Author:BitPush

Source: Bankless

Author: David Christopher

Original title: Did Prediction Markets Win the Super Bowl?

Compiled and edited by: BitpushNews

This yearSuper Bowl—Seattle Seahawks vs. New England Patriots—While lacking the superstar effect of last year's Chiefs vs. Hawks game featuring Taylor Swift, it marks a turning point:Prediction MarketFor the first time, it has been explicitly regarded as a true rival to traditional sports betting.

Two major prediction market platformsKalshiandPolymarketThe market has been built around this game, the halftime show, and advertising, and the initial data paints an interesting and complex picture.

Before we begin, a quick note: sports betting companies have not yet compiled and reported their total betting volume—this takes several days. Therefore, this article is based on the analysis of sports betting companies' forecast data and the actual trading volume in the forecast market.

Sports betting predictions: Reaching new highs, but with a slowdown in growth.

The American Association of Sports Betting Associations (AASB) projects that U.S. sports betting companies will spend approximately $1.76 billion on Super Bowl XL, a record high and representing a year-over-year increase of about 27%. While specific figures may vary slightly depending on the source, most forecasts point in the same direction: another record high, continuing the eight-year growth trend since the Supreme Court legalized sports betting in 2018.

However, the growth rate is clearly slowing. Currently, 39 states and Washington D.C. have opened sports betting, with only Missouri being a new addition in this cycle—meaning that the previous surge driven by market expansion is giving way to gradual growth. Against this backdrop, prediction markets have become another factor inhibiting growth. Ed Birkin of H2 Gambling Capital told Fortune magazine that he estimates prediction markets will account for 80% of the year-over-year increase in betting activity this year, predicting that prediction market trading volume will reach $630 million throughout the entire event period.

Based on currently available data, the market's performance appears to be far below that figure.

Kalshi

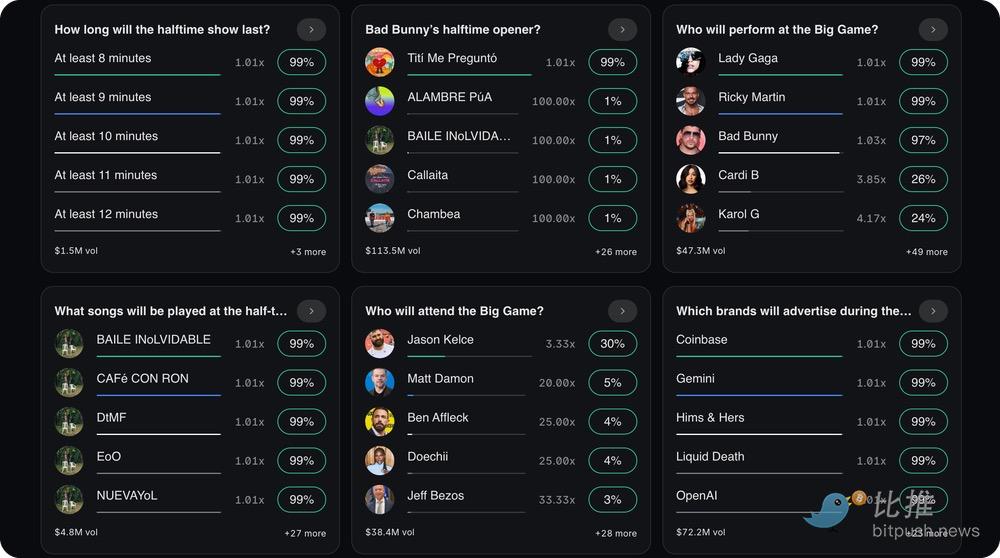

Kalshi's dedicated Super Bowl marketplace (contracts directly linked to the game, halftime show, and broadcast) generated significant, but less-than-expected, trading volume.

Bad Bunny halftime show opening theme: $113.5 million

Which companies will premiere the ads: $72.2 million

Who will perform in the competition: $47.3 million

In these few leading markets alone, the total trading volume was approximately $233 million, far below analysts' forecast of $630 million for the entire prediction market.

Furthermore, Kalshi's flagship NFL marketplace—a "Super Bowl winner" contract open for several months throughout the season—has seen over $500 million in total trading volume. However, this figure reflects the cumulative trading volume for the entire NFL season, not just Super Bowl weekend. Even so, it's less than a third of what sports betting companies estimate for betting volume on a single Super Bowl game.

For months, sports betting has accounted for the vast majority (over 90%) of Kalshi's total transaction volume, thanks to its promotional channels that are no less effective than, and in some cases even better than, those of sports betting companies.

First, Kalshi's federal regulation by the U.S. Commodity Futures Trading Commission means that U.S. users can access it directly through its mobile app, just like a sports betting app. Coupled with substantial advertising funding from venture capital and a partnership with Robinhood, Kalshi stands out. This foundation is paying off: in January alone, Kalshi was downloaded 1.9 million times.DraftKingsandFanDuelThe two new prediction market apps, launched last December, have combined for fewer than 100,000 downloads (they launched in states where their traditional sports betting apps are not permitted, but have so far received a lukewarm reception). Furthermore, DraftKings partnered with Crypto.com last Friday to expand its event contract offerings, indicating that existing giants are taking this threat seriously.

