concerns of southbound funds regarding Hong Kong stocks in 2026.

III. Outlook: Market sentiment is digesting, creating opportunities for investment; pay attention to the potential turning point brought about by the post-holiday peak in share lock-up expirations.

1. Hong Kong stock market liquidity has been under pressure recently, but there are signs that the marginal pressure has eased.Last week, foreign capital experienced a temporary outflow, mainly due to two factors: firstly, the continued deadlock in US fiscal spending and the risk of a partial government shutdown temporarily suppressed risk appetite; secondly, the market overreacted to personnel changes at the Federal Reserve, although Warsh was considered a potential hawk, his policy proposals had already been priced in by the market. We believe that the current liquidity environment has entered a period of observation, and there is limited room for further tightening.

2.Market sentiment has largely been digested, and a reversal in sentiment may present a window of opportunity for investment.

The Hang Seng Tech Index recently broke through its annual moving average, reflecting a significant release of suppressed sentiment. If positive catalysts emerge, Hong Kong stocks are expected to see a combined effect of sentiment recovery and capital inflows.

(1) Liquidity expectations tend to stabilize: The market impact of the Fed’s personnel changes has been largely digested. Although the liquidity environment in 2026 will be marginally tighter than in 2025, it is still expected to remain relatively loose.

(2) Demand for allocation by domestic and foreign capital remains: The pricing power of southbound funds has steadily increased to 20%-30%, and the recent intensive submissions of Hong Kong stock-themed funds show that the willingness to allocate in the medium and long term remains strong; foreign capital actively deployed core Chinese assets at the beginning of the year, and if market sentiment recovers, the possibility of foreign capital returning is high.

(3) Industry trends are sustainable: AI application and edge innovation are expected to continue to be implemented in 2026, including the iteration of models such as DeepSeek and the launch of C-end AI products by major Internet companies, which will provide fundamental support for the technology sector.

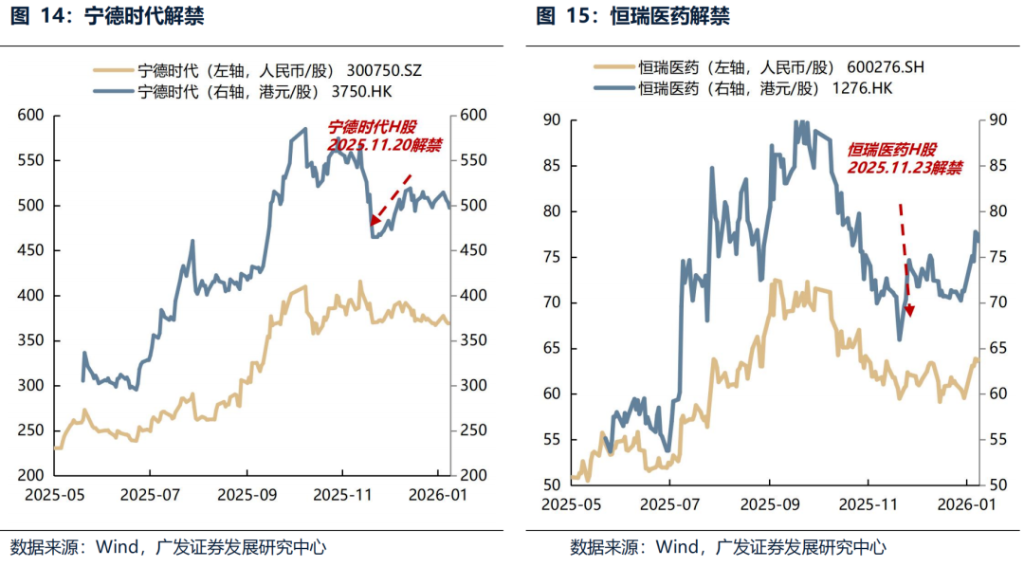

3.Pay attention to the potential opportunities brought about by the post-Spring Festival lifting of restrictions.

