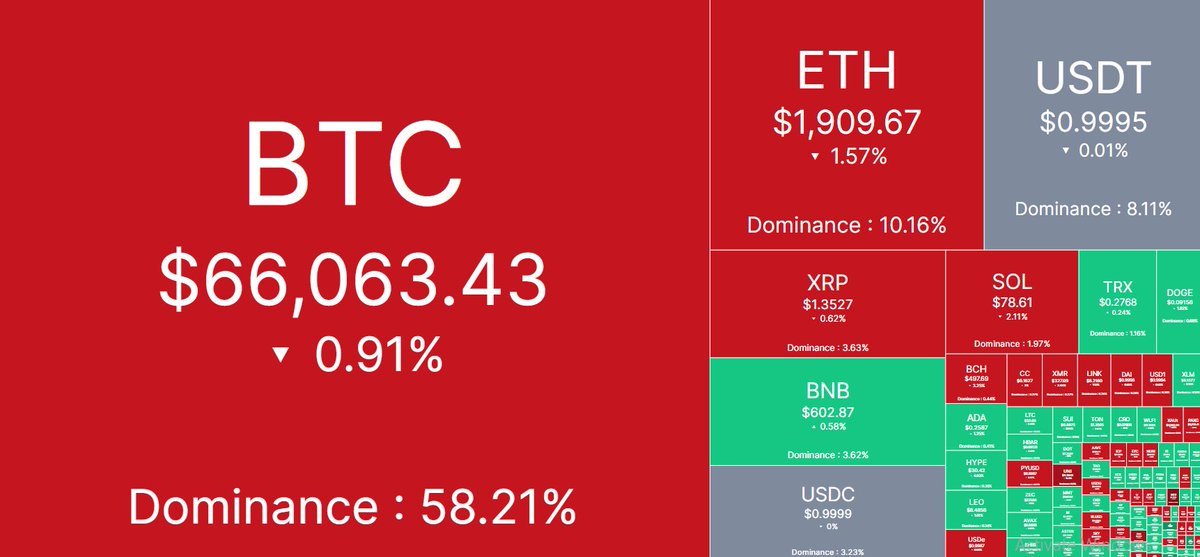

BTC

$68,945.51

+2.27%

ETH

$2,037.08

+4.08%

USDT

$0.9997

+0.01%

XRP

$1.41

+2.10%

BNB

$610.79

-0.01%

USDC

$1.00

+0.01%

SOL

$83.35

+3.46%

TRX

$0.2789

+0.47%

WTRX

$0.2787

+0.16%

stETH

$2,042.42

+4.00%

DOGE

$0.09579

+2.19%

BCH

$540.00

+6.74%

ADA

$0.2706

+2.54%

USDS

$1

-0.00%

WSTETH

$2,457.82

+1.43%

WBTC

$68,803.88

+2.32%

HYPE

$31.86

+2.97%

WBETH

$2,223.36

+4.36%

WETH

$2,024.64

+2.60%

XMR

$347.74

+3.19%

USDe

$0.9991

+0.02%

CC

$0.1653

-0.34%

LINK

$8.73

+3.80%

weETH

$2,194.79

+2.31%

AETHUSDT

$0.9997

-0.03%

AETHWETH

$1,913.35

-3.41%

CBBTC

$68,591.60

+1.12%

DAI

$1.00

+0.03%

XLM

$0.1624

+0.62%

USD1

$1

-0.03%

BTCB

$69,098.76

+2.09%

LTC

$54.38

+2.64%

HBAR

$0.09541

+1.79%

ZEC

$243.91

+3.24%

AVAX

$9.16

+3.62%

PYUSD

$1.00

+0.03%

SHIB

$0.0{5}629

+3.28%

SUI

$0.9544

+3.76%

sUSDe

$1.22

+0.02%

TON

$1.46

+6.57%

RAIN

$0.0103

+3.34%

CRO

$0.07796

+1.17%

WLFI

$0.1045

-3.15%

XAUT

$4,990.90

-1.08%

PAXG

$5,017.62

-1.21%

DOT

$1.31

+2.18%

UNI

$3.44

+2.56%

MNT

$0.6277

+0.74%

BFUSD

$0.9996

-0.01%

AAVE

$116.90

+7.88%

ASTER

$0.727

+2.39%

M

$1.41

-1.12%

TAO

$162.00

+5.47%

BGB

$2.37

-0.53%

USDf

$0.9976

+0.03%

OKB

$76.61

+2.24%

SKY

$0.06933

+3.96%

USDG

$1.00

+0.00%

PEPE

$0.0{5}377

+1.89%

syrupUSDC

$1.15

-0.02%

RLUSD

$1.00

+0.03%

PI

$0.1506

+11.23%

ETC

$8.45

+2.80%

NEAR

$1.02

+5.94%

ICP

$2.35

-2.93%

ONDO

$0.2616

+4.35%

RSETH

$2,074.72

-0.91%

BTCT

$69,194.82

+1.84%

JLP

$3.67

+2.27%

JITOSOL

$105.06

+3.79%

WLD

$0.393

+2.29%

KCS

$8.43

+3.41%

POL

$0.0991

+5.88%

ATOM

$2.07

+4.86%

USDCE

$0.9961

-0.59%

USDD

$0.9997

-0.01%

ENA

$0.1198

+3.10%

WBNB

$613.10

+0.07%

BBTC

$66,435.48

-0.74%

NIGHT

$0.05446

+9.80%

KAS

$0.03206

-0.14%

ALGO

$0.0935

+2.63%

QNT

$68.73

+0.66%

USDTb

$0.9996

+0.02%

GT

$7.12

+1.17%

LBTC

$68,985.06

+1.89%

FLR

$0.00959

-0.52%

WFLR

$0.009443

-2.73%

RETH

$2,353.10

+3.11%

TRUMP

$3.36

+3.22%

FBTC

$68,144.58

+0.97%

MYX

$2.99

+6.56%

XDC

$0.03687

+1.51%

BNSOL

$91.30

+3.51%

APT

$0.936

+1.52%

PUMP

$0.002035

+2.67%

RNDR

$1.38

+4.37%

U

$1.00

+0.02%

KHYPE

$32.34

+2.54%

FIL

$0.935

+3.31%

BTC

$68,945.51

+2.27%

ETH

$2,037.08

+4.08%

USDT

$0.9997

+0.01%

XRP

$1.41