Polymarket

Polymarket's similar full-season NFL market deals total approximately $700 million—more than Kalshi's—but its Super Bowl-specific market is a different story. Polymarket's top three Super Bowl markets combined for approximately $76 million.

Home game market: $55.26 million

Super Bowl MVP: $12 million

Who will perform the halftime show: $9 million

Polymarket lacks Kalshi's regulatory approval in the US, meaning US users cannot access it directly via the mobile app. Technically, Polymarket now has a US app after acquiring a CFTC-registered exchange last year, but it's currently rolling out gradually through a waiting list, and its Super Bowl offerings are limited. As of a week before the game, the app didn't even list any sports marketplaces; the full suite of Super Bowl-themed games was only available on its global website.

Therefore, most US users still need to access it through websites or VPNs. For casual sports betting players, this is a completely different starting point compared to downloading Kalshi from the App Store.

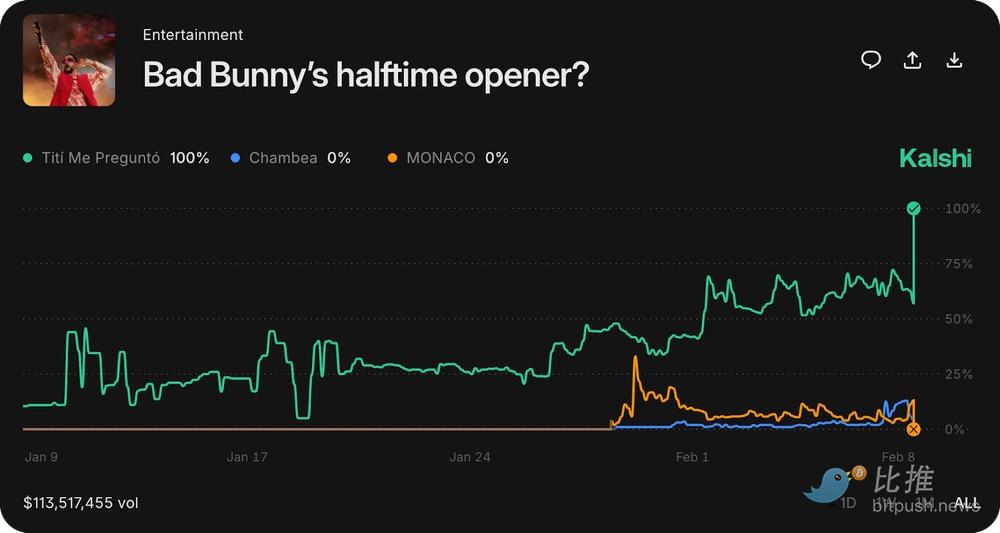

However, Polymarket's true strength lies in its primary use case—information discovery. In the halftime show performer market, Lady Gaga's probability remained consistently around 80% in the days leading up to the show—far before her unexpected appearance at the halftime show, which Billboard magazine had not previously reported on and certainly surprised everyone watching with me.

Regulatory Progress

All of this is happening against the backdrop of unresolved regulatory conflicts.

Kalshi operates as an exchange regulated by the CFTC (Central Federation of Trade Unions), which allowed its sports betting contracts to proceed—especially after new CFTC Chairman Michael Selig stated he would not block or relinquish regulatory power to the states. State betting regulators overseeing sports betting companies have continued to challenge Kalshi and its counterparts in court, with many analysts expecting these cases to eventually reach the Supreme Court.

Currently, prediction markets operate in a gray area, allowing them to cover the entire country without requiring state-by-state licensing—a structural advantage that sports betting companies cannot easily replicate.

summary

So, did the prediction market live up to the hype surrounding the Super Bowl LX? Not quite, compared to the predicted $630 million.

The top Super Bowl-specific marketplaces, visible on the two leading platforms, saw a combined turnover of approximately $310 million—about half of the projected figure. While the NFL market saw significant turnover across both platforms throughout the season, this was the accumulation of months of football games, not a single-week explosion during Super Bowl weekend.

The context is equally important. Kalshi's 1.9 million downloads in January dwarfed the combined total of DraftKings and FanDuel's prediction market apps. This pressure is already evident in stock prices—according to Fortune magazine, Flutter Entertainment, FanDuel's parent company, has seen its stock price decline for eight consecutive weeks, marking its longest losing streak in 23 years; DraftKings' stock price is hovering near its lowest point since 2023, down more than 60% from its all-time high. Bloomberg data shows that in the past three months, market expectations for Flutter's fourth-quarter earnings have been sharply lowered by nearly 49%, and expectations for DraftKings have also declined by 29%. Imagine if someone had bet on Polymarket that "DraftKings will underperform expectations"—they might already be quietly profiting.

Prediction markets may not have conquered the Super Bowl overnight, but they have certainly made their way into the mainstream—and for traditional sports betting platforms, the trajectory of this trend is alarming enough.