This requires close attention in the near future.The peak period for the lifting of share restrictions from late February to early March (nearly 100 billion yuan, exceeding the lifting of restrictions on CATL and Hengrui in late November last year, and the wave of lifting restrictions in December last year) includes many companies such as Zijin Mining International, Nanshan Aluminum, China Hongqiao, Mixue Ice Cream, and Guming. If the market has already absorbed some selling pressure through adjustments before the lifting of restrictions, then the lifting of restrictions may actually form a temporary bottom. If Hong Kong stocks continue to adjust in the near future, the lifting of restrictions may present a good opportunity to invest.

4.Configuration Recommendations:At low points in sentiment, invest in batches of: (1) leading technology companies that benefit from the AI industry trend, such as the Internet; (2) high-dividend stocks whose valuations have been digested and whose fundamentals are sound; and (3) high-quality companies that may rebound after the pressure of the lifting of share lock-up periods is released.

For example, CATL and Hengrui Medicine both experienced a sharp "preemptive" correction a week before their shares were released from lock-up in mid-to-late November 2025 due to market concerns about liquidity shocks, with the risks already priced in. Once the lock-up period ended, the negative news was fully priced in, which in turn prompted the stock prices to quickly bottom out, stabilize, and even rebound.

IV. Global Fund Flows This Week

(a) A/H share market

1. AH Interoperability

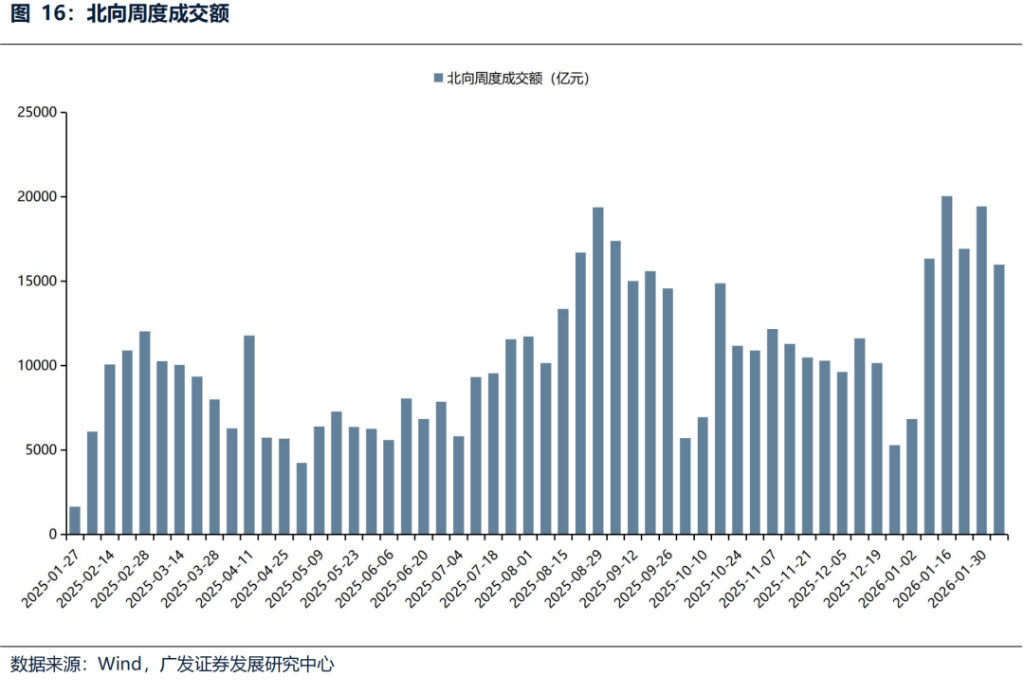

Northbound capital trading volume narrowed this week. The total trading volume of northbound capital this week (February 2nd - February 6th) was 1.60 trillion yuan, with a daily average of 399.901 billion yuan, a decrease of 86.486 billion yuan compared to last week's daily average.