+2.10%

BNB

$610.79

-0.01%

USDC

$1.00

+0.01%

SOL

$83.35

+3.46%

TRX

$0.2789

+0.47%

WTRX

$0.2787

+0.16%

stETH

$2,042.42

+4.00%

DOGE

$0.09579

+2.19%

BCH

$540.00

+6.74%

ADA

$0.2706

+2.54%

USDS

$1

-0.00%

WSTETH

$2,457.82

+1.43%

WBTC

$68,803.88

+2.32%

HYPE

$31.86

+2.97%

WBETH

$2,223.36

+4.36%

WETH

$2,024.64

+2.60%

XMR

$347.74

+3.19%

USDe

$0.9991

+0.02%

CC

$0.1653

-0.34%

LINK

$8.73

+3.80%

weETH

$2,194.79

+2.31%

AETHUSDT

$0.9997

-0.03%

AETHWETH

$1,913.35

-3.41%

CBBTC

$68,591.60

+1.12%

DAI

$1.00

+0.03%

XLM

$0.1624

+0.62%

USD1

$1

-0.03%

BTCB

$69,098.76

+2.09%

LTC

$54.38

+2.64%

HBAR

$0.09541

+1.79%

ZEC

$243.91

+3.24%

AVAX

$9.16

+3.62%

PYUSD

$1.00

+0.03%

SHIB

$0.0{5}629

+3.28%

SUI

$0.9544

+3.76%

sUSDe

$1.22

+0.02%

TON

$1.46

+6.57%

RAIN

$0.0103

+3.34%

CRO

$0.07796

+1.17%

WLFI

$0.1045

-3.15%

XAUT

$4,990.90

-1.08%

PAXG

$5,017.62

-1.21%

DOT

$1.31

+2.18%

UNI

$3.44

+2.56%

MNT

$0.6277

+0.74%

BFUSD

$0.9996

-0.01%

AAVE

$116.90

+7.88%

ASTER

$0.727

+2.39%

M

$1.41

-1.12%

TAO

$162.00

+5.47%

BGB

$2.37

-0.53%

USDf

$0.9976

+0.03%

OKB

$76.61

+2.24%

SKY

$0.06933

+3.96%

USDG

$1.00

+0.00%

PEPE

$0.0{5}377

+1.89%

syrupUSDC

$1.15

-0.02%

RLUSD

$1.00

+0.03%

PI

$0.1506

+11.23%

ETC

$8.45

+2.80%

NEAR

$1.02

+5.94%

ICP

$2.35

-2.93%

ONDO

$0.2616

+4.35%

RSETH

$2,074.72

-0.91%

BTCT

$69,194.82

+1.84%

JLP

$3.67

+2.27%

JITOSOL

$105.06

+3.79%

WLD

$0.393

+2.29%

KCS

$8.43

+3.41%

POL

$0.0991

+5.88%

ATOM

$2.07

+4.86%

USDCE

$0.9961

-0.59%

USDD

$0.9997

-0.01%

ENA

$0.1198

+3.10%

WBNB

$613.10

+0.07%

BBTC

$66,435.48

-0.74%

NIGHT

$0.05446

+9.80%

KAS

$0.03206

-0.14%

ALGO

$0.0935

+2.63%

QNT

$68.73

+0.66%

USDTb

$0.9996

+0.02%

GT

$7.12

+1.17%

LBTC

$68,985.06

+1.89%

FLR

$0.00959

-0.52%

WFLR

$0.009443

-2.73%

RETH

$2,353.10

+3.11%

TRUMP

$3.36

+3.22%

FBTC

$68,144.58

+0.97%

MYX

$2.99

+6.56%

XDC

$0.03687

+1.51%

BNSOL

$91.30

+3.51%

APT

$0.936

+1.52%

PUMP

$0.002035

+2.67%

RNDR

$1.38

+4.37%

U

$1.00

+0.02%

KHYPE

$32.34

+2.54%

FIL

$0.935

+3.31%

Market

/XRP Price

XRP

XRP

No.4

$1.4122

+2.10%

≈$1.41

Market Cap

$141.2B

Cir. Cap

$85.94B

Cir. Supply

60.85B

Cir. Rate

60.8619%

Total Supply

99.99B

Max Supply

100B

24h Volume

$2.01B

24h Vol (BTC)