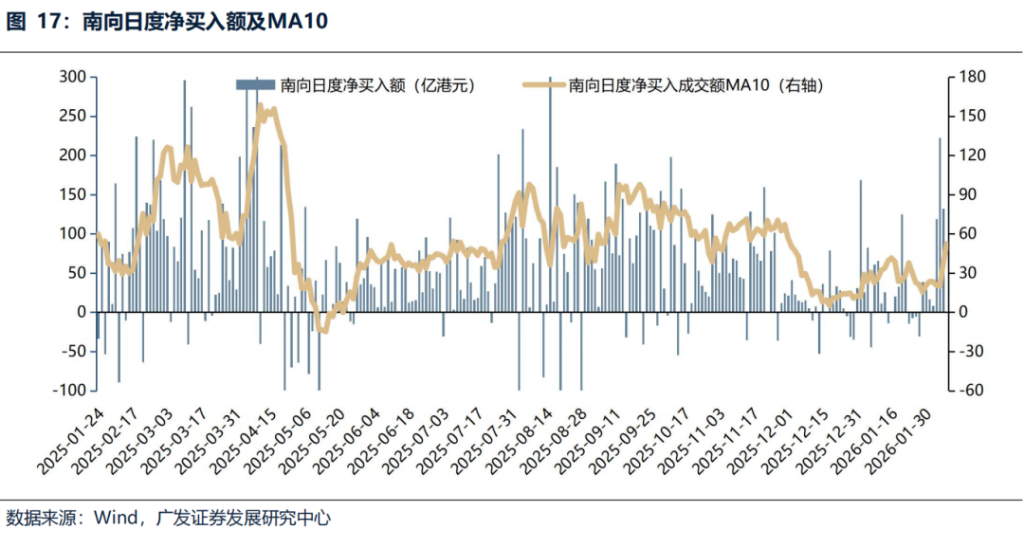

Southbound capital continued its net inflow this week. From February 2nd to February 6th, net southbound capital inflow reached HK$15.408 billion, compared to HK$10.372 billion last week. At the individual stock level, the top stocks with the largest net inflows from southbound capital included Tencent Holdings (HK$15.98 billion), Tracker Fund of Hong Kong (HK$3.799 billion), and Xiaomi Group-W (HK$3.611 billion); the top stocks with the largest net outflows included SMIC (HK$2.521 billion), Zijin Mining (HK$1.477 billion), and Hua Hong Semiconductor (HK$844 million).

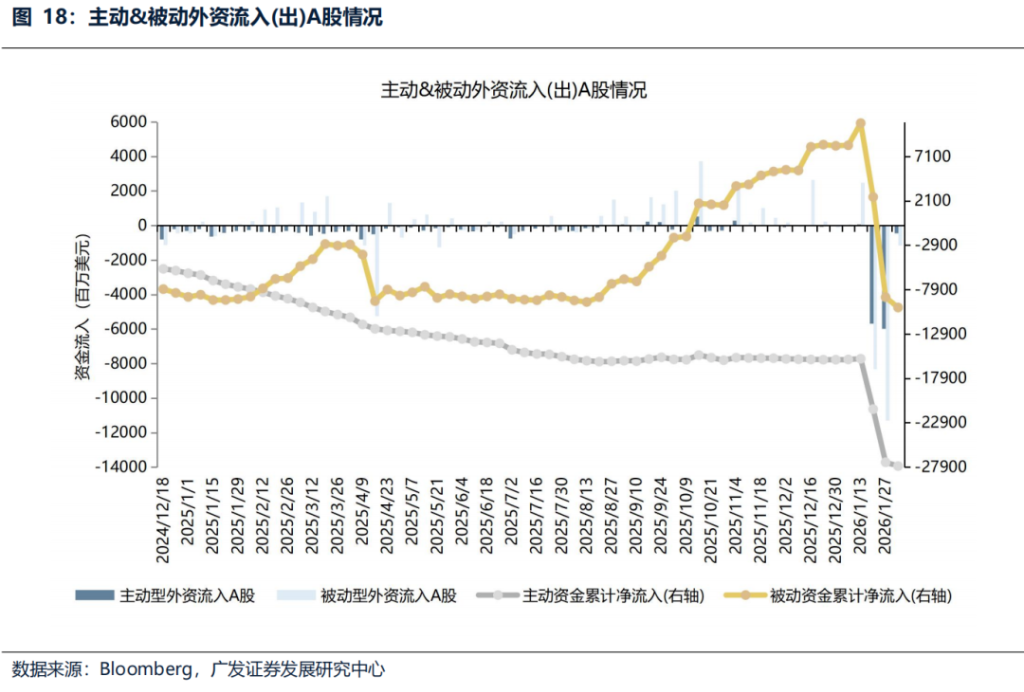

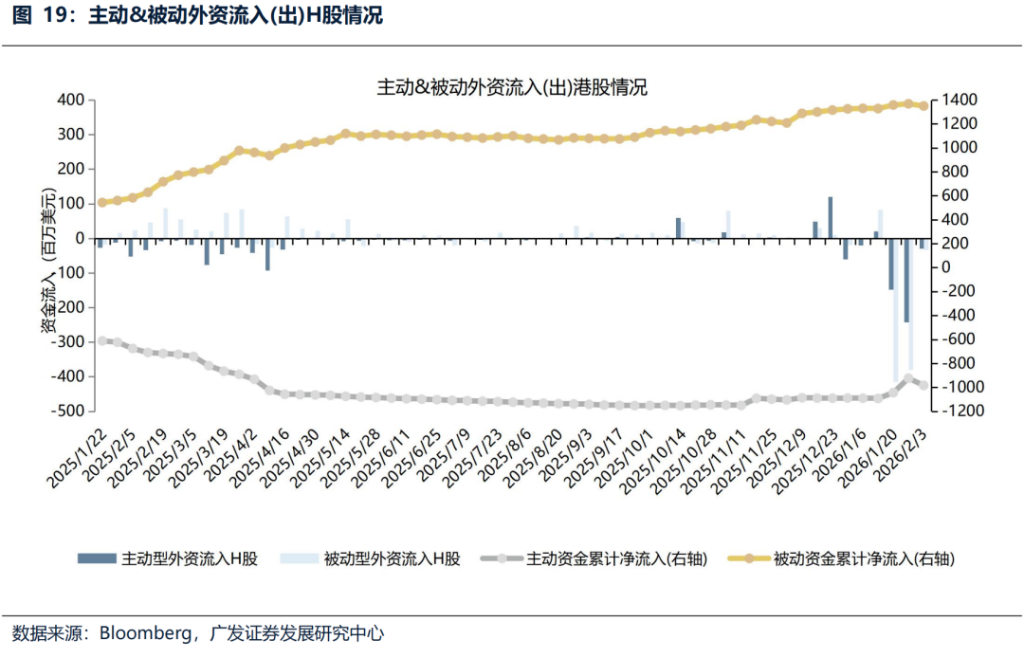

2. Regarding foreign capital flows: A-share capital outflows are converging, and H-share capital outflows are converging.

A. Capital outflow convergence; H. Capital outflow convergence.As of Wednesday this week (January 28 - February 4), foreign capital outflow from A-shares was US$1.589 billion, compared to US$17.281 billion last week; foreign capital outflow from H-shares was US$0.63 billion, compared to US$6.21 billion last week.