2.85B

24h Turnover

0.03316102%

Market Share

3.75%

Performance

Low

1.35

Range

+0.06%

High

1.42

Listing

$0.01

ATH (2014-07-07)

$3.84

-63.24%ATL (2018-01-04)

$0.002802

+50293.42%Official

Converter

Chart

Market

About

Ad

XBIT Invite: Earn points & commission

XRP

XRP

No.4

$1.4122

+2.10%

≈$1.41

Price

Cap

K-line

Depth

1 Second

1 Minute

5 Minutes

1 Hour

4 Hours

1 Day

TradingView

1H

+1.96%

24H

+2.1%

7D

-6.67%

30D

-34.51%

1Y

-42.31%

All

+23.46K%

AI Assistant

XRP下跌原因

XRP资金流向

XRP买卖支撑位

XRP多空比分析

XRP趋势分析

Ask AI

XRP Market

CEX Spot

CEX Derivatives

# | Exchange | Pairs | Price | +2%Depth | -2%Depth | Volume (24h) |

|---|---|---|---|---|---|---|

1 |  MEXC Global MEXC Global | XRPUSDC | 1.4126 | $51,574.92 | $71,271.89 | 835,155 |

2 |  Bitget Bitget | XRPUSDC | 1.4125 | $51,574.92 | $71,271.89 | 1,058,253 |

3 |  Bybit Bybit | XRPUSDC | 1.4125 | $51,574.92 | $71,271.89 | 6,793,063 |

4 |  OKX OKX | XRPUSDT | 1.4135 | $1,789,188.71 | $1,624,483.82 | 37,712,803 |

5 |  Bitget Bitget | XRPUSDT | 1.4131 | $1,789,188.71 | $1,624,483.82 | 41,552,274 |

6 |  Bybit Bybit | XRPUSDT | 1.4136 | $1,789,188.71 | $1,624,483.82 | 48,572,646 |

7 |  Binance Binance | XRPUSDC | 1.4129 | $51,574.92 | $71,271.89 | 56,956,533 |

8 |  Hotbit Hotbit | XRPUSDT | 1.41019 | $1,789,188.71 | $1,624,483.82 | 60,749,144 |

9 |  gate.io gate.io | XRPUSDT | 1.413 | $1,789,188.71 | $1,624,483.82 | 74,212,008 |

10 |  MEXC Global MEXC Global | XRPUSDT | 1.4133 | $1,789,188.71 | $1,624,483.82 | 75,249,826 |

12 items

- 1

- 2

Rows

About XRP

Bullish

Bearish

Community

WhaleFUD

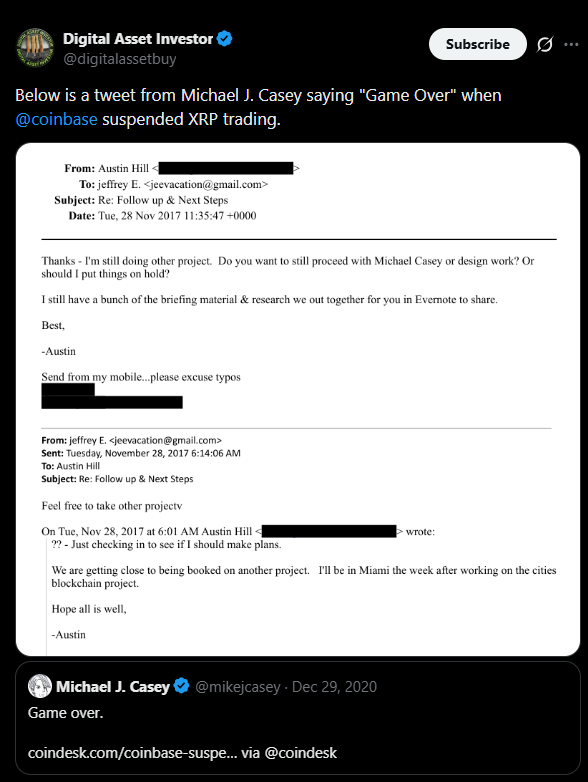

Binance

TheCryptoBasic

TheCryptoBasic

TheCryptoBasic

TheCryptoBasic

Blockchain PhD student

TheCryptoBasic

吴说区块链

TheCryptoBasic