(ii) Important overseas markets

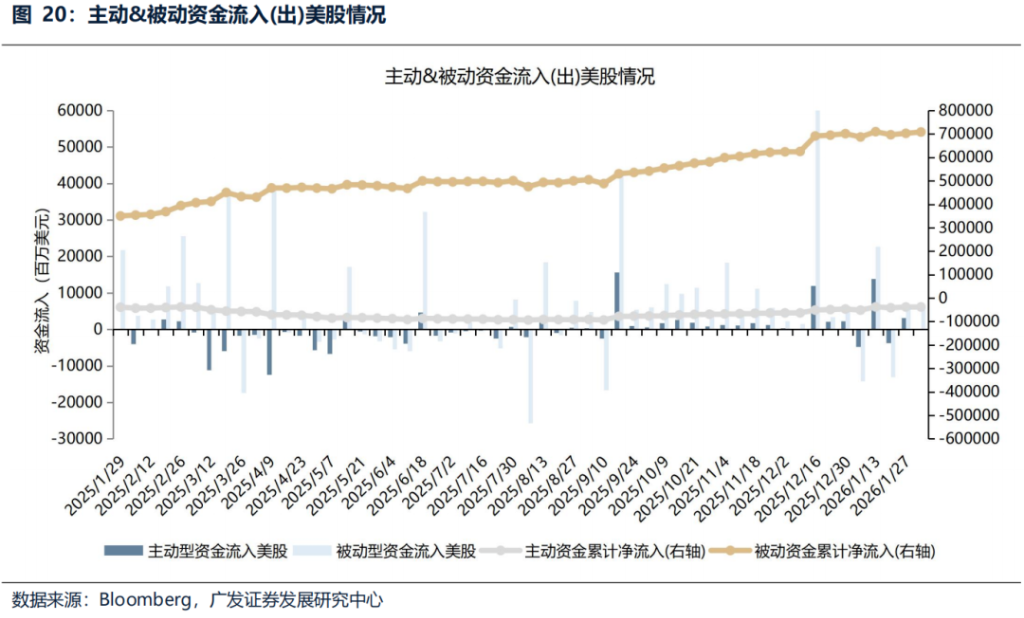

1. US Stock Market Fund Flows

The inflow of active and passive funds into US stocks has converged.As of Wednesday (January 28 - February 4), active funds flowed into US stocks by $220 million, down from $3.217 billion last week; passive funds flowed into stocks by $5.61 billion, down from $6.009 billion last week.

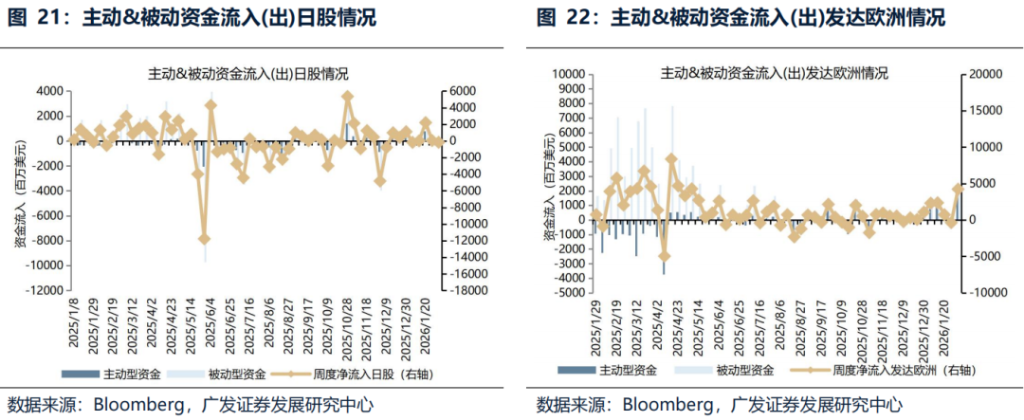

2. Other important market fund flows: This week, funds flowed out of the Japanese market and flowed into developed European markets.

This week, funds flowed out of the Japanese market and flowed into developed European markets.Specifically, the Japanese market saw an outflow of $165 million this week, compared to an inflow of $47 million last week; the developed European market saw an inflow of $4.226 billion this week, compared to an outflow of $370 million last week.

This article is sourced from: